- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pilgrim's Pride (PPC) Beats On Q3 Earnings And Revenues

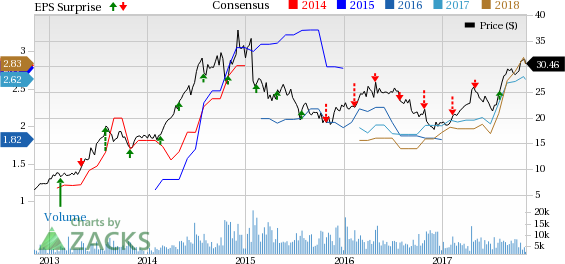

Premium consumer goods company Pilgrim's Pride Corporation (NASDAQ:PPC) reported better-than-expected results for third-quarter 2017. The company is poised to grow on the back of its diversified bird-size portfolio and strategic business acquisitions.

Earnings

The company’s quarterly earnings of 93 cents per share surpassed the Zacks Consensus Estimate of 77 cents. The bottom line also came in higher than the year-ago tally of 39 cents per share.

Revenues

In the reported quarter, Pilgrim's Pride generated net revenues of $2,793.8 million, up 12% year over year. In addition, the top line comfortably surpassed the Zacks Consensus Estimate of $2,267 million.

Revenues from U.S. operations came in at $1,938.5 million, up 12.4% year over year. Mexican operations generated revenues of $341 million in the reported quarter, up 11% year over year. Top-line results from the company’s European operations also improved 11% year over year to $514.3 million.

Costs/Margins

Pilgrim's Pride's cost of sales in the reported quarter increased 3.3% year over year to $2,315.3 million. Gross margin expanded 700 basis points (bps) year over year to 17.1%.

Selling, general and administrative expenses flared up 34.6% year over year to $102.2 million. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin came in at 16.6%, advancing 707 bps year over year.

Balance Sheet/Cash Flow

Pilgrim's Pride exited the third quarter with cash and cash equivalents of approximately $401.8 million, up from $292.5 million recorded on Dec 25, 2016. Long-term debt (net of current portion) was $2,548.6 million, as against $1,396.1 million as of Dec 25, 2016.

In the reported quarter, the company generated $618.5 million of cash from its operating activities, up 12% year over year. Capital spending totaled $258.4 million compared to $221 million incurred in the year-ago quarter.

Outlook

Pilgrim's Pride anticipates that solid demand for chicken in both international and domestic end-markets will bolster the company’s revenues and profitability in the quarters ahead. The latest Moy Park acquisition (September 2017) is likely to strengthen its European business, going forward. At the same time, the successful integration of GNP Company (January 2017) is projected to drive the company’s profitability in the near term.

Zacks Rank and Other Stocks

Pilgrim's Pride currently sports a Zacks Rank #1 (Strong Buy). Some other top-ranked stocks within the same space are listed below:

Energizer Holdings, Inc. (NYSE:ENR) currently holds a Zacks Rank of 2 (Buy) and has a positive average earnings surprise of 23.02% for the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inter Parfums, Inc. (NASDAQ:IPAR) carries a Zacks Rank of 2 and has a positive average earnings surprise of 18.08% for the trailing four quarters.

Lamb Weston Holdings Inc. (NYSE:LW) also has a Zacks Rank of 2 and has a positive average earnings surprise of 11.02% for the same time frame.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Energizer Holdings, Inc. (ENR): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.