- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Oversold Conditions Deepen In The Stock Market As Breakdowns Worsen

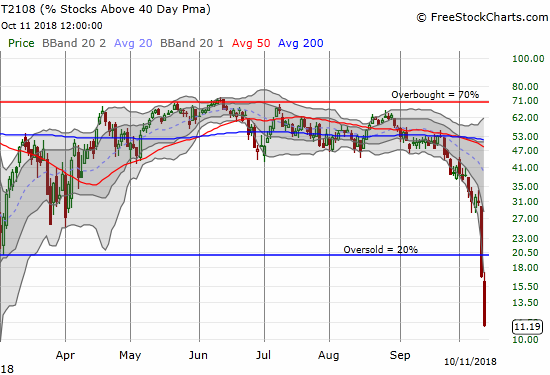

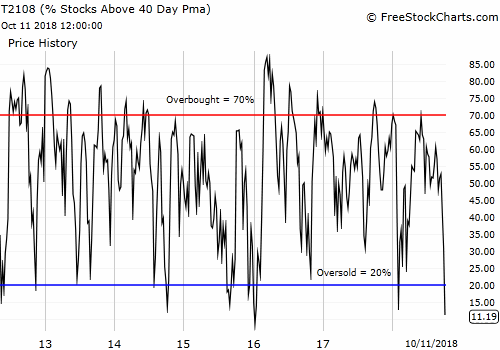

AT40 = 11.2% of stocks are trading above their respective 40-day moving averages (DMAs) (oversold day #2)

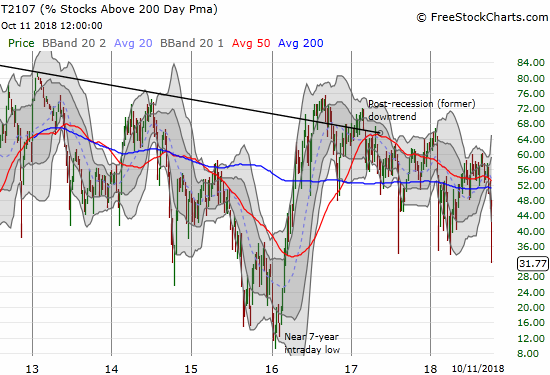

AT200 = 31.7% of stocks are trading above their respective 200DMAs ()

VIX = 23.0 (an increase of 44.0%)

Short-term Trading Call: bullish (change from neutral)

Commentary

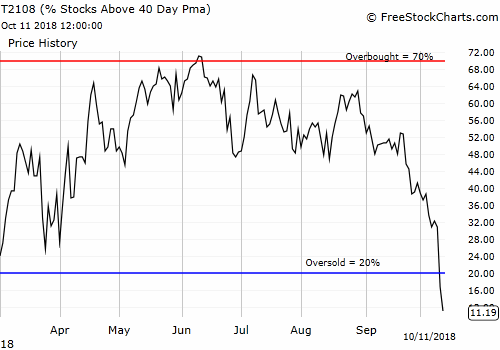

The market sell-off is unfolding quickly. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), plunged ever deeper into oversold territory. This time AT40 fell from 16.7% to 11.2% to end the day at closing levels last seen during the epic January, 2016 sell-off.

AT40 (T2108) fell off a cliff these past two trading days!

Now that AT40 is so low, AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, becomes a lot more important to monitor as an indicator of longer-term health. The weekly chart below shows the multi-year overall downtrend is well-intact. So just like almost every other rally from oversold levels, I expect the next rally to end at an even lower AT200 high. For now, the question is just how much lower will sellers push AT200.

AT200 (T2107) last closed this low in early 2016. Sellers still have plenty of room for pressing their points downward.

