- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Parker-Hannifin Discusses Strategies And Long-Term Targets

Parker-Hannifin Corporation (NYSE:PH) discussed initiatives to grow organically, transforming the business, the Win Strategy 3.0, capital allocation policy and targets for fiscal 2023 (ending June 2023) at the investor meeting held on Mar 12.

It is worth mentioning here that the company’s shares declined 11.7% on Mar 12, while recovery of 7.6% was recorded on Mar 13. The closing price was $140.32 last Friday.

Inside the Headlines

As noted, the company is poised to gain from lower costs (achieved through restructuring actions), streamlined organization structure (with 84 divisions versus 126 previously) and the Win Strategy 3.0 (implemented in fiscal 2019 — ended June 2019).

It is worth noting here that the Win Strategy 3.0 comprises four goals — including engaged people, customer experience, profitable growth and financial performance.

Also, it added that its healthy balance sheet and cash positions helped in making acquisitions. Notably, the CLARCOR acquisition in March 2017 will likely yield revenue synergies of $100 million and cost benefits of $160 million by fiscal 2020 (ending June 2020). Also, Exotic Metals Forming Company, acquired in September 2019, will likely result in cost gains of $13 million by the end of fiscal 2023. The buyout of LORD Corporation in October 2019 will likely generate cost synergies of $125 million by fiscal 2023 end.

Parker-Hannifin also communicated that its adjusted earnings will exclude expenses (intangible asset amortization) related to buyouts beginning fiscal 2021 (ending June 2021).

By fiscal 2023, Parker-Hannifin predicts revenue growth of 150 basis points (bps) greater than Global Industrial Production Index (GIPI). Both adjusted segment operating margin, and adjusted earnings before interest, tax, depreciation and amortization (EBITDA) are estimated to be 21%. Free cash flow is predicted to be $2.3 billion, while adjusted earnings per share are anticipated to be $16.90.

From fiscal 2019 to 2023, the company anticipates using $16.5 billion capital for dividend payments of $2.5 billion, capital expenditure of $1.5 billion, share buyback of $1 billion and debt reduction of $3.9 billion. Also, it allocated $2.2 billion for acquisitions and other purposes. Notably, $5.4 billion was used for the Exotic and LORD buyouts. Gross debt to EBITDA is expected to reach 2.0x in fiscal 2023 from 2.8x in fiscal 2019.

Zacks Rank, Price Performance and Estimate Trend

With a market capitalization of $18 billion, Parker-Hannifin currently carries a Zacks Rank #3 (Hold). It is poised to benefit from acquired assets, unique Win Strategy and growth investments. However, forex woes, high debts and realignment expenses might be spoilsports.

In the past three months, the company’s shares have dipped 31.1% versus the industry’s decline of 20.9%.

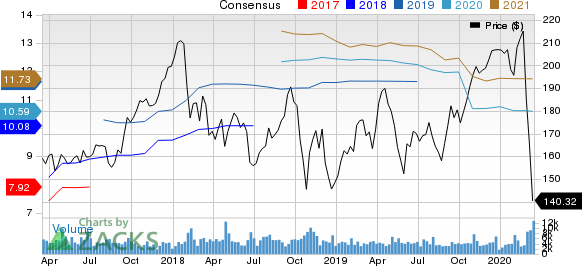

Also, the Zacks Consensus Estimate for its earnings per share is pegged at $10.59 for fiscal 2020 and $11.73 for fiscal 2021, marking declines of 0.9% and 0.7% from the respective 60-day-ago figures. Also, estimates represent a year-over-year decline of 10.6% for fiscal 2020 and growth of 10.9% for 2021.

Parker-Hannifin Corporation Price and Consensus

Graco Inc. (GGG): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.