- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Previewing Big Tech Earnings: Apple, Microsoft and Other Giants

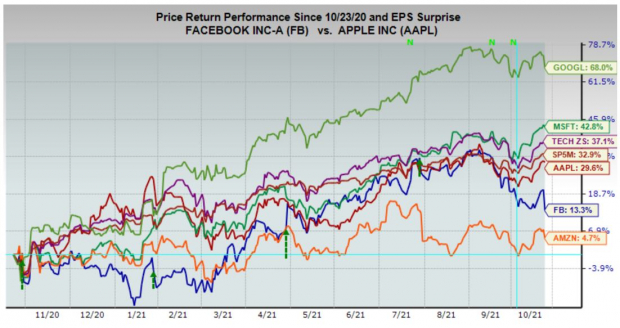

The recent stock market performance of the five largest Technology companies – Apple AAPL, Microsoft MSFT, Alphabet (NASDAQ:GOOGL) GOOGL, Facebook (NASDAQ:FB) FB and Amazon AMZN – that are on deck to report Q3 results this week has been mixed, with Alphabet and Microsoft riding high and Amazon and Facebook struggling to gain traction.

You can see the group’s recent performance in the chart below that shows the one-year performance of the Zacks Technology sector (purple line - third from the top, up +37.1%) and the S&P 500 index (light red line - fourth from top, up +32.9%), Microsoft (MSFT – dark green line; second from the top, up +42.9%), Apple (AAPL – red line; third from the bottom, up +29.6%) and Amazon (AMZN – orange line at the bottom, up +4.7%) and Facebook (FB – blue line, second from the bottom, up +13.3%).

As you can see above, Facebook and Amazon are clearly the laggards, with Facebook’s recent leg down reflective of a seemingly never-ending run of bad news for the company. The market has pushed Facebook down following the Snap SNAP quarterly report, which likely improves the odds of a positive surprise from the social-media giant after the market’s close on Monday (10/25).

Microsoft, which reports after the closing bell on Tuesday (10/26), along with Alphabet, Advanced Micro AMD and Twitter (NYSE:TWTR) TWTR, has become a unique Tech player that enjoys multiple growth engines, from enterprise software to cloud leadership and many other things. No doubt, Microsoft shares are the second-best performer in this group in the above chart, second only to Alphabet.

These five companies combined now account for 22.9% of the total market capitalization of the S&P 500 index, second only to the Technology sector’s weight in the index at 32.8% and above the other 15 sectors, including Finance at 13.8%.

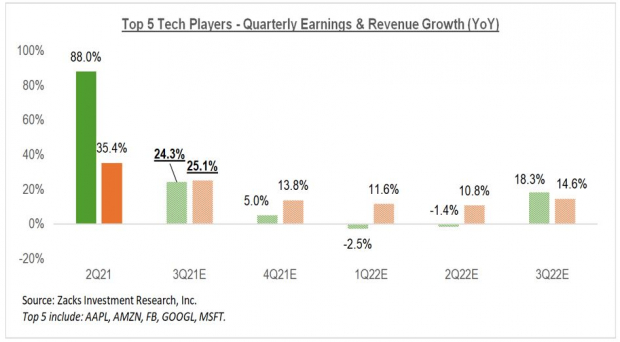

The chart below shows the earnings and revenue picture for this group of 5 companies in the aggregate, on a quarterly basis, with expectations for 2021 Q3 highlighted.

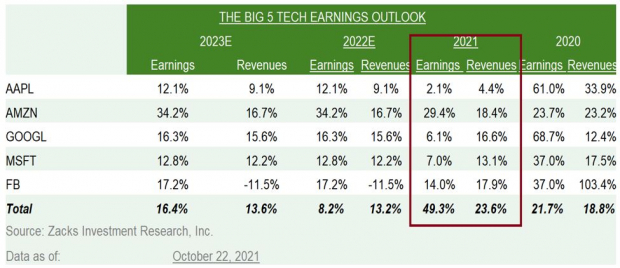

The table below shows the group’s earnings picture on an annual basis.

Take a look at the pandemic-affected numbers for 2020 for the group and contrast that to the overall profitability picture for the S&P 500 when the index’s earnings and revenues declined by -13% and -1.7%, respectively.

When some people refer to these companies as ‘defensive’ Tech, they are essentially referring to this earnings power that has visibility and stability. The only somewhat negative spin that one could put on these otherwise impressive growth numbers for the group is the expected deceleration in the coming periods.

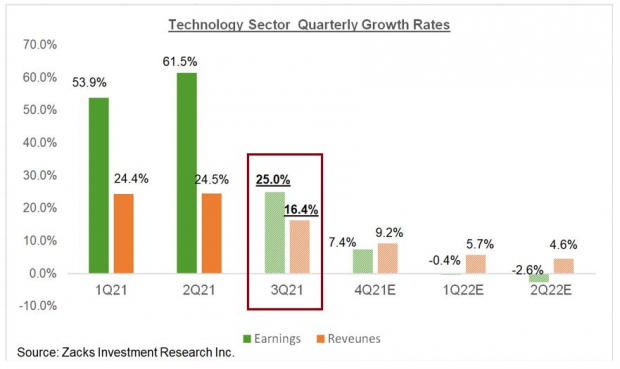

Beyond the big 5 Tech players, total Q3 earnings for the Technology sector as a whole are expected to be up +25% from the same period last year on +16.4% higher revenues. The chart below shows the sector’s Q3 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming three periods.

