- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pound Steady, UK Manufacturing Production Meets

The British pound is almost unchanged in Wednesday trade. In the North American session, the pair is trading at 1.2995, down 0.18% on the day. On the release front, its has been a busy day on both sides of the pond. in the UK, Manufacturing Production improved to 0.0%, matching the forecast. The UK trade deficit jumped to GBP 12.7 billion, higher than the deficit of GBP 11.0 billion. Over in the US, inflation indicators disappointed, as PPI and Core PPI both declined 0.1%, missing their estimates of +0.1%. Unemployment claims rose to 244 thousand, higher than the estimate of 240 thousand. Inflation numbers will again be in focus on Friday, as the US releases CPI and Core CPI.

The British manufacturing sector is in trouble, based on a key indicator, Manufacturing Production. The indicator has managed just one gain in 2017, and the June reading of 0.00% is hardly good news. There was no relief from Britain’s trade balance, as the deficit climbed to GBP 12.7 billion in June, marking a three month high. Investors remain concerned about Brexit, and the Bank of England has not shied away from warning that Britain’s departure from the EU will hurt the British economy. One of the buzz words surrounding Brexit is “transition period”, as some politicians have come out in favor of a period between Britain’s departure and post-Brexit rules coming into effect. This would minimize the destabilizing effect of Brexit on financial companies, for example. On Wednesday, BoE Deputy Governor and PRA Chief Executive Sam Woods said that “some form of implementation period is desirable”, although he stopped short of providing any specifics. The concept of a transition period could come up in talks between the two sides if the May government decides that it wants a transition period.

The markets are looking for some clarity from the Federal Reserve, which is showing signs of backtracking on another rate hike in 2017. Earlier this year, the Fed strongly hinted that it planned to raise rates three times in this year, but so far only pressed the rate trigger twice, in March and June. After the June hike, Fed Chair Janet Yellen shrugged off concerns over low inflation, saying that it was due to “transient” factors. However, inflation has not improved and the Fed has changed its tune. Last week, St. Louis Federal Reserve President James Bullard said he opposed further Fed hikes, warning that another hike would actually delay inflation from hitting the Fed’s target of 2%. The Fed appears uncertain about when to raise rates, and predictably, this hesitancy is making investors skeptical that the Fed will act. There is little chance that the Fed will make any moves at the September and November meetings, and the odds of a rate hike in December are currently at 42%. Analysts are hoping for some insight into the Fed’s thinking when the Fed Reserve Dallas President Robert Kaplan and Minneapolis President Neel Kashkari deliver speeches on Friday.

GBP/USD Fundamentals

Thursday (August 10)

- 4:30 British Manufacturing Production. Estimate 0.0%. Actual 0.0%

- 4:30 British Goods Trade Balance. Estimate -11.0B. Actual -12.7B

- 4:30 British Construction Output. Estimate +1.4%. Actual -0.1%

- 4:30 British Industrial Production. Estimate 0.1%. Actual 0.5%

- 7:30 British NIESR GDP. Actual 0.2%

- 8:30 US PPI. Estimate +0.1%. Actual -0.1%

- 8:30 US Unemployment Claims. Estimate 240K. Actual 244K

- 8:30 US Core PPI. Estimate +0.2%. Actual -0.1%

- 10:00 US FOMC Member William Dudley Speaks

- 10:30 US Natural Gas Storage. Estimate 38B. Actual 28B

- 13:01 US U.S. 30-Year Auction

- 14:00 US Federal Budget Balance. Estimate -60.9B

Friday (August 11)

- 8:30 US CPI. Estimate 0.2%

- 8:30 US Core CPI. Estimate 0.2%

- 9:40 US FOMC Member Robert Kaplan Speaks

- 11:30 US FOMC Member Neel Kashkari Speaks

*All release times are GMT

*Key events are in bold

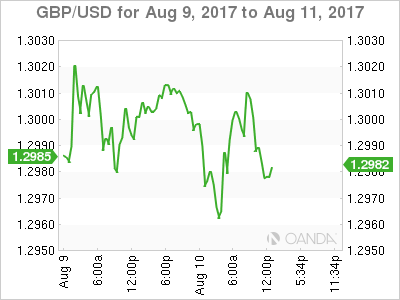

GBP/USD for Thursday, August 10, 2017

GBP/USD August 10 at 12:00 EDT

Open: 1.3004 High: 1.3016 Low: 1.2968 Close: 1.2995

GBP/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2767 | 1.2865 | 1.2946 | 1.3058 | 1.3121 | 1.3238 |

- GBP/USD posted small gains in the Asian and European sessions. The pair lost ground in the North American session but has partially recovered

- 1.2946 is providing support

- 1.3058 is the next resistance line

Further levels in both directions:

- Below: 1.2946, 1.2865 and 1.2767

- Above: 1.3058, 1.3121, 1.3238 and 1.3347

- Current range: 1.2946 to 1.3058

OANDA’s Open Positions Ratio

GBP/USD ratio remains unchanged this week. Currently, long positions have a majority (59%), indicative of trader bias towards GBP/USD reversing directions and moving upwards.

Related Articles

MON: Eurogroup Meeting, Norwegian CPI (Feb), EZ Sentix Index (Mar), Japanese GDP (Q4) TUE: EIA STEO WED: 25% US tariff on all imports of steel and aluminium comes into effect,...

Brief Reminder In 2018, US President Donald Trump initiated a trade war update with sanctions against China. Economic disagreement between the United States and China began in...

Trump’s U-Turns Keep the Market Under Pressure Both US equity indices and the US dollar remain under severe stress as US President Trump continues his back-and-forth on the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.