- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pharma Stock Roundup: AstraZeneca's Q3 Earnings, Roche & Merck Drugs Get FDA Nod

Earnings remained in focus this week with companies like AstraZeneca (NYSE:AZN) reporting third quarter results. Meanwhile, companies like Roche (OTC:RHHBY) and Merck & Co., Inc. (NYSE:MRK) were in the news due to regulatory updates.

Recap of the Week’s Most Important Stories

Mixed Results from AstraZeneca: AstraZeneca’s third quarter results were mixed with the company missing on earnings but beating on revenues. The company has several pipeline events lined up in the coming quarters including data on cancer drugs like Lynparza and Imfinzi as well as regulatory submissions for moxetumomab pasudotox (leukemia) and selumetinib (thyroid cancer) among others (Read more: AstraZeneca Misses Q3 Earnings, Tweaks 2017 EPS View).

FDA Nod for Merck CMV Drug: Merck gained FDA approval for Prevymis (letermovir) for the prevention of cytomegalovirus (“CMV”) infection and disease in adult allogeneic hematopoietic stem cell transplant (“HSCT”) patients. A common and potentially serious viral infection in allogeneic HSCT recipients, any level of CMV infection is associated with increased mortality in HSCT patients. Merck said that Prevymis is the first new CMV medicine to be approved in the United States in 15 years.

Merck intends to launch the drug in December at a list price of $195 per day for the tablets and $270 for the injection. Merck is a Zacks Rank #3 (Hold) stock - you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sanofi (PA:SASY) Signs MS Deal worth up to $805M: Sanofi (NYSE:SNY) has entered into an agreement with Principia Biopharma Inc. for the latter’s clinical-stage, blood brain barrier crossing, oral BTK inhibitor, PRN2246, which has the potential to be developed for the treatment of multiple sclerosis (“MS”) and other central nervous system (“CNS”) diseases. Sanofi is willing to shell out up to $805 million including an upfront payment of $40 million. The balance will be payable on the achievement of milestones. Principia will also earn royalties on product sales. Moreover, the company has the option to co-fund late-stage development costs in exchange for either higher royalties on global sales or a profit and loss sharing arrangement in the United States. Sanofi already has a presence in the MS market in the form of Lemtrada and Aubagio.

Glaxo Files for Nucala Label Expansion in the United States: GlaxoSmithKline plc (NYSE:GSK) is looking to expand the label of its IL-5 antagonist, Nucala (mepolizumab), which is currently approved by the FDA as an add-on maintenance treatment for patients with severe asthma aged 12 years and older, and with an eosinophilic phenotype.

Glaxo is now seeking FDA approval for the drug to be used as an add-on to maintenance treatment for patients who have chronic obstructive pulmonary disease (“COPD”) with an eosinophilic phenotype.

According to information provided by the company, COPD is estimated to affect 384 million people across the world and is currently the fourth leading cause of death in the world. However, given its prevalence, it could become the third leading cause of death by 2020.

Glaxo has also filed for FDA approval of Nucala for the treatment of adult patients with eosinophilic granulomatosis with polyangiitis (“EGPA”).

Roche Lung Cancer Drug Gets FDA Nod for First-Line Setting: Roche gained FDA approval for its lung cancer drug, Alecensa (alectinib), for the first-line treatment of people with a specific type of lung cancer. The label expansion was based on phase III data which showed that Alecensa significantly extended the time that people lived without their disease worsening compared to Xalkori (crizotinib). The risk of the cancer spreading to or growing in the brain or central nervous system was also significantly lower in the Alecensa arm. This approval expands the patient population for Alecensa significantly with the treatment previously being approved in the second-line setting.

Roche also gained FDA approval for its melanoma drug, Zelboraf, for the treatment of Erdheim-Chester disease (“ECD”), a rare blood disease.

Roche has gained 1.1% year to date, compared to the 15.9% rally of the industry it belongs to.

Performance

Large Cap Pharmaceuticals Industry 5YR % Return

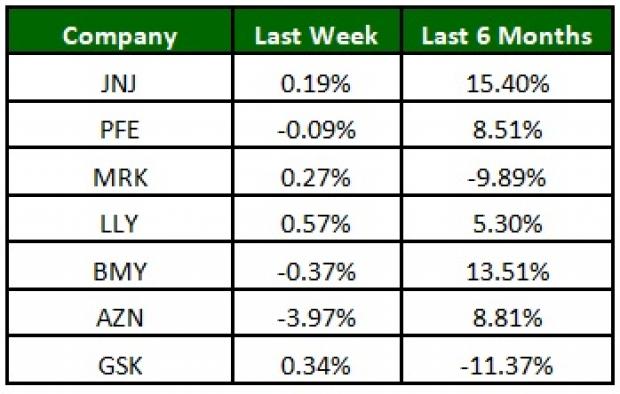

The NYSE ARCA Pharmaceutical Index declined marginally (0.2%) this week. Among major stocks, Eli Lilly (NYSE:LLY) was up 0.6% while AstraZeneca was down 3.9%. Over the last six months, Johnson & Johnson (NYSE:JNJ) was up 15.4% while Glaxo declined 11.4% (See the last pharma stock roundup here: Pfizer (NYSE:PFE), Teva's Q3 Earnings, Novartis Seeks New Indication for Kymriah).

What's Next in the Pharma World?

With third quarter earnings season almost over, watch out for regulatory and pipeline news from pharma stocks.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Sanofi (SNY): Free Stock Analysis Report

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.