- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Puma (PBYI) Falls Despite Narrower-Than-Expected Q3 Loss

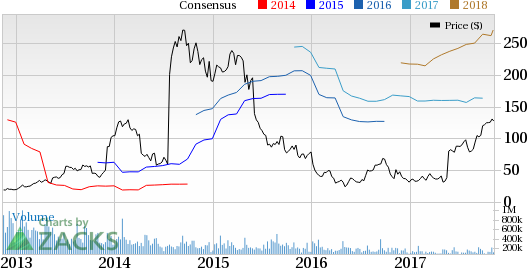

Puma Biotechnology, Inc. (NASDAQ:PBYI) reported a loss of $2.07 in the third quarter of 2017, much narrower than the Zacks Consensus Estimate of a loss of $3.46. The company had reported a loss of $2.02 in the third quarter of 2016.

Shares of Puma, however, slumped 11.2% on Thursday. However, so far this year, Puma’s shares have outperformed the industry. Specifically, the company’s shares have risen 288.1% in this time frame while the industry registered an increase of 3.1%.

The small biotech’s only marketed product, Nerlynx (neratinib) was launched in the United States in August for the treatment of early stage HER2-positive breast cancer in patients who have been previously treated with Roche’s (OTC:RHHBY) Herceptin-based adjuvant therapy. So Q3 is the first quarter in which Puma recorded sales for Nerlynx. The FDA approved Nerlynx in July and shipments to wholesalers began later in the month.

In the quarter, the company recorded revenues of $6.1 million from initial sales of Nerlynx. Revenues came in higher than the Zacks Consensus Estimate of $3 million. The company did not report any product sales in the third quarter of 2016.

On the call, the company mentioned that in the specialty pharmacy channel, 779 new patient prescriptions have been received since the FDA approval in July through October end. A month-over-month increase in new patient enrollments has been witnessed in the specialty pharmacy network with the trend expected to continue.

Nerlynx is also under review in the EU for the same indication with an opinion from the Committee for Medicinal Products for Human Use (CHMP) expected in the first quarter of 2018.

In the third quarter, research and development (R&D) expenses were $49.5 million, down 4.8% from the year-ago quarter. Selling, general and administrative expenses however increased 132% year over year to $32.5 million due to higher professional fees, payroll costs and other costs to support the commercial launch of Nerlynx.

Additional Studies on Nerlynx

Several additional studies on Nerlynx targeting different types of breast cancer patient populations and in earlier-line settings are currently underway. Meanwhile, several phase II combination studies on Nerlynx for the treatment of breast cancer are ongoing.

In the quarter, the company presented five-year follow-up from the phase III ExteNET study at the European Society of Medical Oncology meeting. The data showed that after a median follow-up of 5.2 years, treatment with Nerlynx led to a 27% reduction in the risk of invasive disease recurrence or death versus placebo.

Meanwhile, Puma expects to present data from the phase III study in third-line HER2-positive metastatic breast cancer in the first half of 2018.

Apart from the HER2-positive breast cancer indication, the company believes that Nerlynx holds potential for the treatment of several other cancers as well, including NSCLC and other tumor types that over-express or have a mutation in HER2.

Zacks Rank & Stocks to Consider

Puma currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are PDL BioPharma, Inc. (NASDAQ:PDLI) and Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) , both with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of PDL BioPharma have increased 42.9% this year so far while earnings estimates for 2018 have increased 3.2% in the past 30 days.

Shares of Ligand Pharmaceuticals have risen 42.2% this year so far while earnings estimates for 2018 have increased 0.5% in the past 30 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

PDL BioPharma, Inc. (PDLI): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Puma Biotechnology Inc (PBYI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.