- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Q3 Earnings Effect: 5 Hottest ETF Charts

The Q3 earnings season has reached its tail end, with 90.3% of the S&P 500 index market capitalization that has reported so far up 6.8% on 6.2% revenue growth. The beat is impressive with 73.4% surpassing EPS estimates and 67% coming ahead of top-line expectations.

Revenue growth represents acceleration and is widespread. However, the auto and utility sector posted a revenue decline, and an earnings growth rate is lower than the historical periods. Additionally, the proportion of companies beating earnings and revenue estimates are also somewhat on the downside (read: Tap Q3 Growth with Revenue-Weighted ETFs).

Given this, several equity ETFs have impressed with their performances and have generated handsome returns over the trailing one month. While there are winners in many corners of the space, below are five ETFs that buoyed up on robust earnings results. In addition, we have given a chart for their one-month performance and compared them with the broad market fund (AX:SPY) and the broad sector.

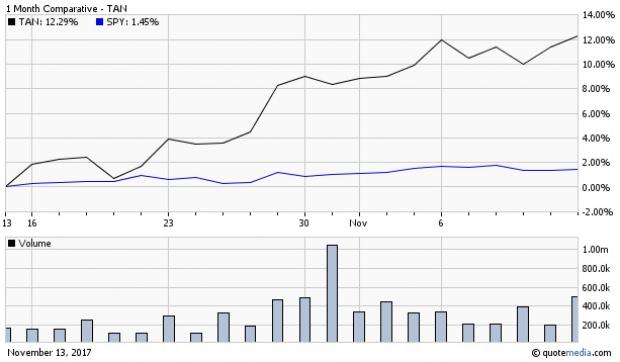

Guggenheim Solar ETF (LON:TAN)

This ETF offers exposure to the global companies involved in the solar power industry. It has gained 12.3% in the past month on strong Q2 earnings. In particular, upbeat earnings from First Solar (NASDAQ:FSLR) FSLR and SolarEdge Technologies SEDG led to a strong rally in the ETF. The two stocks make up for a combined 19.1% share in the basket. TAN has a Zacks ETF Rank #3 (Hold) with a High risk outlook. Overall, the solar industry came up with a 47% earnings beat in Q3 and has returned 25.3% in a month (read: 5 Top-Performing Stocks of the Top ETF of October).

First Trust Nasdaq Semiconductor ETF FTXL

This fund offers exposure to the most-liquid U.S. semiconductor securities based on volatility, value and growth. The string of better-than-expected results from the industry players such as Micron Technology (NASDAQ:MU) , Intel (NASDAQ:INTC) , Lam Research (NASDAQ:LRCX) LRCX, Texas Instruments (NASDAQ:TXN) and NVIDIA Corporation (NASDAQ:NVDA) instilled optimism in the space, pushing the stocks to multi-year highs. These five stocks account for 38.5% share in the basket. Further, an astronomical surge in cryptocurrencies such as Bitcoin and Ethereum, and technological innovation have added to the strength. FTXL has gained 8.1% in one month and carries a Zacks ETF Rank #2 (Buy) (read: Best ETFs & Stocks from October's Top Performing Sector).

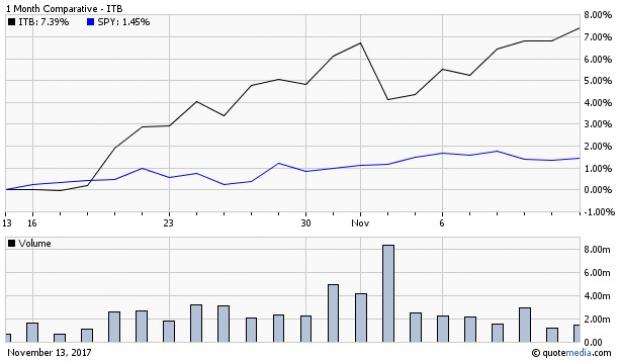

iShares U.S. Home Construction ETF (WA:ITB)

ITB provides a pure play to home construction stocks and holds 47 stocks in its basket. Total earnings for the construction sector are up 11% on 13.8% higher revenues, with 81.8% beating EPS estimates and 63.6% beating on revenues. In fact, it has been the best performing sector in terms of price performance in response to earnings, gaining an average of 1.8%. As a result, ITB has surged 7.4% in a month and has a Zacks ETF Rank #2 with a High risk outlook (read: Best Sector ETFs & Stocks from Trump's First-Year Win).

