- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Prothena (PRTA) Earnings Beat In Q3, Pipeline In Focus

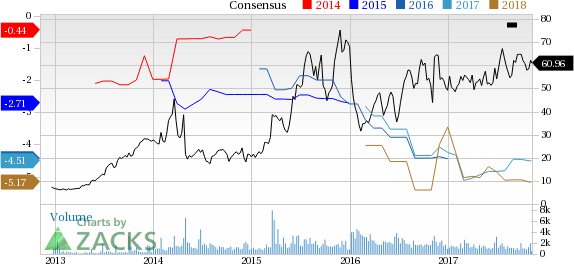

Prothena Corporation plc (NASDAQ:PRTA) reported a loss of $1.37 per share in the third quarter of 2017, narrower than the Zacks Consensus Estimate loss of $1.41 but wider than the year-ago loss of $1.26.

Moreover, quarterly revenues came in at $0.3 million, in line with the Zacks Consensus Estimate and the year-ago quarter.

Prothena’s stock has moved up 24% in the year so far compared with the industry’s gain of 4.8%.

Quarter in Detail

R&D expenses were $41.3 million, up 53.9% year over year primarily due to higher product manufacturing costs, and lower personnel and clinical trial costs.

General and administrative expenses were $12.4 million, down 22.9% year over year.

2017 Outlook

Prothena projects net cash burn from operating and investing activities in the range of $142-$152 million, a decrease of $18 million based on savings related to the decision not to advance PRX003 and other favorability from development, manufacturing and taxes. The company expects to end 2017 with approximately $409 million in cash, cash equivalents and restricted cash (midpoint).

Pipeline Updates

Prothena continues to progress with its pipeline candidates. The company is evaluating its lead candidate NEOD001 in the phase III VITAL Amyloidosis study in newly diagnosed treatment-naïve patients with AL amyloidosis and cardiac dysfunction. Enrolment has been completed in the VITAL study.

Prothena is also evaluating the candidate in a phase IIb study, PRONTO, in previously treated patients with AL amyloidosis and persistent cardiac dysfunction. The company completed enrolment in this study and top-line results from the study are expected following the 12-month study period in the second quarter of 2018.

Moreover, Prothena is evaluating PRX002, in collaboration with Roche Holdings (OTC:RHHBY) for the treatment of Parkinson’s disease and other related synucleinopathies. The company initiated a phase II study, PASADENA, on PRX002 in patients suffering from Parkinson`s disease which triggered a $30-million milestone payment from Roche to Prothena. The study is continuing enrolment.

Alongside, Prothena is also working to advance PRX004 in a phase I study in patients with ATTR amyloidosis. The candidate is expected to enter clinic in mid-2018.

Prothena announced results from a phase Ib multiple ascending dose (MAD) study of pipeline candidate, PRX003 in psoriasis patients. The primary objectives of the study were achieved. However, advancing PRX003 into mid-stage clinical development required a well-defined relationship between biological activity and meaningful clinical effects and these prerequisites were not met.

As a result of failed data on PRX003, Prothena will focus on advancing NEOD001 (phase IIb and phase III), PRX002 (phase II) and PRX004 (expected to enter phase I by mid-2018).

Our Take

The narrower-than-expected loss in the third quarter was encouraging. The company’s efforts on developing its pipeline are encouraging. We expect investor focus to remain on further updates from its late-stage candidate, NEOD001.

Zacks Rank & Key Picks

Prothena currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked health care stocks in the same space include Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) and Agenus Inc. (NASDAQ:AGEN) . While Ligand sports a Zacks Rank #1 (Strong Buy) while Agenus carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates have moved up $3.68 to $3.70 for 2018 over the last 30 days. The company pulled off positive earnings surprises in two of the trailing four quarters, with an average beat of 6.19%.

Agenus’ loss per share estimates have narrowed from $1.40 to $1.36 for 2018 over the last 30 days. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 4.27%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Prothena Corporation PLC (PRTA): Free Stock Analysis Report

Agenus Inc. (AGEN): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.