- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pure Storage (PSTG) Q3 Earnings And Revenues Beat Estimates

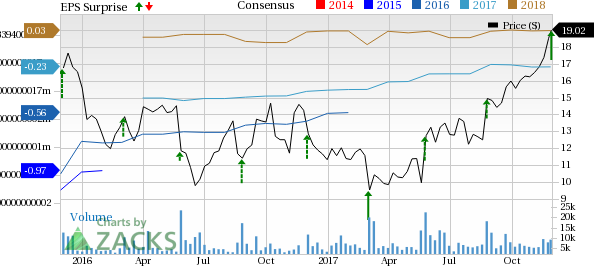

Pure Storage Inc. (NYSE:PSTG) reported non-GAAP loss of 1 cent per share in the third quarter of fiscal 2018, which was narrower than the Zacks Consensus Estimate of a loss of 3 cents. The figure was also much narrower than the year-ago loss of 10 cents per share.

Total revenues were $277.7 million, up 41% year over year and ahead of the Zacks Consensus Estimate of $272 million. Revenues surpassed the upper end of the guided range.

Management noted that the company is on track to cross the $1 billion mark in annual revenues for fiscal 2018. The ongoing quarter is expected to be its first profitable quarter.

Pure Storage stock has gained 68.2% year to date, outperforming the 26.7% rally of the industry it belongs to.

Quarter Details

In the third quarter, Product revenues of $223.2 million surged 39% on a year-over-year basis, primarily driven by “strong repeat purchases” by existing customers and an expanding customer base.

The company’s cloud customers contributed around 25% to its business while existing customers contributed 70%. The company’s strong product portfolio with the likes of FlashArray and FlashBlade business segments was a top-line booster. Additionally, the company’s data platform for cloud is gaining traction

Support revenues of $54.5 million increased a massive 50% on a year-over-year basis on the back of the company’s ongoing support contracts.

During the quarter, Pure Storage added more than 300 new customers, bringing the total base to 4000 organizations and reflecting an increase of 54% from the year-ago quarter.

Management is optimistic about its scalable storage solutions in an era when the world is typically being driven by big-data, artificial intelligence (AI) and data analytics based information. The company is currently focusing on three major aspects, namely increasing its cloud customer base, solidifying the position of its next generation workload related core data infrastructure and tapping large enterprises as they “cloudify” their on-premise IT infrastructure.

However, the company continues to face intensifying competition due to the presence of major players such as Amazon’s (NASDAQ:AMZN) Web Services and Microsoft’s (NASDAQ:MSFT) Azure in cloud storage.

Nevertheless, management is positive about the company’s partner ecosystem, which assisted the company in winning a multimillion dollar deal with a prominent financial services institution.

Management stated that the storage market for AI is likely to witness CAGR of 78% over the next five years. Pure Storage is well poised to grab the opportunity. The company’s partnership with NVIDIA (NASDAQ:NVDA) , which is a dominant player in AI related computation, is anticipated to be a further positive.

Management was optimistic on top-line growth positively impacting operating leverage. Non-GAAP operating margin increased 910 basis points (bps) to (0.7%), primarily due to the company’s focus on improving operational efficiency.

Guidance

Pure Storage expects fourth-quarter fiscal 2018 revenues in the range of $327–$335 million. Non-GAAP gross margin is anticipated to be in the range of 63.5% to 66.5%. Non-GAAP operating margin is projected to be in the range of 3% to 7%. The next quarter is expected to be first profitable quarter for the company since it went public.

For fiscal 2018, management expects revenues to be in the range of $1.012 billion to $1.02 billion. Non-GAAP gross margin is expected to be in the range of 66.6% to 66.5%. Non-GAAP operating margin is anticipated to be in the range of (3.5%) to (4.9%).

Zacks Rank and Key Picks

Pure Storage has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Pure Storage, Inc. (PSTG): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Mid-cap stocks don’t get the same headlines as large caps but move aggressively in both directions, creating outsized opportunities for investors. Unlike their mega-cap...

There’s no doubt it’s been a rough couple weeks for stocks: Both the S&P 500 and the tech-focused NASDAQ have wiped out most of this year’s gains, as of this writing. Stocks...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.