- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Paychex (PAYX) Q2 Earnings Match Estimates, Revenues Beat

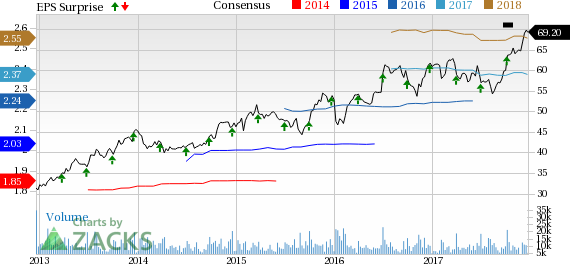

Paychex Inc. (NASDAQ:PAYX) reported fiscal second-quarter 2018 results wherein the top line beat the Zacks Consensus Estimate but the bottom line came in line with the same. However, the company registered year-over-year improvement on both the counts.

Non-GAAP earnings per share of 59 cents increased 5% from the year-ago quarter.

Notably, the stock has returned 10.6% on a year-to-date basis, outperforming 7% growth recorded by the industry.

Quarter Details

Paychex reported total revenues (including interest on funds held for clients) of $826.5 million, up 7% year over year. Excluding interest on funds held for its clients, total services revenues (Payroll service and Human Resource Services) were up 7% year over year to $812.5 million. The Zacks Consensus Estimate was pegged at $823 million.

Payroll Service segment revenues went up 1% from the year-ago period to $444.8 million, primarily on the back of higher revenues per check, which benefited from price increases and net of discounts. However, revenues were negatively impacted by a change in client base mix.

Human Resource Services segment revenues rose 15% year over year to $367.7 million, chiefly driven by strong growth in client base across the prominent human capital management (HCM) services.

Interest on funds held for clients increased 23% on a year-over-year basis to $14 million, mainly benefiting from higher average interest rates earned.

Paychex’s total expenses rose 7% from the year-ago quarter to $494.3 million due to increased investments in technology and combined PEO business. Acquisition of HROI accounted for 5% of the total increase in expenses. Total expenses, as a percentage of total revenues, increased 20 basis points (bps) to 59.8%.

Operating income grew 7% year over year to $332.2 million. However, Paychex’s operating margin decreased 10 bps to 40.2%.

Adjusted net income surged 8% year over year to $437.2 million.

Balance Sheet & Cash Flow

Paychex exited the fiscal second quarter with cash, cash equivalents and corporate investments of $338.6 million compared with $323.4 million recorded at the end of the previous quarter. The company has no long-term debt. For the first half of fiscal 2018, the company generated operating cash flow of $519.4 million.

During the first two quarters, Paychex repurchased 1.6 million shares for $94.1 million.

Guidance

The guidance for fiscal 2018 provided at the end of the first quarter remains unaltered.

Total revenues are expected to grow around 6%. The Zacks Consensus Estimate is currently pegged at $3.35 billion.

Payroll Services Revenues are anticipated surge between 1% and 2%.

Human Resource Services revenues are projected to grow in the range of 12-14%.

Operating margin is anticipated to be between 39% and 40%. Effective income tax rate, excluding any potential impact from tax reform legislation, is projected to be 35.0% to 35.5%.

Interest on funds held for clients and investment income is expected to grow in the mid-to-upper-teen range.

Net income is still likely to advance 5% year over year on a GAAP basis and 7% on a non-GAAP basis. Non-GAAP earnings per share are estimated to be up in the range of 7-8%, which comes to $2.35-$2.38. The Zacks Consensus Estimate is currently pegged at $2.37.

Our Take

The company’s top-line is benefiting from acquisitions. In the second quarter fiscal 2018, HROI which was acquired in August 2017, added 3% to total service revenue growth.

However, the company is facing issues in retaining its customer base for the last few quarters, which is a major concern. Due to a challenging demand environment and modest decline in retention, the company’s payroll client base remained flat in the previous quarter. Additionally, political uncertainty, which in turn impacted outsourcing decision making in the mid-market, affected the company’s client base.

Furthermore, increasing competition from industry peers like Automatic Data Processing, Insperity, Intuit (NASDAQ:INTU), H&R Block (NYSE:HRB), Broadridge Financial Solutions and DST System is another key concern.

Currently, Paychex has a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader technology sector are Western Digital Corp. (NASDAQ:WDC) , Axcelis Technologies Inc. (NASDAQ:ACLS) and Applied Materials, Inc. (NASDAQ:AMAT) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term EPS growth rate for Western Digital, Axcelis and Applied Materials is projected to be 31.12%, 20% and 12.67%, respectively.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Western Digital Corporation (WDC): Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Paychex, Inc. (PAYX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.