- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Philips & Nuance Team Up To Bring AI In Radiology Reporting

Koninklijke Philips N.V. (NYSE:PHG) recently announced that it has decided to team up with Nuance Communications (NASDAQ:NUAN) to bring artificial intelligence-based (AI) image interpretation and reporting capabilities to radiologists. The partnership will leverage Philips’ Illumeo with adaptive intelligence, and Nuance’s PowerScribe 360, to reduce discrepancies, and improve radiology reporting, standardization as well as accuracy.

Touted as one of the modern imaging and informatics technology, Illumeo is powered with adaptive intelligence. It supplements the work of a radiologist by integrating contextual awareness capabilities with advanced data analytics. On the other hand, Nuance PowerScribe 360, a real-time radiology reporting platform, facilitates rapid generation of high-quality actionable reports.

The integration of Philips Illumeo and Nuance PowerScribe 360 will enable radiologists to access a variety of tools at the point-of-care. These include tools for risk stratification, faster turnaround times as well as greater report accuracy and structure. The collaboration will enable radiologists to access AI-driven solutions and practical applications, including the integration of ACR guidelines, which would save time as well as effort along with improving report quality and patient outcomes.

Healthcare Market Losing Momentum

Philips has broadened its presence in the healthcare markets in recent quarters and expects this segment to be a long-term growth driver. However, the company’s near-term profitability is likely to be hurt by sluggish growth prospects of the healthcare market on a global scale. For instance, the company expects the United States to witness low single digit growth in the healthcare industry, in light of uncertainties like slowing government spending and events surrounding the ACA (Affordable Care Act) legislation. Also, factors like anti-corruption initiatives, slow GDP growth and centralized tendering remain country-specific risks for China are likely to dampen the prospects of the healthcare industry, thwarting the company’ growth.

Moreover, as this Zacks Rank #5 (Strong Sell) company has a geographic presence in more than 80 countries, it is exposed to a number of regional and local regulatory rules in sensitive areas like healthcare. The company believes such stringent rules expose it to difficulties in obtaining clearances or approvals for new products, which in turn, may lead to unfavorable performance. Further, the industry in which Philips operates is highly dynamic, which indicates that failure to accelerate the company’s innovation-to-market processes may lead to materially adverse effects on its financial condition as well as operating results.

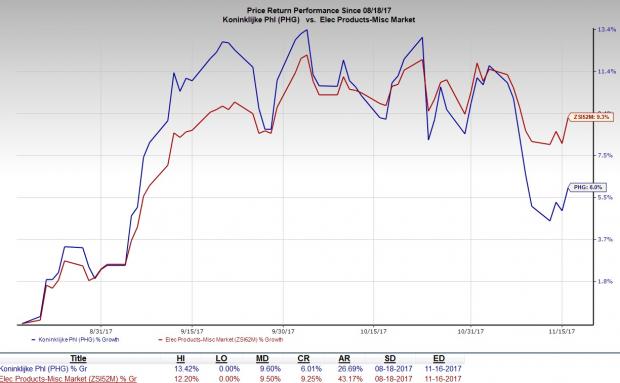

The stock has returned 6% in the last three months, underperforming the industry’s gain of 9.3%. Moreover, analysts have become increasingly bearish on the stock over the past few months, with estimate revisions moving south. With two downward revisions compared with no upward revision in the past two months, the Zacks Consensus Estimate for fiscal 2017 earnings has declined from $1.58 to $1.37.

Stocks to Consider

Some better-ranked stocks in the same space are Garmin Ltd. (NASDAQ:GRMN) and Control4 Corporation (NASDAQ:CTRL) . While Garmin sports a Zacks Rank #1 (Strong Buy), Control4 carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Garmin has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 15.9%.

Control4 has outpaced estimates in the preceding four quarters, with an average earnings surprise of 100.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Nuance Communications, Inc. (NUAN): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Koninklijke Philips N.V. (PHG): Free Stock Analysis Report

Control4 Corporation (CTRL): Free Stock Analysis Report

Original post

Related Articles

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date,...

US index futures broke lower after Marvell Technology's earnings missed. Nasdaq and S&P 500 are now testing key support zones. Meanwhile, Amazon, Oracle, Tesla and...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.