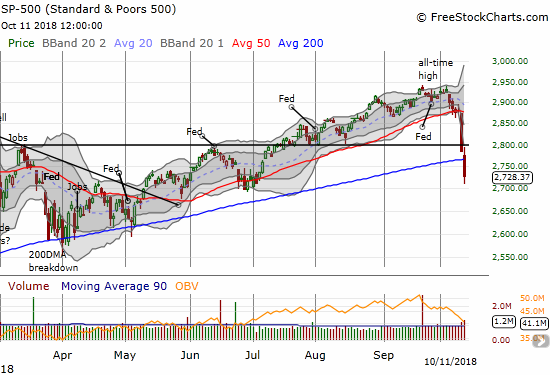

As the breadth indicators continue to drop deeper into oversold territory, the major indices are following gravity into new or worse breakdowns. The S&P 500 SPY wasted little time in breaking down below its 200DMA. The index stretched further below its lower Bollinger Band (BB) as it neared flatline with its 2017 closing price.

The S&P 500 (SPY) lost 2.1% to close with a 200DMA breakdown and a 3-month low.

Note well that for 2018 there has only been ONE Fed meeting where the S&P 500 did not tumble soon thereafter. The February swoon was of course the worst incident as the panicked selling started the day after. This time around, the panic took six trading days to get started.

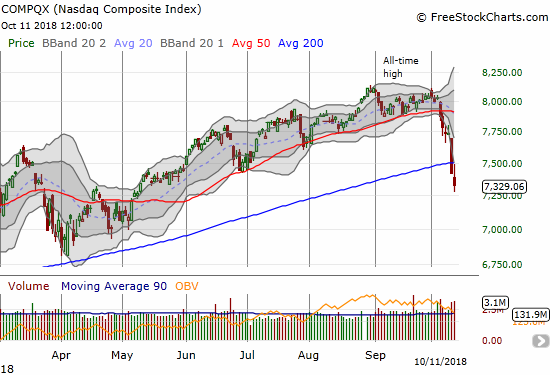

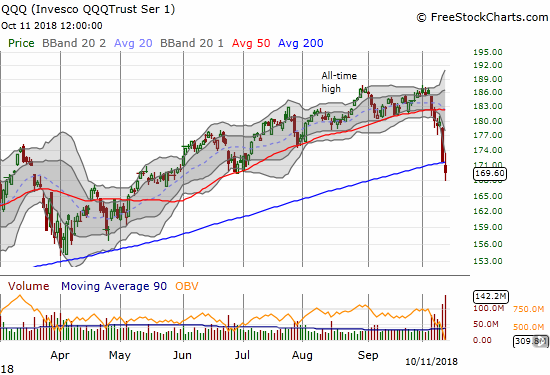

The NASDAQ Composite extended its 200DMA breakdown with a 1.3% loss. The Invesco QQQ Trust QQQ gave up its 200DMA support with a 1.2% loss.

The NASDAQ closed at a 5-month low as it confirmed its 200DMA breakdown.

The Invesco QQQ Trust (QQQ) closed at a 3+ month low as it broke down below its 200DMA for the first time since June, 2016.

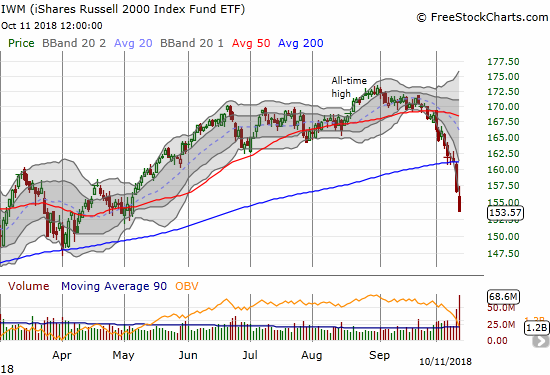

Small caps are leading the way in erasing 2018’s gains. The iShares Russell 2000 ETF IWM lost another 1.9% and closed just one point above its 2017 close.

The iShares Russell 2000 ETF (IWM) closed at a 5-month low and is nearly flat year-to-date. IWM confirmed its 200DMA breakdown.