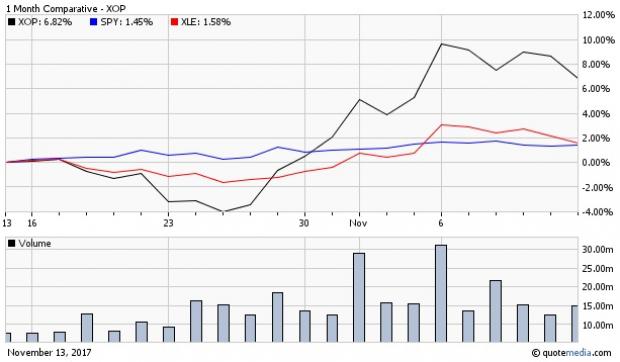

SPDR S&P Oil & Gas Exploration & Production ETF (V:XOP)

This fund offers exposure to the oil and gas exploration and production segment of the broad energy sector, which has been the star performer this earnings season. While many energy ETFs have performed exceptionally well, XOP stole the show gaining 6.8% in a month. This is primarily thanks to the dual tailwinds of upbeat earnings report and the jump in oil prices. Overall, the Exploration and Production industry came up with a 53% earnings beat in Q3. The fund has a Zacks ETF Rank of #4 (Sell) with a High risk outlook (read: Oil Price Scales 2-Yr High: 5 Best Energy ETFs & Stocks).

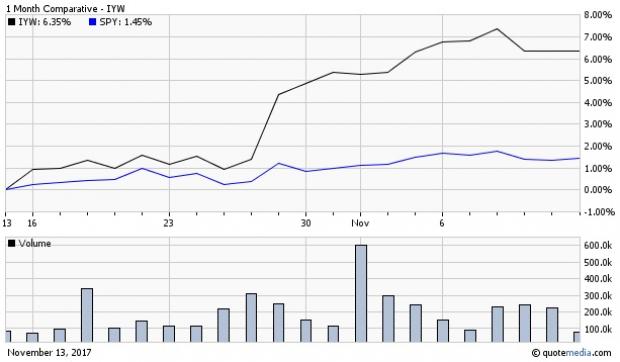

iShares Dow Jones US Technology ETF IYW

This ETF offers broad exposure to technology stocks and is up 6.3% in a month. The strength is driven by blockbuster results from Alphabet (NASDAQ:GOOGL) , Intel (NASDAQ:INTC) , Microsoft (NASDAQ:MSFT) , Facebook (NASDAQ:FB) and Apple (NASDAQ:AAPL) . These firms account for nearly half of the portfolio. Notably, total earnings from 86.4% of the sector’s total market capitalization reported so far are up 23.3% on 10.9% higher revenues, with 81.3% of the companies beating on earnings and 87.5% exceeding top-line estimates. The sector saw solid positive earnings estimate revision following earnings and has a solid Zacks Rank in the top 31%. IYW has a Zacks ETF Rank #1 (Strong Buy) with a Medium risk outlook (read: 7 Top-Ranked Tech ETFs on Unstoppable Rally).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

SPDR-SP 500 TR (SPY (NYSE:SPY)): ETF Research Reports

ISHARS-US HO CO (ITB): ETF Research Reports

SPDR-SP O&G EXP (XOP): ETF Research Reports

GUGG-SOLAR (TAN): ETF Research Reports

ISHARS-US TECH (IYW): ETF Research Reports

FT-NDQ SEMICON (FTXL): ETF Research Reports

Intel Corporation (INTC): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.