- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pre-Earnings Options Bulls Flock To Lululemon Stock

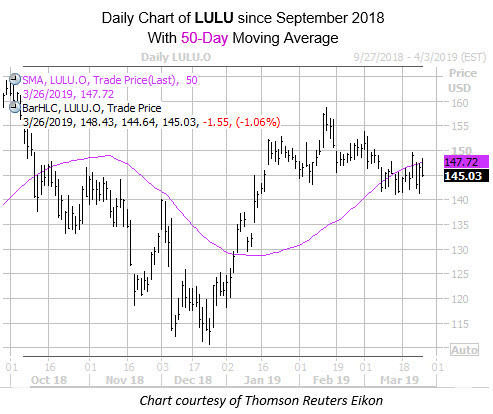

Yoga apparel retailer Lululemon Athletica Inc (NASDAQ:LULU) is down 1.1% at $145.03 in afternoon trading, as traders gear up for the company's fourth-quarter earnings -- set for release after the market closes tomorrow, March 27. Below, we will take a look at dig into how LULU has been faring on the charts, and see what the options market is pricing in for the stock post-earnings.

Lululemon Athletica stock has added an impressive 20.5% in 2019 and touched a four-month peak of $158.67 on Feb. 13. However, a pullback from here has the shares below their 50-day moving average, which ushered LULU lower in the fourth quarter.

Looking into LULU's earnings history, the retail stock has closed higher the day after its quarterly report in all but two of the past eight quarters, including a 16.3% surge last June. Over the past two years, the shares have swung an average of 12.6% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 16% move for Thursday's trading.

Moving onto options data, LULU's 10-day call/put volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands at a top-heavy 1.28, and ranks in the 61st percentile of its annual range. This suggests calls have been purchased over puts at a slightly faster-than-usual pace during the past two weeks.

Echoing this sentiment is the stock's Schaeffer's put/call open interest ratio (SOIR) of 0.84, which ranks in the 24th percentile of its annual range. This shows a stronger-than-usual call-skew among near-term options. The April 150 call has been particularly popular among call buyers and is home to peak open interest on LULU stock.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.