- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Breaking News

Q4 Earnings Preview: What to Expect from JPMorgan and the Big Banks

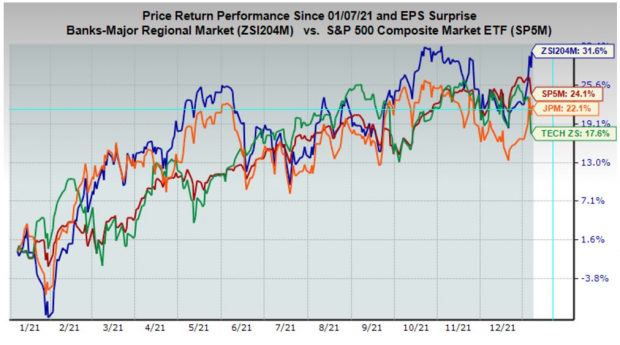

Bank stocks have perked up lately, as the outlook for interest rates has become more favorable to the group’s business. The market sees the coming Fed tightening cycle and the resulting projected steepening of the yield curve as a benefit to bank margins.

You can see this upgraded sentiment shift in the chart below that plots JPMorgan JPM, which kicks-off the 2021 Q4 reporting cycle for the group on Friday, January 14th, the Zacks Major Banks Industry (Blue line) and the S&P 500 index (Red line) over the preceding year.

We have also added the Zacks Technology sector to the chart—the green line—to show the market’s souring on growth opportunities in the new monetary policy backdrop.

JPMorgan is expected to have earned $3.01 per share on $29.89 billion in revenues in 2021 Q4. This would represent a year-over-year change in earnings and revenues of -26.8% and +2.3%, respectively.

JPMorgan shares were down following each of the preceding 5 quarterly releases despite handily beating estimates. This makes us think that the setup is likely not very favorable for how JPM shares might be expected to behave in response to the release, particularly with the stock up more than +3% over the past month even as the S&P 500 index has modestly lost ground (down -0.5%).

Other industry players on deck to report Q4 results the same day as JPMorgan include Citigroup C, Wells Fargo (NYSE:WFC) WFC and BlackRock (NYSE:BLK) BLK.

Bank earnings over the past year or so benefited from record capital market activities (investment banking as well as trading volumes), benign credit conditions that allowed reserve releases, partly offset by net interest margin pressures and anemic loan demand.

With respect to capital markets in the Q4 quarterly releases, we should expect continued strong numbers from JPMorgan, Citi and the other money center operators and brokers. While the group’s Q4 capital markets totals will most likely be below the strong showing in the September quarter, they will nevertheless be significantly above pre-pandemic levels. Trends in the pipeline about investment banking deal flow suggest that the strong momentum should continue in 2022, though likely below the record 2021 level.

It will be interesting to see management’s commentary about trends in the core banking business, particularly about loan demand. The group’s Q4 results are expected to show some modest improvement in loan growth, but it has so far been a lot weaker than would be consistent with the degree of rebound in household and business spending. Management’s outlook for the yield curve will also be informative.

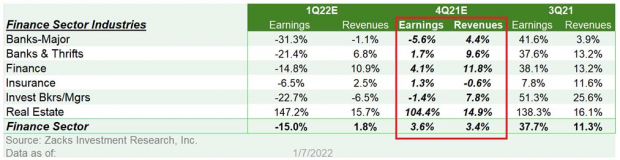

For the Zacks Major Banks industry, which includes these major banks and account for roughly 45% of the Finance sector’s earnings, Q4 earnings are expected to decline -5.6% on +4.4% higher revenues. This would follow +41.6% earnings growth on +3.9% higher revenues.

For the Finance sector as a whole, total Q4 earnings are expected to increase +3.6% on 3.4% higher revenues. The chart below shows Q4 expectations for the Finance sector’s constituent industries in the context of what these industries reported in Q3 and what is expected for 2022 Q1.

