- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Paylocity (PCTY) Acquires BeneFLEX, Strengthens Portfolio

Paylocity Holding (NASDAQ:PCTY) recently announced the acquisition of BeneFLEX HR Resources – a privately held employee benefit agency, in an all-cash deal.

BeneFLEX manages employee benefit related plans including the likes of health savings accounts (HSAs), health reimbursement accounts (HRAs), flexible spending accounts (FSAs), and COBRA for the Midwest and California based mid-market clients. The company was founded in 1994 and is headquartered in St. Louis.

Per Paylocity’s CEO, Steve Beauchamp, this inorganic addition has enriched the company’s product suite with a host of benefit administration related solutions. Apart from this, the acquisition brings in BeneFLEX’s 36 trained employees along with a number of “clients and referring brokers” to the Paylocity.

The company stated that while reporting the results for third-quarter of fiscal 2018, it will be discussing how the acquisition will impact its financials.

Paylocity’s Solutions Gaining Traction

Notably, Paylocity is performing well backed by the robust performance of its HCM product suite which has resulted in new client additions and existing client growth.

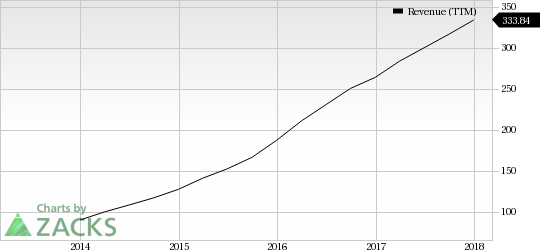

Driven by the strong demand for the company’s solutions, revenues of second-quarter fiscal 2018 came in at $86 million, reflecting an increase of 25% on a year over year basis. Notably, an accelerated market penetration of low implementation cost-based HCM products assisted the non-GAAP gross margin to expand 230 basis points (bps) year over year to 62.3%.

During last earnings conference call, management stated that the company’s platforms were used by over million users in a single month during the second quarter, marking a new record for the company. Further, with adjusted EBITDA increasing 54.5% from the year-ago quarter, the company is encouraged to invest further in sales and marketing initiatives in the second half of fiscal 2018 as well as in 2019.

Further, these sales initiatives will be a boost for the better penetration of the products. We believe the enhanced offerings via the integration of the solutions suite of acquired entities will be lucrative for the customers, consequently proving to be a top-line driver going ahead.

Zacks Rank and Key Picks

Paylocity carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Paycom Software, Inc. (NYSE:PAYC) , Veeva Systems Inc. (NYSE:VEEV) and NVIDIA Corporation (NASDAQ:NVDA) all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term EPS growth rate for Paycom, Veeva and NVIDIA are projected to be 25.8%, 17% and 10.3%, respectively.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

Paylocity Holding Corporation (PCTY): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.