- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Philips Teams Up With HomeLab To Improve Indoor Air Quality

Koninklijke Philips N.V. (NYSE:PHG) recently announced that it has partnered with HomeLab to create a healthy home environment. The partnership will leverage Philips Air Purifier tool along with professional grade AeraSense technology to automatically monitor, react, as well as purify indoor air, capturing 99.97% of particles. In fact, incorporating Philips Air Purifier into HomeLab’s Healthy Home Program will make it easier to track and control air quality in home, facilitating healthier homes.

Combining HEPA and VOC purifier with a professional grade PM2.5 monitor, the Philips 2000i Smart Air Purifier tracks pollution trends as well as decrease allergens simultaneously. The active carbon filter aids in trapping toxic gases (VOCs), while the HEPA filter traps minute particles as small as 0.3 microns, including dust mites, pet dander, pollen and mold.

Philips Air Purifier’s unique numerical index, connected app and corresponding color ring, alerts users even if there is a minor change in indoor air conditions, supporting HomeLab’s analysis. The collaboration will enable users to visualize allergen levels with the color coded ring and watch air improvement simultaneously as the purifier is set to work. It will also allow users to control the device from smart phones as well as view both indoor as well as outdoor pollution.

Our Take

In the past couple of years, Philips has successfully morphed from a lighting company into a healthcare technology provider. However, the company’s near-term profitability is likely to be hurt by sluggish growth prospects of the healthcare market on a global scale. In light of uncertainties like slowing government spending and events surrounding the Affordable Care Act (“ACA”) legislation, the company expects the United States to witness low-single digit growth in the healthcare industry.

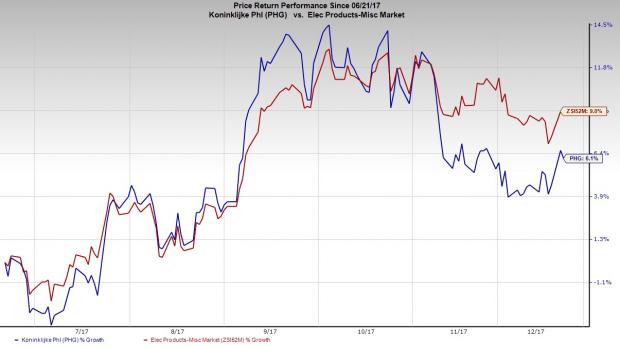

Moreover, country-specific risks for China like anti-corruption initiatives, slow GDP growth and centralized tendering are likely to dampen the prospects of the healthcare industry, thwarting growth. Also, in the HealthTech Other vertical, the company anticipates incurring approximately EUR 80 million of net cost, higher than previous guidance. These costs are likely to negatively impact margins in the quarters ahead. Not surprisingly, the Zacks Rank #4 (Sell) company has returned 6.1% in the last six months, underperforming the industry’s growth of 9%.

Stocks to Consider

Some better-ranked stocks from the same space include Analog Devices, Inc. (NASDAQ:ADI) , Amphenol Corporation (NYSE:APH) and Apptio Inc. (NASDAQ:APTI) . While Analog Devices sports a Zacks Rank #1 (Strong Buy), Amphenol and Apptio carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Analog Devices has outpaced estimates in the preceding four quarters, with an average earnings surprise of 16.3%.

Amphenol has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 8.9%.

Apptio has surpassed estimates in the preceding four quarters, with an average positive earnings surprise of 47.6%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Apptio Inc. (APTI): Free Stock Analysis Report

Koninklijke Philips N.V. (PHG): Free Stock Analysis Report

Amphenol Corporation (APH): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.