- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

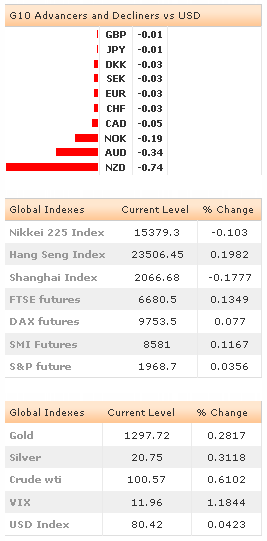

Post-Yellen USD-Appetite Hits Gold, G10

Market Brief

The FOMC Chair Yellen’s semi-annual testimony triggered price action in US yesterday. In her speech before the Senate, Janet Yellen reiterated that the slow growth in wages indicates the slack in jobs market and that the growth projections for the year have been downgraded due to weak first quarter GDP. According to Yellen, the US economy will continue growing at moderate pace, the inflation expectations are anchored, and the inflation is seen below 1.75% this year. As long as the inflation remains below Fed’s 2% target, the high level of accommodation remains appropriate, she said, yet increase in rates would come sooner and be faster if the labor data continues improving at the current pace. The Fed hawks took over the market; USD gained broadly yet the US 10-year government yields couldn’t make it higher than 2.57%. The second part of the testimony is due today. Will USD/JPY break the critical 200-dma resistance (101.95)?

XAU/USD sold-off to $1,292 (50-dma) during Yellen’s testimony. Bids remain above the critical $1,285/87 (200-dma / Fibonacci 50.0% on Jan-Mar rally), yet the negative pressures intensify. A breakout below the support zone should gather enough momentum to push the levels to $1,240 (Jun support). The key support is eyed at $1,180/1,200, four year low region.

WTI traded down to $99 for the first time since May 5th as the geopolitical risk premium eases regarding the Iraqi situation, Brent crude spiked below $105.00. Oversold conditions suggest short-term correction at the current levels.

The broad-based USD pick-up sent EUR/USD down to 1.3558 (lowest since June 18th). The pair broke below June-July ascending channel, the trend indicators turned negative. Decent option barriers at 1.3575/1.3600 should keep the upside solid today. The critical support zone stands at 1.3477/1.3503 (2014 low / June 5th ECB stimulus reaction low).

The Cable has been the least hurt by the USD strength among G10 currencies. The surprise acceleration in UK inflation (1.9% on year to June) limited the impact of any negative shock. Post-CPI in London yesterday, GBP/USD surged to the fresh year high of 1.7192 – the highest since October 2008. The post-Yellen weakness remained limited at 1.7131 in New York and Asia. As technicals sharply reverse in favor of a fresh positive bias, the downside correction is likely to resume as long as 21-dma (1.7089) support holds. The UK releases the unemployment figures today, the 3-month average jobless rate is seen at 6.5% versus 6.6% printed a month before.

NOK, NZD and AUD were the most hit. In addition to post-Yellen sell-off, the softer-than-expected 2Q inflation reading in New Zealand pulled NZD/USD down to 0.8691 for the first time in three weeks. The short-term trend momentum gains speed on the downside, 0.8611/48 (100/50-dma) should provide the first support. Offers are building at 0.8700/20.

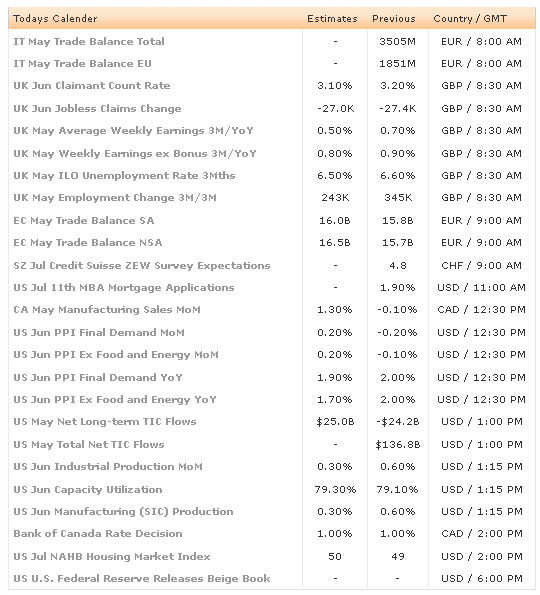

The BoC gives policy verdict today and is expected to maintain the status quo. Today’s economic calendar: Italian May trade Balance, UK June Jobless Claims and Claimant Count Change, May ILO Unemployment Rate 3-months and Average Weekly Earnings, Euro-Zone May Trade Balance, ZEW Survey July Expectations in Switzerland, US July 11th MBA Mortgage Applications, Canadian May Manufacturing Sales m/m, US June PPI m/m & y/y, US May Total Net TIC Flows and Net Long-term TIC Flows, US June Industrial Production and Capacity Utilization, US June Manufacturing (SIC) Production, US July NAHB Housing Market Index and US Fed Beige Book.

Currency Tech

EUR/USD

R 2: 1.3640

R 1: 1.3575

CURRENT: 1.3558

S 1: 1.3503

S 2: 1.3477

GBP/USD

R 2: 1.7270

R 1: 1.7192

CURRENT: 1.7134

S 1: 1.7089

S 2: 1.7060

USD/JPY

R 2: 102.47

R 1: 101.95

CURRENT: 101.68

S 1: 101.07

S 2: 100.76

USD/CHF

R 2: 0.9037

R 1: 0.9013

CURRENT: 0.8966

S 1: 0.8940

S 2: 0.8898

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

Forex Strategy is Bearish: USD/JPY is currently at 146.76 in a 5th fractal wave in a channel. We are looking for a continuation to the ATR target at the 146.10 area, with a...

The Canadian dollar is steady at the start of the week. USD/CAD is trading at 1.4385, up 0.06% on the day. The Canadian dollar declined 0.50% on Friday after Canada’s job report...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.