- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Patterson Companies (PDCO) Misses On Q2 Earnings, Cuts View

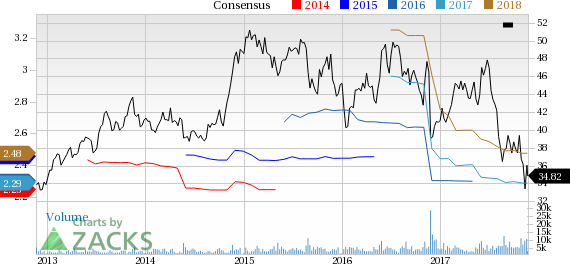

Patterson Companies Inc. (NASDAQ:PDCO) reported adjusted earnings of 51 cents per share in second-quarter fiscal 2018, missing the Zacks Consensus Estimate of 54 cents. Earnings were also lower than the year-ago figure of 56 cents. Hurricanes hurt Patterson Companies’ earnings per share by approximately a penny in the quarter.

Net sales fell 2.3% from the year-ago quarter to $1.39 billion, which also missed the Zacks Consensus Estimate of $1.42 billion. Adjusting the effects of foreign currency exchange, sales declined 2.8% on a year-over-year basis, including a negative impact of approximately 60 basis points (bps) from the hurricanes.

Patterson Companies has a Zacks Rank #4 (Sell).

Segmental Analysis

Animal Health Segment: This segment is a leading distributor of products, services and technologies to the production and companion animal health markets in North America and the U.K. Coming to the second-quarter performance of the platform (60% of total sales), sales increased almost 1.4% at constant currency (cc) on a year-over-year basis to $823.6 million.

Companion animal sales declined 1.4%. Production animal sales increased 4.2%, reflecting strong performance across all segments, especially in the swine business.

Dental Segment: This segment provides a virtually complete range of consumable dental products, equipment, software, turnkey digital solutions and value-added services to dentists and dental laboratories throughout North America. In the second quarter, dental sales (40% of total sales) declined 8.4% at cc year over year to approximately $553.6 million. The decline was led by decreased sales of CEREC and digital technology products.

Equipment sales in the dental segment fell 17.7%. Consumable dental supplies decreased 4.4%. However, other services and products, primarily comprising technical service, parts and labor, software support services and office supplies, increased 0.6%.

Share Repurchase Update

Patterson Companiesrepurchased approximately 1 million shares of its outstanding common stock for $36.5 million in the reported quarter. The company also paid $24.8 million in cash dividends to shareholders.

Guidance Downbeat

The company expects adjusted earnings per share for fiscal 2018 in the range of $2.00 to $2.10, way below the previously issued band of $2.25 to $2.40. Patterson Companies expects deal amortization expenses of $25.3 million or 27 cents per share. The company estimates integration and business restructuring expenses at $5.3 million or 6 cents per share.

Our Take

Patterson Companies exited the second quarter on a tepid note, missing the Zacks Consensus Estimate for both the counts. Furthermore, a downbeat guidance indicates looming concerns. Lackluster performance by the dental segment is a concern. Management expects headwinds in the technology-based equipment business to persist through fiscal 2018. However, we are upbeat about the company’s Animal Health segment that witnessed strong sales last quarter. Patterson Companies provides a wide range of consumable supplies, equipment, software and value-added services. The company’s broad spectrum of products cushions it against economic downturns in the MedTech space. We believe a diversified product portfolio, strong veterinary business prospects, accretive acquisitions and strategic partnerships are key growth catalysts.

Stocks to Consider

A few better-ranked stocks in the broader medical sector are PetMed Express (NASDAQ:PETS) , Luminex Corporation (NASDAQ:LMNX) and IDEXX Laboratories (NASDAQ:IDXX) .

Notably, PetMed Express sports a Zacks Rank #1 (Strong Buy). The company has a long-term expected earnings growth rate of 10%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Luminex represents a return of 5.1% over the last year. The stock has a Zacks Rank #1.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. The stock has climbed 39.2% over a year’s time and has a Zacks Rank #2 (Buy).

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Patterson Companies, Inc. (PDCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.