- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Philip Morris (PM) Down 5.1% Since Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for Philip Morris International Inc (NYSE:PM) . Shares have lost about 5.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Philip Morris Misses Q3 Earnings & Sales, Lowers View

After reporting weaker-than-expected results in the first half of 2017, Philip Morris continued with its dismal performance in the third quarter. Both earnings and revenues lagged the Zacks Consensus Estimate in third-quarter 2017 results. Moreover, the company also lowered its earnings guidance for 2017.

Quarter in Detail

Adjusted earnings of $1.27 per share missed the Zacks Consensus Estimate of $1.39. While the company benefited from strong pricing and growth in Reduced Risk Products, lower cigarette volumes hurt its performance. Nevertheless, adjusted earnings in the reported quarter inched up 1.6% from the year-ago period.

Net revenue, excluding excise taxes, was $7,473 million, which increased 7% (up 9% excluding unfavorable currency of $136 million) in the third quarter. Favorable pricing and volume/mix in the quarter drove revenues. While, revenue increased across Asia, Latin America & Canada and the European Union (EU), the same had declined in Eastern Europe, the Middle East & Africa (EEMA).

During the quarter, revenues from combustible products declined 3.6% (down 4.6% excluding negative currency) to $6.5 billion. On the contrary, Reduced Risk Products (RRPs) reported a whopping increase from last-year quarter, stemming from the shift of customer preference away from tobacco products. The company generated revenues of $947 million from RRPs, significantly higher than $212 million reported last year.

However, net revenues lagged the Zacks Consensus Estimate of $7,616 million.

Total cigarette and heated tobacco unit shipment volume fell 0.5% to 208.2 billion units. The figures were unfavorable in the EU, EEMA region and in Latin America & Canada mainly owing to low cigarette shipment volumes. These were offset by increased volumes in Asia, as well as higher heated tobacco unit shipment volume across all regions. While cigarette shipment volume declined 4.1% in the quarter, heated tobacco unit shipment volume of 9.7 billion units, increased significantly from 2.1 billion units recorded in third-quarter 2016.

Adjusted operating companies income was up 2.2% year over year to $3.1 billion due to favorable pricing and growth witnessed in Asia. Excluding currency impact of $140 million, adjusted operating income increased 6.8%. However adjusted operating margin was down 190 basis points to 42%.

Segment Details

European Union: Net revenue in the European Union region increased 0.2% year over year to $2.2 billion. Excluding the impact of currency, net revenue declined 2.2%, mainly driven by unfavorable volume/mix in France, Spain, U.K. and Germany, which were partly offset by Italy.

Adjusted operating companies income, excluding unfavorable currency, decreased by 7.6%. Adjusted operating companies income margin, excluding favorable currency, decreased by 2.8 points to 48.1%.

Eastern Europe, the Middle East & Africa (EEMA): Net revenue in EEMA region decreased 7.9% year over year to $1.8 billion. Excluding the impact of currency, net revenue declined 2.4%, principally driven by unfavorable volume/mix which reflects lower markets and market share in Russia and Saudi Arabia. These were partially offset by favorable pricing variance.

Adjusted operating companies income, excluding unfavorable currency, decreased 11.7%. Adjusted operating companies income margin, excluding unfavorable currency, decreased by 4.8 points to 44.9%.

Asia: The company recorded net revenue growth of 27.8% to $2.7 billion in Asia. Excluding currency impact, revenue was up 31% from the prior-year quarter, owing higher shipment volumes and increased revenues from RRP’s, despite a decline in cigarette revenues.

Adjusted operating companies income, excluding unfavorable currency, increased 47.2%.

Latin America and Canada: In Latin America and Canada, revenues increased 6.5% (up 8.5% excluding currency) to $756 million, primarily driven by growth in cigarette and RRP’s revenues, despite decline in shipment volumes.

Adjusted operating companies income, excluding unfavorable currency, increased 21.4%.

Financial Update

During the quarter, Philip Morris increased the regular quarterly dividend by approximately 2.9% to reach an annualized rate of $4.28 per share.

Guidance

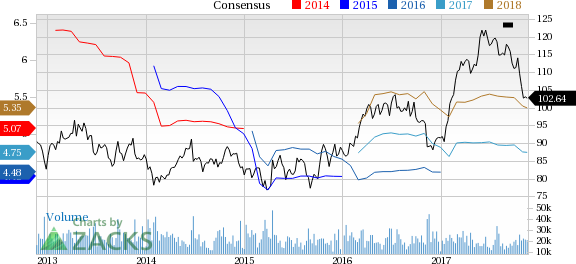

Philip Morris lowered its earnings guidance for 2017 and now expects the same in range of $4.75 to $4.80, lower than the previous range of $4.78 to $4.93. The revised guidance depicts a growth of 9-10% over the adjusted earnings of $4.48 delivered in 2016. The estimated earnings range, however, excludes the negative impacts of currency of 17 cents, and favorable tax item of 4 cents.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter.

VGM Scores

At this time, Philip Morris' stock has a nice Growth Score of B, though it is lagging a lot on the momentum front with an F. The stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for growth investors based on our style scores.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Philip Morris International Inc (PM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.