- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Q4 Earnings Season: Can Banks Deliver?

Q4 Earnings Season: Can Banks Deliver?

With the December jobs report now out of the way, the market can start focusing on the 2013 Q4 earnings season. The reporting cycle doesn’t really get into high gear till next week, but we have a Finance-heavy list of 51 companies reporting results this coming week, including 27 S&P 500 members.

The Finance sector is heavily represented in this week’s reporters, with all of the sector’s big guns like J.P. Morgan (JPM), Wells Fargo (WFC), Bank of America (BAC), Citigroup (C ) and Goldman Sachs (GS) coming out with results this week. J.P. Morgan has been in the news for all the wrong reasons, with regulatory and litigation issues dominating the headlines. The bank’s Q4 earnings report will likely be quite ‘noisy’, but its superior core earnings power should remain intact.

The banking group as a whole will continue to suffer net margin pressures as loan growth remains tepid and the mortgage business continue losing ground. On the capital markets front, the equity business likely did fairly good in Q4, while the fixed income and currencies side remained under pressure. Morgan Stanley (MS) has a stronger equities franchise, while Goldman has always been a FICC powerhouse. Total earnings for the Finance sector as a whole are expected to be up +19.4% from the same period last year, with easy comparisons, particularly for Bank of America and the insurers, driving the year-over-year growth.

The Q4 earnings season has gotten underway already, with results from 24 S&P 500 members out. Total earnings for these 24 companies (not EPS, median or otherwise) are up +18.6% from the same period last year, with a ‘beat ratio’ of 54.2% and a median surprise of +1.5%. Total revenues are up +7.2%, with an impressive revenue ‘beat ratio’ of 66.7% and a median surprise of +1.5%. Comparing the results for this admittedly small of number of companies with what we saw from the same group in Q3 and the last few quarters, the earnings and revenue growth rates and the revenue beat ratio compare favorably, while the earnings beat ratio is a bit on the weak side.

But at this stage, the Q4 earnings season’s story isn’t about the few companies that have reported, but bulk of those whose results are awaited. To that point, the ‘composite’ picture for Q4, where we combine the results from the 24 companies that have reported already with the 476 still to come, is for growth rate of +6.3%. This reflects +1.2% higher revenues and net margin gains of about 50 basis points. Finance remains a big growth driver in Q4 – total earnings growth for the S&P 500 in Q4 drops to +3.7% once the sector is excluded.

As has been the case at the start of recent quarterly earnings cycles, the current +6.3% growth rate for Q4 represents a sharp drop over the last three months, as the chart below shows.

This negative revisions behavior is hardly unusual as we have been repeatedly seeing this pattern play out in recent quarters. Companies have been overwhelmingly guiding lower, prompting analysts to cut estimates for the following quarter. The revisions behavior ahead of the Q3 earnings season was no different. Estimates for most sectors came down since the quarter got underway, but the Q4 revisions were particularly pronounced for the Industrials, Finance, Autos and Energy sectors.

The earnings growth expected in Q4 at this stage of the reporting cycle is the highest that we have seen in any of the last few quarters. A big reason for that is easy comparisons, as 2012 Q4 represented the lowest quarterly earnings total for the S&P 500 in the last six quarters, with the comps particularly easy for the Finance sector, helping produce the sector’s impressive +19.4% growth rate.

Within the Finance sector, the comparisons are particularly easy for the insurance industry – the industry alone accounts for more than a quarter of the sector’s total earnings – given the impact on the industry’s profitability from the East Coast storms in late 2012. Total earnings for the insurance industry are expected to be up more than +40% in Q4, with all the major industry players like Chubb (CB) and Travelers (TRV) producing strong growth rates.

While easy comparisons are driving the year over year growth rate in Q4, there hasn’t been much growth lately despite very high level overall total earnings. Total earnings for companies in the S&P 500 reached an all-time record at $262.5 billion, surpassing the previous record reached the quarter before. Current estimates for Q4 work out to a modestly lower total for the quarter. But when all is said and done about Q4, we will likely have seen another quarterly record.

But of more interest than Q4 growth will be management guidance for 2014. Companies typically provide guidance only for the following quarter, but they do tend to discuss their outlook their outlook for the coming year on the Q4 earnings calls. It will be interesting to see if management teams see any material improvement in the earnings picture this year along the lines of current consensus earnings expectations for 2014. Total earnings are expected to be up +10% in 2014, up from +4.6% growth in 2013, with most of the growth coming in the back half of the year.