The Overall Earnings Picture

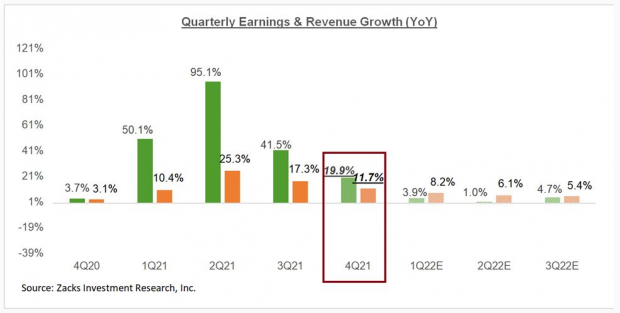

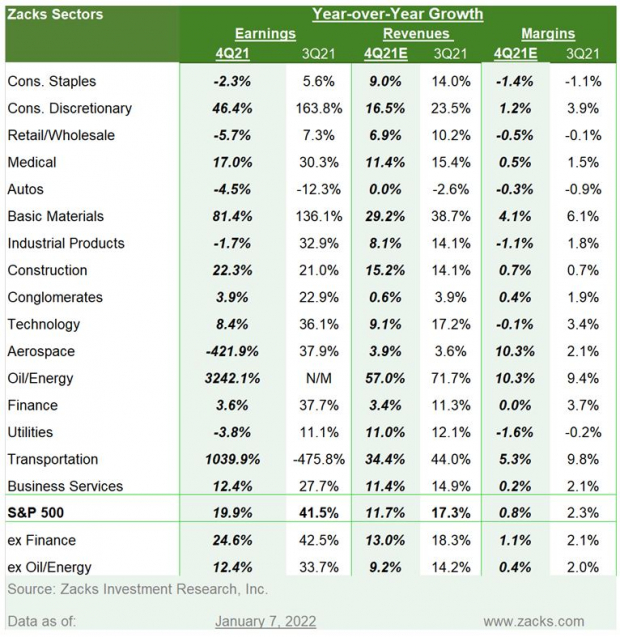

Beyond the Finance sector, the expectation is for Q4 earnings for the S&P 500 index to be up +19.9% from the same period last year on +11.7% higher revenues. This would follow +41.5% earnings growth on +17.3% revenue growth in 2021 Q3.

The chart below takes a big-picture view of S&P 500 quarterly expectations, with earnings and revenue growth expectations for the next three quarters contrasted with actuals for the preceding four periods; expectations for 2021 Q4 have been highlighted.

As you can see in the above chart, the growth pace is expected to decelerate meaningfully over the coming quarters, but still remain positive.

The chart below provides a big-picture view on an annual basis.

Q4 Earnings Season Gets Underway

The Q4 reporting cycle will (unofficially) get underway this week. But from our perspective, the Q4 earnings season has gotten underway already, with results from 20 S&P 500 out at this stage. These 20 index members - including bellwether operators like FedEx (NYSE:FDX), Nike (NYSE:NKE), Oracle (NYSE:ORCL) and others - reported results for their fiscal quarters ending in November, which we count as part of the official December-quarter tally.

We have roughly 30 companies on deck to report results this week, including 8 S&P 500 members. This week’s reporters include the aforementioned big banks and a few other major players like Delta Airlines (NYSE:DAL) and chip-maker Taiwan Semiconductor.

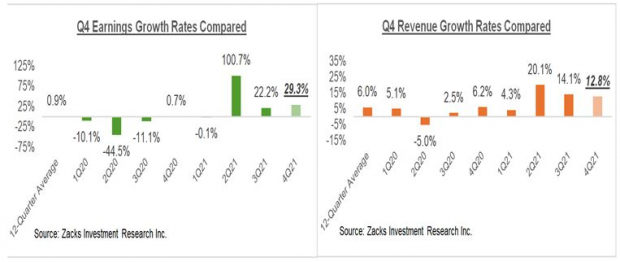

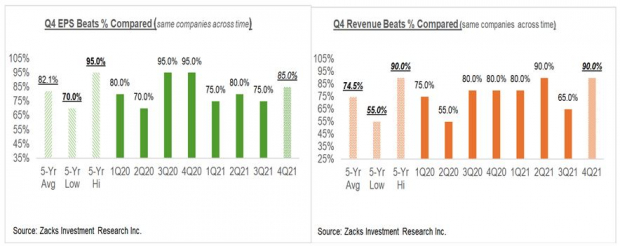

For the 20 index members that have reported already, total Q4 earnings or aggregate net income is up +29.3% from the same period last year on +12.8% higher revenues, with 85% of the companies beating EPS estimates and 90% beating revenue estimates.

This is too small a sample to draw any firm conclusions from. That said, the comparison charts below put the earnings and revenue growth rates for these 20 companies in a historical context.

The comparison charts below put the Q4 EPS and revenue beats percentages in a historical context.

The summary table below shows Q4 expectations in the context of what we saw in the preceding period.

For an in-depth look at the overall earnings picture and expectations for the coming quarters, please check out our weekly Earnings Trends report >>>> Handicapping the Q4 Earnings Season

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in little more than 9 months and NVIDIA (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (NYSE:JPM): Free Stock Analysis Report

Citigroup Inc. (NYSE:C): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.