- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pepsi Data Signals Strength Before Earnings Call

PepsiCo Inc (NASDAQ:PEP) is charged up and in growth mode under its new CEO. Can it translate to a big earnings beat to keep the 2019 rally alive? The data is promising, to say the least.

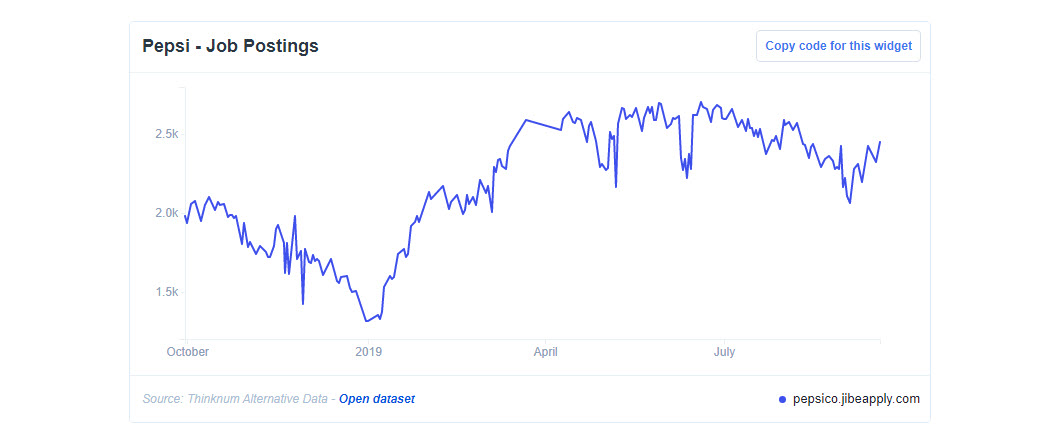

One year into new CEO Ramon Laguarta's tenure, Pepsi is starting to see the benefits of new leadership. Shares are up 25% this year, and after a dip in job postings, the company added 85% more postings in 2019. It bears noting that Pepsi's postings proceed on a cyclical pattern, but our data has previously identified Laguarta's ambitions to grow certain parts of the business.

When Pepsi reports earnings October 3, analysts tracked by Zacks Investment Research are looking for $1.50 EPS.

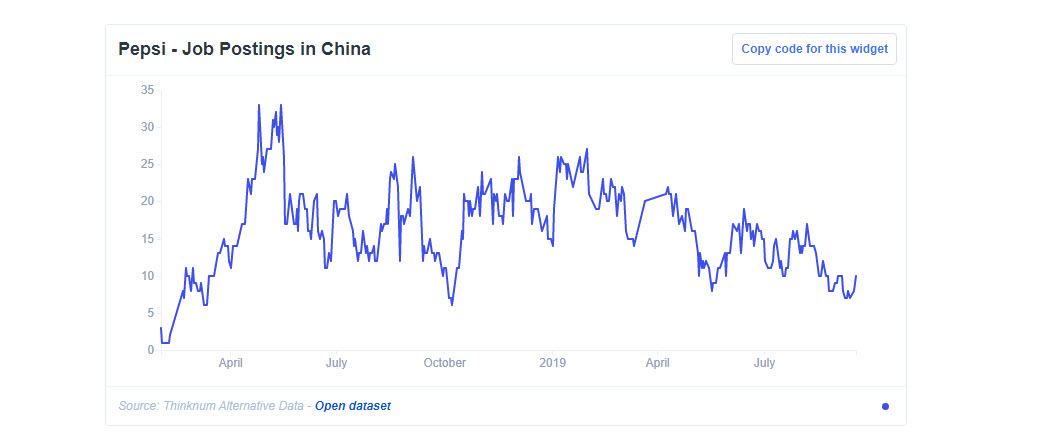

But Pepsi isn't growing everywhere. In fact, its job postings based in China are down more than 50% from their peak earlier this year.

That's not the case everywhere on Wall Street, however - data reflects that a number of companies that had previously shied away from China, like Nike (NYSE:NKE) and Micron (NASDAQ:MU), have changed course and appear to be re-investing in job postings there.

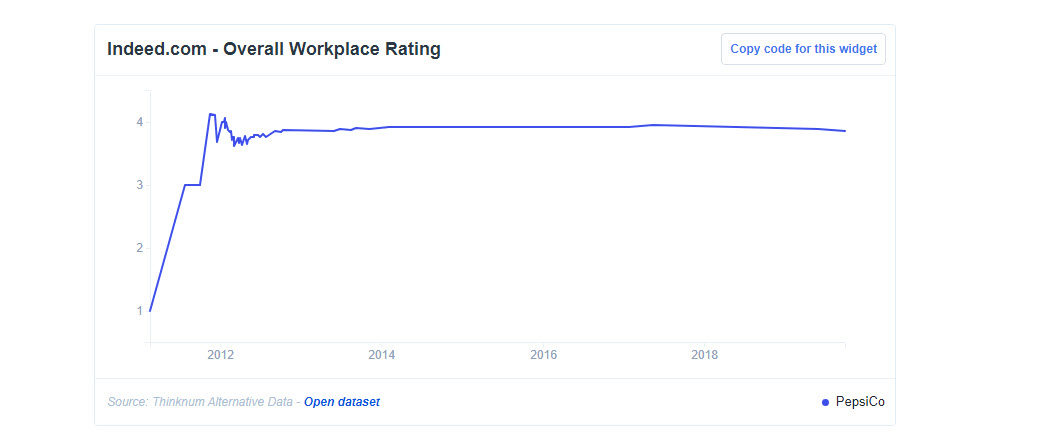

Finally, we have an opportunity to take a look at workforce sentiment, thanks to our Indeed.com Overall Workplace Rating Tracker. Generally speaking a CEO has a one-year grace period where she or he can make an impact, and begin to gauge results - and for Laguarta, that time hasn't yet come. However, from the peak - dating back a couple of years - worker satisfaction has dipped by about 2%.

Laguarta's predecessor, Indra Nooyi, was liked by staffers, who drove up her Indeed.com rating - so while the stock price reflects growth, Pepsi's workplace rating is worth watching going forward.

About the Data:

Thinknum tracks companies using the information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.