- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Qatar’s GDP To Recover In 2017-18

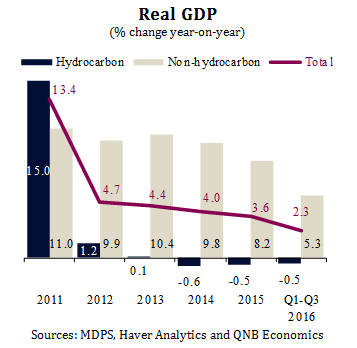

Qatar’s Ministry of Development Planning and Statistics (MDPS) released GDP data for Q3 2016 last week. Real GDP growth accelerated from 1.8% in Q2 to 3.7% in Q3 owing to a recovery in the hydrocarbon sector. As a result, growth in the first three quarters of 2016 averaged 2.3% versus the same period a year earlier. We expect growth to pick up going forward driven by the non-hydrocarbon sector as a result of a fading drag from manufacturing, rising government capital spending and high population growth.

The hydrocarbon sector recovered from a contraction of 2.0% year-on-year in the first half of 2016 to grow by 2.7% year-on-year in Q3 2016. Data shows that crude oil production, which accounts for around one third of the hydrocarbon sector, moved in the opposite direction, rising in the first half and falling in Q3 year-on-year. Natural gas and related liquids outweigh crude oil, accounting for two thirds of the hydrocarbon sector.

We can, therefore, infer that the main driver of hydrocarbon GDP has been a dip in natural gas production in the first half of 2016 followed by a recovery in Q3. This is likely a result of routine maintenance carried out on some of Qatar’s liquefied natural gas trains during the first half of the year, with production on these trains sincerecovering to capacity in Q3.

Growth in the non-hydrocarbon sector slowed to 4.7% year-on-year in Q3 2016 from 5.6% in the first half of 2016. The main drag on growth was the manufacturing sector, which contracted by 1.3% year-on-year. Going back to 2014, the drop in oil prices in the middle of that year led to the cancellation of a number of petrochemical projects, which were the main contributor to manufacturing growth. As a result of the drop in investment into petrochemicals, the performance of the manufacturing sector has been in decline since 2014.

However, a number of other non-hydrocarbon sectors maintained relatively high growth rates in Q3 2016. The construction sector was the main driver, growing at 12.4% year-on-year in Q3 and contributing 1.9 percentage points (pps) to non-hydrocarbon GDP growth. A number of services sectors also performed well, such as financial services, which contributed 0.9 pps to year-on-year non-hydrocarbon GDP growth, government services (0.7 pps) and real estate services (0.5 pps).

We expect real GDP growth to recover in 2017-18 with the non-hydrocarbon sector continuing to be the main driver of growth for a number of reasons. First, the slowdown in the non-hydrocarbon sector is partly attributable to a drag from manufacturing, which we expect to fade.

Second, government investment is expected to continue to drive growth. The government budget announced in December slated a 3.2% increase in capital spending for 2017 and the Ministry of Finance has signalled its intention to sign QAR46bn of multi-year contracts in 2017, adding to a stock of QAR374bn in ongoing total project budgets in Qatar (see our recent commentary, Qatar’s fiscal deficit set to decline in 2017).

Third, government investment continues to attract workers to Qatar who require a range of services and increase aggregate demand in the economy. The latest population data from December 2016 show year-on-year population growth of 7.3%.

Finally, the outlook for oil prices has improved markedly. Oil prices are currently USD55/barrel, 17% higher than the average of USD47/b in Q3 2016. We expect oil prices to continue rising to the USD60/b level if the production cuts recently announced by OPEC and non-OPEC are fully implemented (see our recent commentary, Oil price forecasts up on OPEC agreement, but implementation key). Higher oil prices should boost government revenue and embolden capital spending plans as well as supporting sentiment, investment and consumer spending in the broader economy.

Compared to 2016, we expect a continued positive trend in oil prices in 2017-18, which should support a recovery in growth with the non-hydrocarbon sector as the main driver. Nonetheless, fiscal deficits are expected to continue and the recovery is likely to be moderate with headline real GDP forecast to be 3.8% in 2017 and 4.1% in 2018.

Related Articles

MON: Eurogroup Meeting, Norwegian CPI (Feb), EZ Sentix Index (Mar), Japanese GDP (Q4) TUE: EIA STEO WED: 25% US tariff on all imports of steel and aluminium comes into effect,...

Brief Reminder In 2018, US President Donald Trump initiated a trade war update with sanctions against China. Economic disagreement between the United States and China began in...

Trump’s U-Turns Keep the Market Under Pressure Both US equity indices and the US dollar remain under severe stress as US President Trump continues his back-and-forth on the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.