- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Can TransUnion (TRU) Beat Q3 Earnings On Broad-Based Growth?

TransUnion (NYSE:TRU) is slated to report third-quarter 2017 results before the opening bell on Oct 27.

In the last reported quarter, the company’s earnings trumped the Zacks Consensus Estimate by 6.8%. TransUnion has an impressive average positive surprise of 10.6% for the trailing four quarters, beating estimates all through.

We expect TransUnion to score an earnings beat in the to-be-reported quarter as well.

Why a Likely Positive Surprise?

Our proven model shows that TransUnion has the right combination of the two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. This is perfectly the case here as you will see below:

Zacks ESP: TransUnion has an Earnings ESP of +2.14%, as the Most Accurate estimate of 48 cents is pegged above the Zacks Consensus Estimate of 47 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #2, which when combined with a positive ESP, makes us reasonably confident of an earnings beat.

Conversely, we caution against stocks with a Zacks Ranks #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Growth Drivers for the Quarter

TransUnion has an attractive business model with highly recurring and diversified revenue streams, significant operating leverage, low-capital requirements, and strong and stable cash flows. In addition, the inherent nature and significance of the company’s solutions in customers’ decision-making steps endow it with high-customer retention and revenue visibility. These factors have helped drive consistent operating results for the company in recent times, and will likely boost the upcoming quarterly results as well.

During the quarter, TransUnion acquired leading provider of vehicle and driving records, Datalink Services, Inc. d/b/a Compass Driving Records. This acquisition will enable TransUnion’s DriverRisk solution to offer the insurance industry a full-driving record platform. We anticipate the acquisition to have a favorable impact on the quarter’s results.

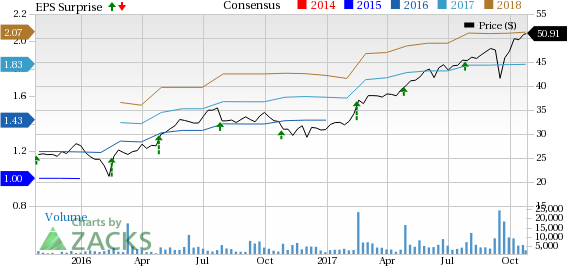

TransUnion Price, Consensus and EPS Surprise

TransUnion has been enjoying strong growth momentum in recent times. Particularly, the company’s USIS segment, which witnessed 16% year-over-year growth in revenues in the second quarter, will likely record sturdy top-line growth in the coming results as well. The Zacks Consensus Estimate for the USIS segment revenues in the to-be-reported quarter is pegged at $294 million, reflecting impressive growth of 13.5% year over year.

Further, we expect the International segment to continue its strong growth trajectory this quarter. The Zacks Consensus Estimate for this segment’s revenues is pegged at $91 million, underlining striking year-over-year growth of 15.2%.

In fact, the Consumer Interactive segment, which has been weak in recent times, is also expected to return to the growth track this quarter. The segment’s Zacks Consensus Estimate for the quarter’s sales is $102 million, indicating growth of 6.3% year over year. However, the revenues of the segment are expected to decline sequentially.

The company’s collaboration with Carahsoft Technology Corp. — a trusted government IT solutions provider — will also likely boost the results in to-be-reported quarter.

As emerging market economies continue to develop and mature, the company becomes well positioned to gain from the associated favorable socio-economic trends. Additionally, increased risk of identity theft due to data breaches, and higher consumer awareness about the importance and usage of their credit information are propelling the demand for TransUnion’s consumer solutions. These factors bode well for the company’s operating results.

Per the company’s guidance provided in the last quarterly results, consolidated revenues are expected to be in the range of $470-$475 million for third-quarter 2017. Adjusted EBITDA is projected to be between $185 million and $189 million, while adjusted earnings are expected to be between 45 cents and 46 cents per share.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Terex Corporation (NYSE:TEX) , with an Earnings ESP of +3.17% and a Zacks Rank of 2, is expected to release quarterly numbers around Nov 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNH Industrial N.V. (NYSE:CNHI) , with an Earnings ESP of +8.11% and a Zacks Rank of 2, is slated to report results on Oct 31.

Rockwell Collins, Inc. (NYSE:COL) , with an Earnings ESP of +2.23% and a Zacks Rank of 2, is expected to report quarterly figures around Oct 27.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

TransUnion (TRU): Free Stock Analysis Report

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

CNH Industrial N.V. (CNHI): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.