- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Plug Power (PLUG) To Report Q4 Earnings: What To Expect?

Plug Power Inc. (NASDAQ:PLUG) is scheduled to release fourth-quarter 2019 results on Mar 5, before market open.

The company delivered weaker-than-expected results in three of the last four quarters, while surpassing estimates in one. Earnings surprise for the last four quarters is a negative 40.21%, on average. Notably, in the last reported quarter, the company’s loss per share of 8 cents lagged the Zacks Consensus Estimate of 6 cents loss per share.

In the past three months, shares of the company have gained 32.1% against the industry’s decline of 6.2%.

Let us delve deeper.

Key Factors and Estimates

The growing popularity of fuel cell engines and hydrogen stations has been benefiting Plug Power over time. This is expected to have contributed to top-line performance in the fourth quarter of 2019. The company’s major product offerings include GenDrive fuel cell systems and ProGen fuel cell engine.

Also, healthy demand from material handling, on-road and stationary markets as well as technological advancements, and efforts to build additional capacity and strengthen sales channels might have been beneficial.

Further, the company’s partnership with ENGIE (signed in the third quarter) might have positively impacted the hydrogen fuel cell business in the quarter.

However, headwinds (like forex issues, geopolitical concerns and others) arising from international operations might have hurt the company’s quarterly performance. Also, higher cost revenues and operating expenses might have been dragging. Notably, cost of revenues and operating expenses increased 5.7% and 5.5%, respectively, in the first nine months of 2019.

Plug Power anticipates record gross billings of $93-$95 million for the fourth quarter. Notably, gross billings were just $61 million in the third quarter of 2019. Also, GenDrives deployment will likely be 2,500 in the quarter.

The Zacks Consensus Estimate for fourth-quarter loss per share is pegged at 6 cents, indicating an improvement from a loss per share of 8 cents recorded in the fourth quarter of 2018. However, the consensus estimate for revenues of $90 million suggests a 50% increase from the prior-year reported figure.

Earnings Whispers

Our proven model doesn’t conclusively predict an earnings beat for Plug Power this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of beating estimates. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Plug Power has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at loss per share of 6 cents.

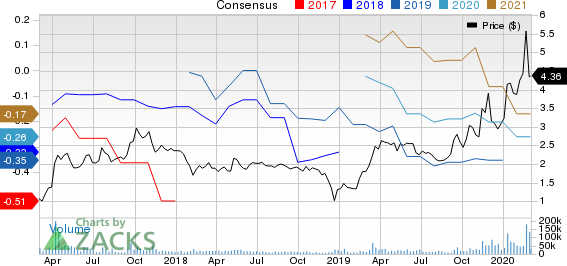

Plug Power, Inc. Price and Consensus

Frontier Communications Corporation (FTR): Free Stock Analysis Report

Plug Power, Inc. (PLUG): Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX): Free Stock Analysis Report

NGM Biopharmaceuticals, Inc. (NGM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.