This big picture view of the ‘Big 5’ players, as well as the sector as whole shows that current estimates for the coming periods reflect a decelerating growth trend.

In terms of the reporting docket, Facebook will report after the market’s close on Monday (10/25), Alphabet and Microsoft will report after the closing bell on Tuesday (10/26), Amazon and Apple after the market’s close on Thursday (10/28).

Other notable reports this week include Starbucks SBUX, Spotify (NYSE:SPOT) SPOT and a host of blue-chip operators in other sectors. In all, this week brings results from more than 820 companies in total, including 161 S&P 500 members, or more than a third of the index’s total membership.

Q3 Earnings Season Scorecard

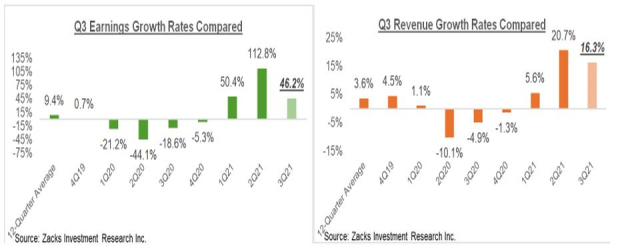

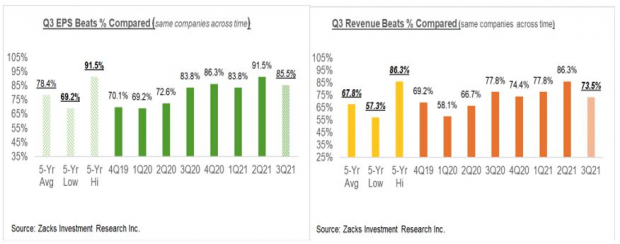

Including all the results that came out through Friday, October 22nd, we now have Q3 results from 117 S&P 500 members or 23.4% of the index’s total membership. Total earnings (or aggregate net income) for these 117 companies are up +46.2% from the same period last year on +16.3% lower revenues, with 85.5% beating EPS estimates and 73.5% beating revenue estimates.

The two sets of comparison charts below put the Q3 results from these 117 index members in a historical context, which should give us a sense of how the Q3 earnings season is tracking at this stage relative to other recent periods.

The first set of comparison charts compare the earnings and revenue growth rates for these 117 index members.

The Finance sector is heavily represented in the results at this stage. For the Finance sector, we now have Q3 results from 54.7% of the sector’s market cap in the S&P 500 index. Total earnings for these Finance sector companies are up +40.2% on +10.1% higher revenues, with 91.7% beating EPS estimates and 83.3% beating revenue estimates.

The reported Q3 earnings growth increases to +50.6% on an ex-Finance basis (+46.2% as a whole). The second set of charts compare the proportion of these 117 index members beating EPS and revenue estimates.

I started getting worried about the revenue numbers at the start of the Q3 earnings season, but the picture has notably improved since then, as you can see above.

Expectations for Q3 & Beyond

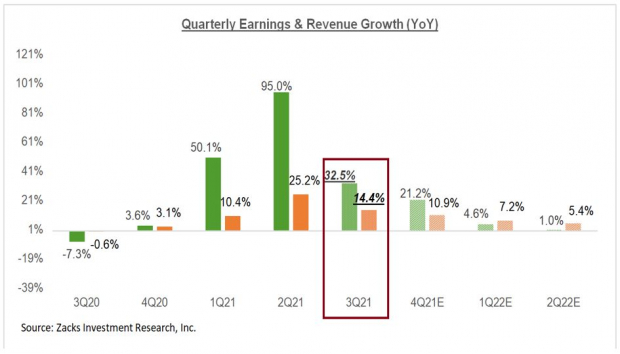

Looking at the quarter as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total Q3 earnings for the S&P 500 index are expected to be up +32.5% from the same period last year on +14.4% higher revenues. The growth rate has started going up as companies come out with better-than-expected results.

The chart below presents the earnings and revenue growth picture on a quarterly basis, with expectations for 2021 Q3 contrasted with the actual growth achieved over the preceding four quarters and estimates for the following three.

The chart below shows the comparable picture on an annual basis.

We mentioned earlier how the aggregate 2021 Q2 earnings tally represented a new all-time quarterly record.

We all know that large segments of the economy, particularly in the broader leisure, travel and hospitality spaces are held down by the pandemic, with companies in these areas still earning significantly less than they did in the pre-Covid period. In fact, many of these companies aren’t expected to get back to pre-Covid profitability levels for almost one more year.

The impressive feature of the record earnings in each of the last two quarters is that they were achieved without help from these key parts of the economy.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>A Strong Earnings Picture Amid Global Headwinds

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it's poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in a little more than 9 months and Nvidia (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (NASDAQ:AMZN): Free Stock Analysis Report

Apple Inc. (NASDAQ:AAPL): Free Stock Analysis Report

Advanced Micro Devices, Inc. (NASDAQ:AMD): Free Stock Analysis Report

Microsoft Corporation (NASDAQ:MSFT): Free Stock Analysis Report

Starbucks Corporation (NASDAQ:SBUX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Snap Inc. (NYSE:SNAP): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.