PPG Industries Inc. (NYSE:) and Air Tractor have jointly brought forth the first electrocoat (e-coat) primer system for the aerospace industry. The latest system will help to manufacture original-equipment aircraft parts on a full scale. Recently, both companies unveiled the system at the Air Tractor agricultural manufacturing facilities in Olney, TX and celebrated the launch in the presence of aerospace industry representatives, elected officials, Air Tractor dealers and PPG Industries’ executives.

The e-coat system is enclosed by a new three-story, 6,600-square-foot facility that includes an automated parts rack hoist, 10 5,000-gallon immersion tanks, cure ovens and a reverse osmosis water-treatment system. The racking system supports 3,000 different-sized and -shaped airplane parts.

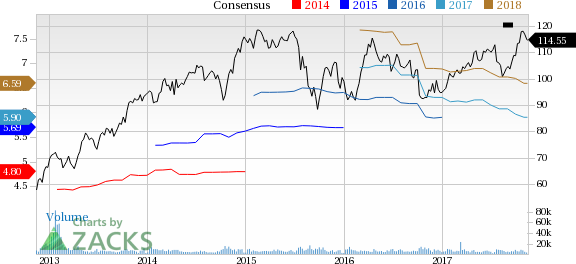

PPG Industries has underperformed the

industry it belongs to over a year. The company’s shares have gained around 19% over this period as against roughly 29.4% gain recorded by its industry.

PPG Industries reported net earnings from continuing operations of $1.52 per share for the third quarter of 2017, as against the year-ago net loss from continuing operations of 79 cents. The results were in line with the Zacks Consensus Estimate.

Net sales in the quarter increased 3.2% year over year to $3,776 million. Sales beat the Zacks Consensus Estimate of $3,748 million. Favorable currency swings positively affected net sales by around 2%.

PPG Industries expects continued moderate global economic growth. Post the mayhem caused by the recent natural disasters, the company doesn’t anticipate any further decline in the level of raw material cost inflation for the balance of this year.

The company also sees an additional selling price increase. Along with addressing the inflationary environment, it remains on track with its restructuring program which is expected to deliver full-year savings of more than $45 million.

PPG Industries expects the recent natural disasters to unfavorably impact fourth-quarter earnings by up to 5 cents per share.

PPG Industries, Inc. Price and Consensus

Some better-ranked stocks in the basic materials space are Ingevity Corporation (NYSE:) , Westlake Chemical Corporation (NYSE:) and POSCO (NYSE:) .

Westlake Chemical has expected long-term earnings growth of 8.4% and flaunts a Zacks Rank #1.

POSCO has expected long-term earnings growth of 5% and carries a Zacks Rank #2 (Buy).

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

PPG Industries, Inc. (PPG): Free Stock Analysis ReportWestlake Chemical Corporation (WLK): Free Stock Analysis ReportIngevity Corporation (NGVT): Free Stock Analysis ReportPOSCO (PKX): Free Stock Analysis ReportOriginal postZacks Investment Research

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.