- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pattern Energy (PEGI) Q4 Earnings & Revenues Beat Estimates

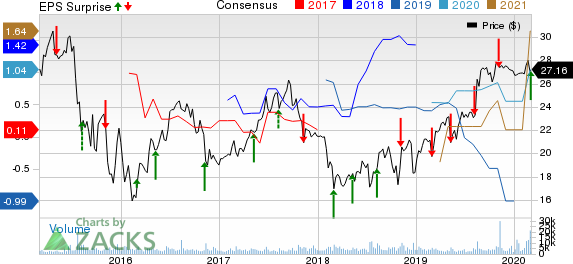

Pattern Energy Group (NASDAQ:PEGI) reported earnings of 54 cents per share in fourth-quarter 2019, beating the Zacks Consensus Estimate of 25 cents by 116%. The company had reported a loss of 15 cents per share in the year-ago quarter.

Total Revenues

Fourth-quarter revenues amounted to $147 million, which beat the Zacks Consensus Estimate of $143 million by 2.8%. Total revenues were 30% higher than the prior-year figure, primarily due to increased electricity sales.

Quarterly Highlights

Pattern Energy sold 2,179,090 megawatt hours (MWh) of electricity on a proportional basis compared with 1,966,677 MWh in the year-ago quarter. The 11% improvement was primarily caused by volume increase resulting from acquisitions and less favorable wind conditions in 2018.

Total operating expenses amounted to $20 million, reflecting an increase of 42.9% from the year-ago level.

The company incurred interest expenses of $33 million compared with $28 million in the year-ago quarter.

During the fourth quarter, the company entered into a definitive merger agreement with Canada Pension Plan Investment Board. Through this merger agreement, the company will acquire Pattern Energy in an all-cash transaction for $26.75 per share.

Financial Highlights

As of Dec 31, 2019, the company had cash and cash equivalents of $156 million compared with $101 million in the corresponding period of 2018.

Its long-term debt was $2,887 million as of Dec 31, 2019, up from the Dec 31, 2018 level of $2,004 million.

The company’s cash flow from operating activities in 2019 was $167 million, down from $279 million recorded a year ago.

Guidance

Pattern Energy, taking into consideration the expected closing of the merger agreement, did not provide a target range of cash available for distribution for 2020.

Zacks Rank

Currently, Pattern Energy has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

FirstEnergy Corporation (NYSE:FE) reported fourth-quarter 2019 operating earnings of 55 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 14.6%.

Xcel Energy Inc. (NASDAQ:XEL) posted fourth-quarter 2019 operating earnings of 56 cents per share, which beat the Zacks Consensus Estimate of 53 cents by 5.6%.

WEC Energy Group (NYSE:WEC) reported fourth-quarter 2019 adjusted earnings per share of 77 cents, which beat the Zacks Consensus Estimate of 72 cents by 6.9%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

FirstEnergy Corporation (FE): Free Stock Analysis Report

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

Pattern Energy Group Inc. (PEGI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.