- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Puma (PBYI) Q4 Loss Narrower Than Expected, Shares Down

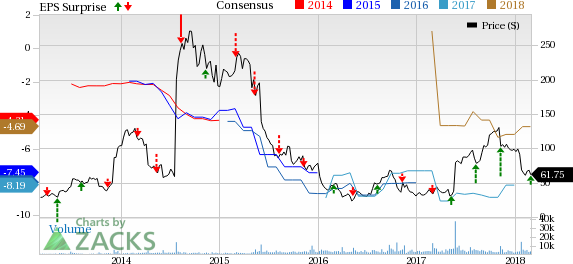

Puma Biotechnology, Inc. (NASDAQ:PBYI) reported a loss of $1.03 in the fourth quarter of 2017, narrower than both the Zacks Consensus Estimate of a loss of $1.98 and the year-ago tally of $1.22.

However, Puma declined more than 5% on Mar 1 in after-hours trading following the earnings release. But the company’s shares have outperformed the industry in a year’s time. The stock has soared 88.2% versus the industry’s decrease of 6.9%.

In the fourth quarter, the company recorded total revenues of $21.6 million consisting of $20.1 million from the sales of its only marketed product, Nerlynx (neratinib) and license revenues of $1.5 million. The top line was higher than the Zacks Consensus Estimate of $20 million.

Nerlynx (neratinib) was launched in the United States last August for treating early stage HER2-positive breast cancer in patients, previously put under Roche’s (OTC:RHHBY) Herceptin-based adjuvant therapy. So the quarter under review is the second such period wherein Puma recorded sales for Nerlynx. The FDA approved the drug in July 2017 and shipments to wholesalers began later in the same month. Last quarter, the company reaped revenues of $6.1 million from the drug’s initial sales.

On fourth-quarter conference call, the company mentioned that the specialty pharmacy channel received 1600 new patient prescriptions since the FDA approval last July through this 2018 January-end. A month-over-month increase in new patient enrollments has been witnessed in the specialty pharmacy network with the trend expected to continue in the near term.

Nerlynx is also under review in the EU for the same indication. However, last month, the company announced that the Committee for Medicinal Products for Human Use has adopted a negative opinion, recommending the refusal of the Marketing Authorization Application for Nerlynx in the EU. Puma plans to submit a request for re-examining the opinion in the first quarter of 2018.

In the reported quarter, research and development (R&D) expenses were $32.9 million, down 3.2% from the year-ago period. Selling, general and administrative expenses however, escalated 136.5% year over year to $22.7 million on higher costs to support the commercialization of Nerlynx.

2017 Results

Puma recorded full-year sales of $27.7 million. However, the company reported no revenue during the same period a year ago.

Full-year loss of $4.93 per share was wider than the year-earlier figure of $4.77.

Additional Studies on Nerlynx

Several additional studies on Nerlynx targeting different types of breast cancer patient populations and in earlier-line settings are currently underway. Meanwhile, several phase II combination trials assessing Nerlynx for the treatment of breast cancer are also on.

Notably, Puma expects to present data from the phase III program in third-line HER2-positive metastatic breast cancer in the first half of 2018.

Other Updates

In November 2017, Puma entered into an exclusive licensing agreement with Specialised Therapeutics Asia, a Singapore-based biotechnology company to commercialize Nerlynx in Australia, New Zealand and Southeast Asia.

Zacks Rank & Key Picks

Puma carries a Zacks Rank #3 (Hold). Two better-ranked stocks in the health care sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Ligand carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings per share estimates have moved up from $17.13 to $18.65 and from $20.38 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company pulled off a positive earnings surprise in three of the last four quarters with an average beat of 9.15%.

Ligand’s earnings per share estimates for 2018 have been revised upward from $3.54 to $4.15 in the last 60 days. The company delivered a positive surprise in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has surged 51.6% over a year.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.