Monday-1/13

- Nothing major on the economic or earnings calendars today.

Tuesday -1/14

- We will get the December Retail Sales data in the morning, with expectations of a +0.2% growth following the +0.7% growth in November. The ex-autos growth rate is expected to be +0.4% vs. +0.4% in November.

- J.P. Morgan and Wells Fargo are the key Q4 earnings reports, both in the morning.

Wednesday-1/15

- We will get the December PPI numbers and January Empire State regional manufacturing surveys.

- Bank of America and Fastenal (FAST) will be the key earnings reports in the morning, while CSX Corp (CSX) report after the close.

- Zacks Earnings ESP or Expected Earnings Surprise, our proprietary leading indicator of earnings surprises, is showing CSX Corp coming out with an earnings beat.

- Stocks with positive Earnings ESP and Zacks Rank of 1, 2 or 3 are highly likely to come out with positive earnings surprises. CSX Corp. has a Zacks Rank #2 (Buy) and Earnings ESP of +0.5%.

Thursday -1/16

- A busy day on the economic calendar, with weekly Jobless Claims, December CPI, and the January homebuilder sentiment index and the Philly Fed survey coming out.

- Citigroup and Goldman Sachs are the key reports in the morning, while Intel (INTC) will report after the close.

- Goldman’s Zacks Rank #3 (Hold) and Earnings ESP of +4.6% show that the company is highly likely to come out with a positive earnings surprise.

Friday-1/17

- We will get the December Housing Starts and Industrial Production data and the preliminary University of Michigan consumer sentiment survey for January.

- General Electric (GE), Morgan Stanley (MS) and Schlumberger (SLB) are the key earnings reports today, all in the morning.

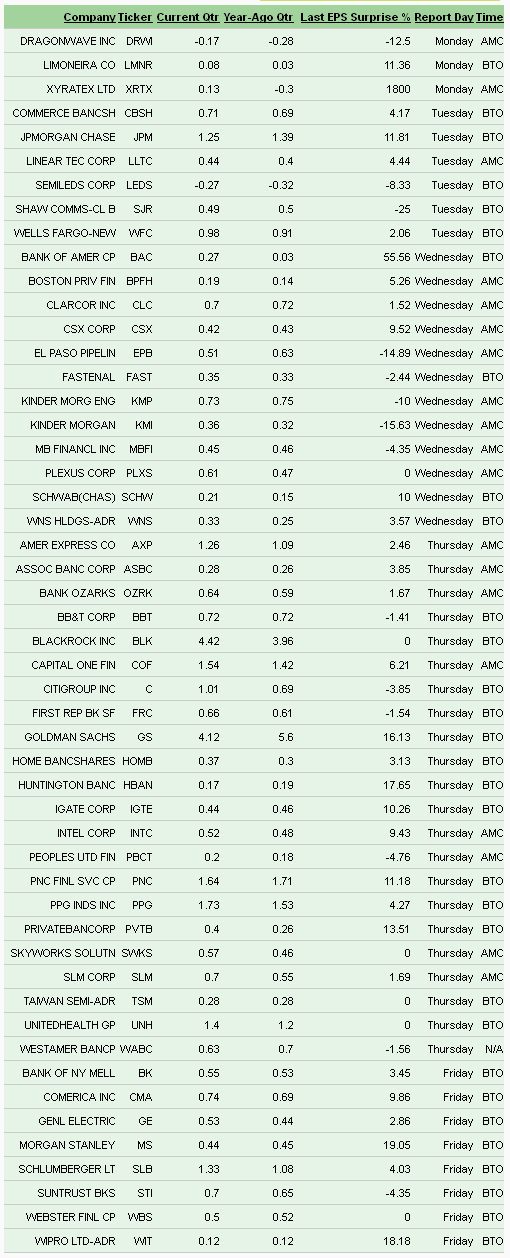

Here is a list of the 51 companies reporting this week, including 27 S&P 500 members.

Original post

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

With Q4 2024 earnings reporting about wrapped up, the trends remain positive, although the outlook for 2025 earnings growth has dimmed. Stocks in leadership positions have begun...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.