- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Petrobras To Counter Competition With Revised LPG Pricing

In a bid to compete with private importers, Petroleo Brasileiro S.A., aka Petrobras (NYSE:PBR) is set to re-evaluate the fuel pricing policies for liquefied petroleum gas (LPG) . The company will review the international markets closely which will enable Petrobras to compete efficiently. Petrobras will revise the parameters used to calculate the international parity price.

In October 2016, Brazilian oil giant Petrobras outlined a pricing formula for petrol and diesel sales to bring about transparency. It was based on international market prices plus a margin for operational risks, profits and taxes. Per the policy, a monthly review of fuel prices was undertaken. Prior to that, the company used to review pricing occasionally and kept fuel prices low despite the high international fuel costs caused by subsidizing local consumption. This resulted in the company losing market share to imports.

However since July 2017, the company started reviewing fuel prices on a daily basis,as it believed that the previous pricing system was not sufficient to meet the increased volatility in oil prices and foreign exchange rates. Further, in a recent update released by the company, Petrobras changed its parity calculation for diesel,reducing its prices at the refinery by 5.7%..

Regarding LPG — a cooking fuel in widespread use by Brazilians — Petrobras felt the need to review its policy following a steep spike in the price since June. The new policy will help the company to counter the growing competition from fuel imported by competitors and grow and maintain its market share.

Zacks Rank and Key Picks

Headquartered in Rio de Janeiro, Petrobras is the largest integrated energy firm in Brazil and one of the largest in Latin America. The company’s activities include exploration, exploitation and production of oil from reservoir wells, shale and other rocks, as well as refining, processing, trading and transportation of oil and oil products, natural gas and other fluid hydrocarbons in addition to other energy-related activities. The company operates in six segments, Exploration and Production (E&P), Refining, Transportation and Marketing, Distribution, Gas and Power, Biofuels and International.

Considering Brazil's huge pre-salt oil reserves — estimated at 9.5 to 14 billion barrels of oil equivalent and widely thought to be the most important oil find in recent years — Petrobras has a strong position to maintain an impressive production growth profile.

However, the company has massive debt loads as it carries a net debt of more than $88 billion, with net debt-to-capitalization ratio of approximately 51%. As such, leverage remains a key area of concern for the firm.

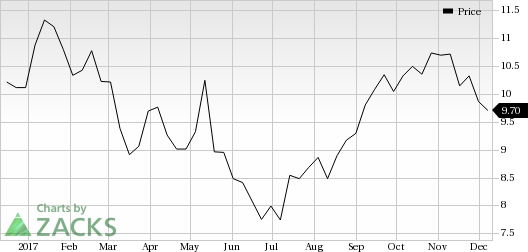

Currently, Petrobras carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the energy space are Northern Oil and Gas, Inc. (NYSE:NOG) , Bill Barrett Corporation (NYSE:BBG) and Rice Midstream Partners LP (NYSE:RMP) . While Northern Oil & Gas sports a Zacks Rank #1(Strong Buy), Bill Barrett and Rice Midstream carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northern Oil and Gas delivered an average positive earnings surprise of 175% in the trailing four quarters.

Bill Barrett posted an average positive earnings surprise of 19.41% in the trailing four quarters.

Rice Midstream delivered an average positive earnings surprise of 35.25% in the trailing four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Petroleo Brasileiro S.A.- Petrobras (PBR): Free Stock Analysis Report

Bill Barrett Corporation (BBG): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

Rice Midstream Partners LP (RMP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.