- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Parker-Hannifin To Gain From Recovering End Markets, CLARCOR

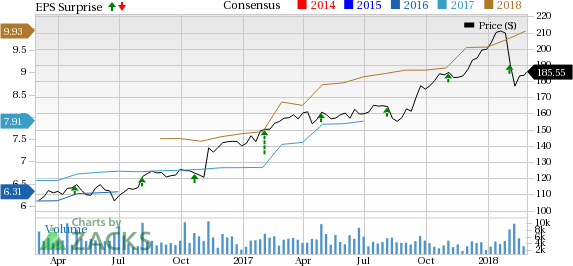

Parker-Hannifin Corporation (NYSE:PH) posted impressive results in the first half of fiscal 2018, after charting robust earnings beats and strong top-line growth in 2017. Recently, the Zacks Rank #2 (Buy) company reported its 10th consecutive earnings beat in second-quarter fiscal 2018 results.

The company’s top line has been gaining momentum on the back of contribution from the CLARCOR acquisition and continued outstanding performance in the company’s Diversified Industrial segment, particularly in North America.Further, its diligent global restructuring initiatives are proving conducive to profits. These initiatives helped Parker-Hannifin offset weakness in some vital regions, which strengthened its position in the end markets.

Buoyed by the competency of the revamped Win Strategy and its strategic acquisitions, Parker-Hannifin is bullish about delivering fundamental financial goals for fiscal 2018. Concurrent with second-quarter fiscal 2018 results, Parker-Hannifin raised its fiscal 2018 guidance once again.

Adjusted earnings from continuing operations are projected in the range of $9.65-$10.05 per share (up from the previous band of $9.10-$9.70). The guidance is adjusted for expected business realignment expenses of approximately $58 million, a net one-time adjustment in income tax expense of $224.5 million and CLARCOR acquisition-related expenses of $52 million. Parker-Hannifin expects to generate synergy savings of about $58 million from CLARCOR integration in fiscal 2018.

The company expects sales to grow in the range of 15.3-18.9% from the previous fiscal, with organic growth projected at around 6.5% and acquisitions to contribute roughly 8.1%.

Parker-Hannifin Corporation Price, Consensus and EPS Surprise

Further, analysts too seem to be optimistic on the stock over the last two months. The Zacks Consensus Estimate for fiscal 2018 earnings has inched up from $9.57 to $9.93, supported by 11 upward estimate revisions versus none downward.

In spite of so many growth drivers and positive developments, the company’s shares have declined 6.6% year to date, underperforming the industry’s upside of 0.1%.

The reason for the disappointing performance could be investors’ concern over the company’s margin trends. It is true that Parker-Hannifin is suffering from near-term margin issues. The reason for the same is that the company is in the middle of integrating CLARCOR and targeted plant closures (23 in fiscal 2017, 39 in fiscal 2018) are also disturbing margins as well as operational efficiency. However, these factors are expected to smoothen in the near term.

The fact that the company’s orders are accelerating should pacify investors. Orders increased 13% in aggregate in fiscal second quarter. This marks the sixth consecutive quarter of order growth for the company, which indicates improving demand in the key end markets and regions.

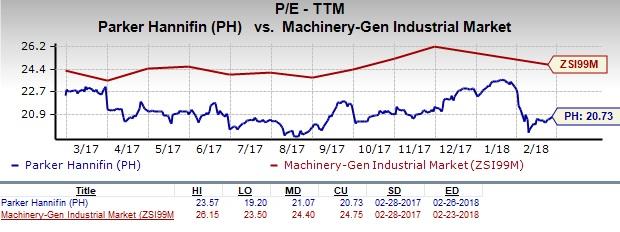

Also, the company is well placed when compared with its peers in terms of valuation. Parker-Hannifin’s trailing 12-months PE ratio is pegged at 20.73, which is quite a bit lower than the industry’s PE of 24.75. This indicates that investors who want exposure to industrial recovery should consider the company as an investment right now.

Other Stocks to Consider

Some other top-ranked stocks in the same space worth considering now include Applied Industrial Technologies, Inc. (NYSE:AIT) , Dover Corporation (NYSE:DOV) and RBC Bearings Incorporated (NASDAQ:ROLL) , each sporting a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies has a robust earnings surprise history, with an average beat of 11% over the trailing four quarters, beating estimates each time.

Dover Corporation has generated four strong beats during the same time frame, for an average positive surprise of 7.3%.

RBC Bearings has a decent earnings surprise history for the preceding four quarters, surpassing estimates thrice for an average of 8.3%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Dover Corporation (DOV): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

RBC Bearings Incorporated (ROLL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.