- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Praxair Hikes Gas Prices To Cover High Energy & Labor Costs

Industrial gas producer and supplier Praxair Inc. (NYSE:PX) recently hiked the prices of industrial gases for its customers in the United States, Mexico, and Canada. The revised prices will be effective Jan 1, 2018.

As revealed, prices of nitrogen, oxygen, argon, hydrogen, carbon dioxide have been increased up to 15%. In addition, the company has hiked its facility fees by roughly 15%. Price changes for individual customers will depend on their contract provisions or products purchased.

Praxair cited increasing costs of energy, distribution and labor as the reason behind the rise in prices of the industrial gases.

A month ago, the company had announced up to 10% increase in helium prices for its bulk liquid helium customers across nations. The price hike will be effective Jan 1, 2018. The price increase will cover higher costs for crude and refined helium, higher distribution costs and investments to improve its helium operations.

We believe Praxair’s margins and profitability is highly dependent on costs of sales and expenses, as any unwarranted increase in these will lower the margins and profitability and vice versa. Notably, in third-quarter 2017, the company’s margin profile suffered from higher costs of sales, increasing 7.8% year over year. Gross margin was down 10 basis points. Also, selling, general and administrative expenses increased 4.5% year over year.

Despite such adversaries, increasing applications have been raising the demand for industrial gases over time, proving beneficial for companies like Praxair. Exiting the third quarter, the company had a solid backlog of $1.5 billion. For 2017, the company anticipates benefitting from a talented workforce, sound product portfolio and new project wins. It anticipates earnings per share to come within $5.78-$5.83, reflecting 12 cents increase at mid-point compared with the previous guidance of $5.63-$5.75. Capital spending is expected to be nearly $1.4 billion.

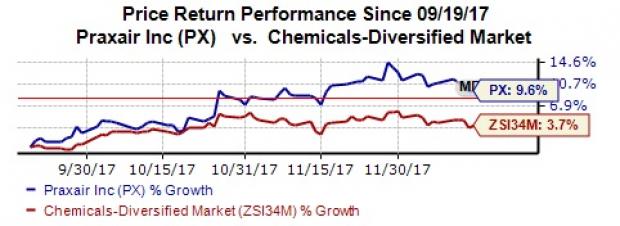

In the last three months, shares of Praxair have yielded 9.6% return, outperforming 3.7% gain of the industry.

Zacks Rank & Other Stocks to Consider

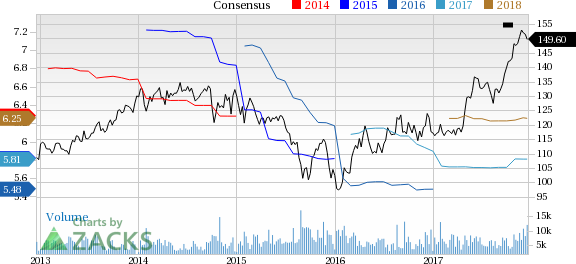

With approximately $42.8 billion, Praxair currently carries a Zacks Rank #2 (Buy). The stock’s earnings estimates for 2017 have been increased by nine brokerage firms in the last 60 days, while that for 2018 by six firms. Currently, the Zacks Consensus Estimate is pegged at $5.81 for 2017 and $6.25 for 2018, reflecting growth of 1.8% and 1.3% over their respective tallies 60 days ago.

Praxair, Inc. Price and Consensus

Praxair, Inc. (PX): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.