- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ovintiv Trims Q2 Capex By $300M To Cope With Oil Price Plunge

The recent softness in the commodity prices compelled energy players to reanalyze their strategies as well as reconsider capex cuts. Notably, after conforming to the capital discipline during the crude downturn (from mid-2014 to 2016), energy companies again reckoned elevating their capital expenditure since 2017. However, a shrinkage in the commodity price convinced explorers and producers to take a relatively cautious approach to capex programs again this year. Instead of augmenting their capital outlays, the energy players are now finding it wiser to focus on adding shareholder value.

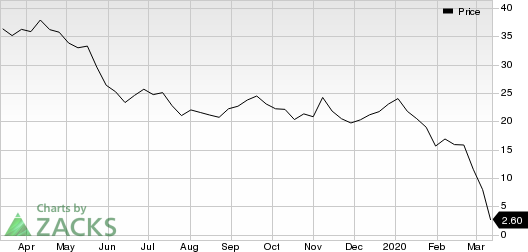

West Texas Intermediate began the year with a little more than $60 per barrel of oil. However, this uptrend was pretty short-lived with the commodity price tanking to multi-year lows to settle at $31.13 on Mar 9.

Reacting to this sudden oil price plunge, Ovintiv Inc. (NYSE:OVV) recently announced intentions to lower second-quarter 2020 capital investment projection by minimum $300 million. It further plans to trim current-year cash costs by $100 million. This will help the company maintain a solid financial position and secure free cash neutrality.

The measures adopted by Ovintiv for capex cuts will comprise abandoning of 10 operated drilling rigs instantly along with an aim to suspend an additional six operated rigs in May this year. Post these rig count cuts, Ovintiv will now be left with three functional rigs in the Permian, two in the Anadarko and two in the Montney.

Importantly, the company has no long-term commitments to accomplish and will steadily keep a vigil on the commodity price performance, adapting to the capital spending adjustment plans further in response to an unstable price scenario.

Zacks Rank & Key Picks

Ovintiv has a Zacks Rank #4 (Sell).

Better-ranked players in the energy space include Oasis Petroleum Inc. (NASDAQ:OAS) , Earthstone Energy, Inc. (NYSE:ESTE) and FTS International, Inc. (NYSE:FTSI) , each carrying a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Oasis Petroleum Inc. (OAS): Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE): Free Stock Analysis Report

FTS International, Inc. (FTSI): Free Stock Analysis Report

Encana Corporation (OVV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.