- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

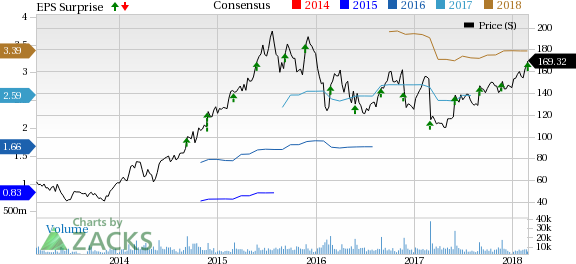

Palo Alto (PANW) Soars On Q2 Earnings And Revenue Beat

Keeping its earnings streak alive, Palo Alto Networks Inc. (NYSE:PANW) again reported better-than-expected results for the second quarter of fiscal 2018. The company’s earnings and revenues surpassed the Zacks Consensus Estimate as well as management’s guided range. Also, it marked year-over-year improvement in both the counts.

Strong quarterly results were mainly driven by healthy demand environment, product launches and increasing adoption of the company’s next-generation security platforms. Buoyed by a marvellous fiscal second-quarter performance, the company provided encouraging guidance for the next quarter and also raised the fiscal 2018 outlook.

Consequently, investors were optimistic about the stock’s prospects as reflected by the share price movement during yesterdays’ after-hours trading. The company’s shares gained more than 5% during late-trading session.

Let’s discuss the quarter in detail.

Revenues

Palo Alto’s revenues of $542.4 million jumped 28% year over year and outpaced the Zacks Consensus Estimate of $525.4 million. In fact, the top line came above the guided range of $518-$528 million.

The year-over-year increase was primarily driven by customer additions, along with product launches. Additionally, the company stated that the successful sales execution has helped it acquire new clients. Palo Alto also managed to increase its existing customers’ expenditures, which contributed to the overall growth. In the reported quarter, the company added nearly 3,000 customers.

Product revenues increased approximately 20% to $202.2 million and surpassed its projected range of $185-$188 million. The company witnessed a 34% surge in subscription and support revenues ($340.2 million). SaaS-based subscription revenues also climbed 36% from the year-ago period. Support revenues increased 31% year over year.

Billings improved 20% year over year to $674.6 million and came ahead the company’s guided range of $640-$655 million.

Geographically, revenues from the Americas climbed 26% on a year-over-year basis. The figures from Europe, the Middle East and Africa were up 35%, while the same from Asia Pacific rose 33%.

Operating Results

Palo Alto’s non-GAAP gross margin shrunk 270 basis points (bps) on a year-over-year basis to 75.9%, mainly due to the ongoing traction with the products introduced in the third quarter of fiscal 2017.

Non-GAAP operating expenses in the fiscal second quarter were $300.1 million, or 55.4% of revenues. This marks a year-over-year improvement of 350 bps backed by the increasing leverage in sales and marketing.

Non-GAAP operating margin expanded 80 bps to 20.5% as loss from reduced gross margin were more than offset by benefit from lower operating expenses (as a percentage of revenues).

The company’s non-GAAP net income for the reported quarter was $91.5 million or 97 cents per share but this includes a $10.6 million or 11 cents benefit from lower effective tax rate from 31% to 22% as a result of implementation of the Tax Cuts and Jobs Act.

Excluding the same, Palo Alto reported non-GAAP net income of $80.9 million or 14.9% of revenues compared with $59.6 million or 14.1% last year. On a per-share basis, the company reported non-GAAP earnings of 86 cents, marking year-over-year growth of 36.5%.

In both situations, quarterly earnings surpassed the Zacks Consensus Estimate of 79 cents as well as the company’s projected range of 78-80 cents.

Balance Sheet

Palo Alto exited the quarter under review with cash, cash equivalents and short-term investments of approximately $1.64 billion compared with $2.3 billion at the end of the fiscal first quarter.

Receivables were $365.1 million compared with $350.8 million recorded in the previous quarter. Furthermore, the company’s balance sheet does not have any long-term debt. It generated cash flow from operations of $517.8 million in the first two quarters of fiscal 2018. Free cash flow during the first half of the fiscal came in at $460 million.

In addition, the company repurchased 1.724 million shares worth $259.1 million. At quarter end, the company had approximately $330 million available under its ongoing share-repurchase authorization.

Guidance

Palo Alto raised its outlook for fiscal 2018. The company now expects revenues in the range of $2.190-$2.220 billion, an improvement of 24-26% year over year compared with $2.145-$2.185 billion, projected earlier. The Zacks Consensus Estimate is pegged at $2.17 billion.

Product revenues are anticipated in the range of $810-$820 million, reflecting year-over-year growth of 14-16% and higher than the previous guidance range of $755-$770 million. Billings are now expected to lie between $2.715 billion and $2.770 billion, which represents growth of 18-21% from the year-ago quarter. The new guidance range is projected higher than the earlier guidance of $2.65-$2.71 billion.

Non-GAAP effective tax rate for the fiscal is now anticipated to be around 24%, significantly lower than the previous projection of 31%. This will have a 36 cents benefit to full-year earnings per share.

Including this, non-GAAP earnings per share are now expected to be in the $3.84-$3.91 band (mid-point $3.875 per share), up from $3.35-$3.41, estimated earlier. The Zacks Consensus Estimate is pegged at $3.39.

For the fiscal third quarter, Palo Alto anticipates revenues in the range of $538-$548 million, up 25-27% year over year. The Zacks Consensus Estimate is pegged at $531 million. Product revenues are forecast in the $193-$196 million band, up 18-19%. Billings are projected to be between $665 million and $680 million, an increase of 22-25%.

Non-GAAP effective tax rate for the next quarter is projected to be approximately 22% due to the implementation of the Tax Cuts and Jobs Act. This will have a benefit of 11 cents per share on the company’s non-GAAP earnings.

Including this, non-GAAP earnings per share are expected in the range of 94-96 cents. The Zacks Consensus Estimate is pegged at 81 cents.

Zacks Rank & Key Picks

Palo Alto currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are NVIDIA (NASDAQ:NVDA) , Intel (NASDAQ:INTC) and Texas Instruments (NASDAQ:TXN) . NVIDIA sports a Zacks Rank #1 (Strong Buy), while Intel and Texas Instruments carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term expected EPS growth rates for NVIDIA, Intel and Texas Instruments are pegged at 10.3%, 8.4% and 9.6%, respectively.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.