- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Papa John's (PZZA) Stock Dips As Q4 Domestic Sales Sink

Papa John's International, Inc. (NASDAQ:PZZA) just released its fourth-quarter and full year 2017 financial results, posting earnings of $0.65 per share and revenues of $467.6 million. Currently, Papa John's is a Zacks Rank #3 (Hold) and is down over 5.50% to $53.25 per share in after-hours trading shortly after its earnings report was released.

PZZA:

Missed earnings estimates. The company posted adjusted earnings of $0.65 per share, missing the Zacks Consensus Estimate of $0.68 per share.

Beat revenue estimates. The company saw revenue figures of $467.6 million, topping our consensus estimate of $461.94 million.

Papa John's system-wide North America comp-sales fell 3.9% in the fourth quarter, while international comparable sales jumped 2.6%. The pizza chain noted that it had 98 net unit openings during Q4, all of which were in international locations.

Looking ahead to fiscal 2018, Papa John’s expects North America comp-sales to dip as low as 3% with a flat year-over-year upside.

“Actions are underway to improve our brand proposition, how we connect with customers, and how we operate at the unit level,” CEO Steve Ritchie said in a statement.

“These actions build on all the strengths of the Papa John’s brand and include a fresh perspective around marketing driven by new media and creative partnerships, hiring a new PR partner, and bringing online a new engine to drive our Papa Rewards loyalty system.”

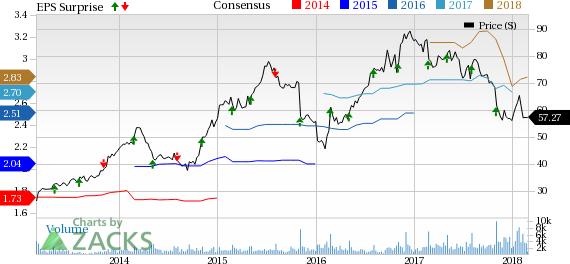

Here’s a graph that looks at PZZA’s Price, Consensus and EPS Surprise history:

Papa John's International, Inc. operates & franchises pizza delivery and carry-out restaurants under the trademark Papa John's. The Company's objective is to become the leading chain of pizza delivery restaurants in each of its targeted markets. To accomplish this objective, the Company has developed a strategy designed to achieve high levels of customer satisfaction & repeat business, as well as to establish recognition & acceptance of the Papa John's brand.

Check back later for our full analysis on PZZA’s earnings report!

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.