- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Paychex (PAYX) Q3 Earnings & Revenues Surpass Estimates

Paychex, Inc. (NASDAQ:PAYX) reported solid third-quarter fiscal 2020 results wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

Adjusted earnings of 97 cents per share outpaced the consensus estimate by 2.1% and increased 9% on a year-over-year basis. Total revenues of $1.14 billion beat the consensus mark by 0.5% and increased 7% year over year.

During the reported quarter, the company witnessed solid growth across its major business lines. Investments done in both expanding product offerings, like Pay-on-Demand, and technology and mobile app enhancements have been fruitful. Further, the company realized continued momentum in the mid-market space and achieved record-level retention rates across many of its services.

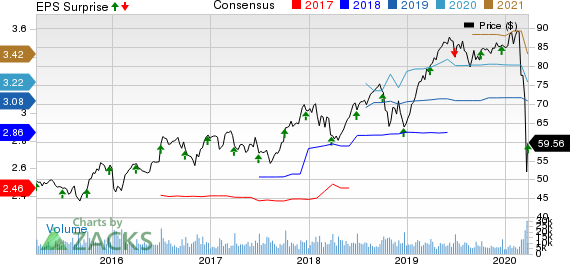

Over the past year, shares of Paychex have declined 24.4% compared with 24.5% loss of the industry it belongs to and 13.2% decrease of the Zacks S&P 500 composite.

Revenues in Detail

Revenues from Management Solutions increased 6% year over year to $850 million. Growth was driven by increase in the company’s client base and revenue per client, which benefited from higher price realization and increased penetration of its suite of solutions, particularly retirement services, time and attendance, and HR outsourcing.

PEO and insurance services revenues were $271.5 million, up 10% from the year-ago quarter. The uptick was driven by growth in clients across the company’s PEO business. Insurance Services revenue growth was due to rise in the number of health and benefit clients and applicants, partially offset by softness in the workers’ compensation market as rates declined.

Furthermore, interest on funds held for clients decreased 7% year over year to $21.2 million on lower average interest rates earned, which was partially offset by higher average investment balances and realized gains.

Operating Performance

Operating income increased 10% year over year to $470.1 million. Operating margin rose to 41.1% from 40.1% in the year-ago quarter.

EBITDA of $520.5 million improved 8% year over year. EBITDA margin came in at 45.6% compared with 45% in the year-ago quarter.

Balance Sheet & Cash Flow

Paychex exited third-quarter fiscal 2020 with cash and cash equivalents of $780 million compared with $600.6 million at the end of the prior quarter. Long-term debt came in at $796.7 million compared with $796.6 million in the prior quarter. Cash provided by operating activities was $488.1 million in the reported quarter.

During the reported quarter, the company paid out $222.5 million in dividends.

Fiscal 2020 View

For fiscal 2020, total revenues are expected to register 8-9% growth. Adjusted earnings per shareare anticipated to register nearly 6% growth.Operating margin is expected to be around 36%. EBITDA margin is expected to be nearly 41%.

Paychex expects PEO and insurance services revenues to register nearly 24% growth compared with the prior guided range of 25-30%. Management solutions revenues are anticipated to register around 4% growth compared with the prior guided range of 5-5.5%.

Interest on funds held for clients is anticipated to decline in the range of 2% to 3% compared with the prior guided growth rate of around 4%.

Zacks Rank & Stocks to Consider

Currently, Paychex carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Omnicom (NYSE:OMC) , TransUnion (NYSE:TRU) and Genpact (NYSE:G) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term expected EPS (three to five years) growth rate for Omnicom, TransUnion and Genpact is 5.6%, 12.8% and 13.9%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Paychex, Inc. (PAYX): Free Stock Analysis Report

Omnicom Group Inc. (OMC): Free Stock Analysis Report

Genpact Limited (G): Free Stock Analysis Report

TransUnion (TRU): Free Stock Analysis Report

Original post

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.