- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

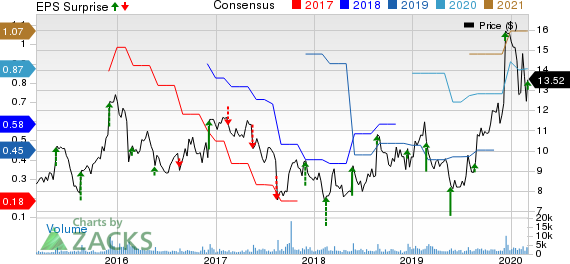

Photronics (PLAB) Q1 Earnings In Line With Estimates, Up Y/Y

Photronics, Inc. (NASDAQ:PLAB) reported first-quarter fiscal 2020 earnings of 16 cents per share, which were in line with the Zacks Consensus Estimate. Also, the bottom line surged 100% from the year-ago quarter’s reported figure.

Revenues of $159.7 million outpaced the consensus mark by 5.8% and rallied 28% on a year-over-year basis.

The year-over-year growth was driven by Photronics’ strong technology portfolio, expanding global operations and the company’s leadership position in the photomask market.

Segment Details

IC Revenues (67% of total revenues) amounted to $107 million, up 13% from the year-ago quarter’s figure but down sequentially due to seasonal softness. However, the company’s efforts to establish a strong presence in China are driving IC revenues.

Moreover, the company’s business in China comprises a few large key customers and many smaller developing customers. They are split evenly between the IC and FPD segments, representing a diverse revenue stream.

FPD Revenues (33% of total revenues) surged 77% year over year to $52.8 million, driven by strong demand for AMOLED and LTPS mobile displays as well as G10.5 displays for the large format TVs.

Moreover, Photronics’ expanded production capabilities at its FPD facility in Hefei was a key contributor.

Operating Details

Selling, general and administrative expenses increased 3.1% year over year to $14.2 million. Research and development expenses were $4 million, down 4.3% year over year.

Total operating profit for the quarter was $16.3 million compared with $8 million in the year-ago quarter.

However, operating margin contracted 350 basis points (bps) year over year to 10.2%, driven by costs of ramping the facilities in China and increased compensation costs.

Balance Sheet & Cash Flow

As of Feb 2, 2020, the company had cash and cash equivalents of approximately $218.3 million compared with $206.5 million as Oct 31, 2019.

Net cash flow from operating activities was $30.8 million as of Feb 2, 2020 compared with $48.3 million as of Oct 31, 2019.

The company repurchased 0.9 million shares for $11 million during the quarter.

Guidance

For the second quarter of fiscal 2020, the company expects revenues in the range of $145-$155 million. The Zacks Consensus Estimate for revenues is pegged at 150.4 million, which indicates year-over-year growth of 14.3%.

Earnings are expected to be between 11 cents and 17 cents per share for fiscal second quarter. The consensus mark for earnings is pegged at 17 cents, which indicates growth of 30.8% from the year-ago quarter’s levels.

Zacks Rank & Stocks to Consider

Currently, Photronics carries a Zacks Rank #3 (Hold).

Applied Materials, Inc. (NASDAQ:AMAT) , Garmin Ltd. (NASDAQ:GRMN) and Microsoft Corporation (NASDAQ:MSFT) are some better-ranked stocks in the same industry. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Applied Materials, Garmin and Microsoft is currently pegged at 9.9%, 7.4% and 13.2%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Photronics, Inc. (PLAB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.