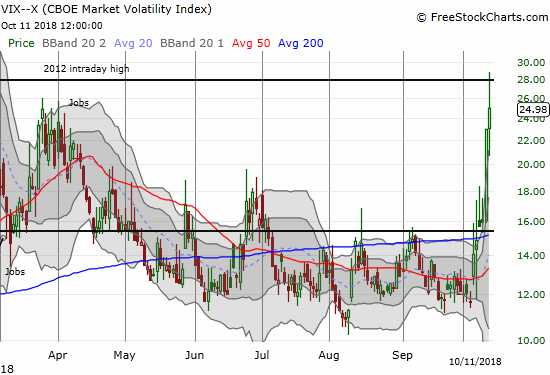

Much to my dismay, the volatility index continued higher today. The VIX gained 8.8% and was up as much as 25.6%. While the volatility faders were active for the 5th of 6 trading days, the VIX’s momentum is clearly higher. I added to my put options on ProShares Ultra VIX Short-Term Futures UVXY by rule, but the prospects for profits by next Friday are dimming.

The volatility index, the VIX, closed at a near 7-month high with an 8.8% gain.

I made my first purchase of call options on SPY soon after the index broke down below its 200DMA. Per the aggressive oversold trading strategy, I will continue adding to this position during the oversold period. However, I started with an expiration for next Friday, so it is possible I will be forced to reset my strategy (likely for November expiration). Until then, I will only add after the VIX has spiked at least 10% from my last purchase. At some point (soon?), I will also buy shares of ProShares Ultra S&P500 SSO) to hold through the extent of the recovery from oversold conditions. Given the extent of the technical damage across the entire market, I have to assume a new bearish phase is unfolding where I will be setting price targets for taking profits at important resistance levels. Still, shorting at key resistance will be very case dependent.

CHART REVIEWS

Disney (NYSE:DIS)

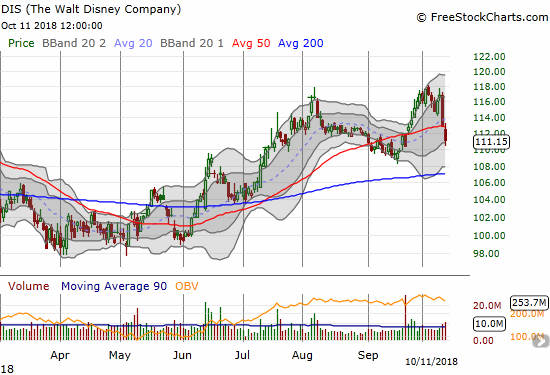

I am a long-term bull on Disney, so am looking to load up on the cheap. So far, DIS is holding up relatively well, and I have not jumped aboard just yet. I am targeting long-term call options expiring January, 2020. DIS broke through its 50DMA support but is one of the minority of stocks still trading comfortably above its 200DMA support.

Disney (DIS) held up well until the last two trading days. Today’s 1.5% loss produced a 50DMA breakdown.

SPDR Gold Shares (NYSE:GLD)

The fear in the market is now deep enough to stir up fresh interest in gold. GLD popped 2.5% for a 2+ month closing high. GLD made a double breakout: above its 50DMA resistance and above a 2-month consolidation period. I immediately moved to buy a call spread on GLD to add to my core position in GLD shares. I did not buy calls outright because I am worried that an implosion in volatility will hurt GLD call options particularly hard.

The SPDR Gold Shares (GLD) broke out in a move that looks like a bottom for the precious metal.

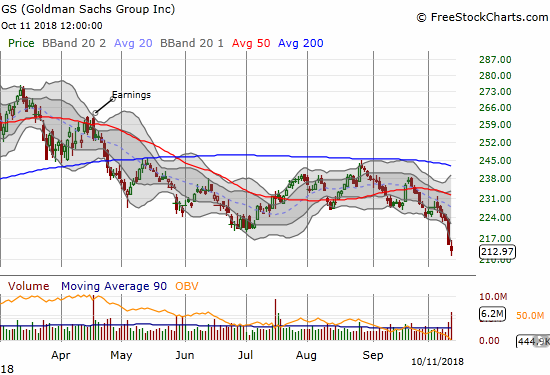

Goldman Sachs (NYSE:GS)

Every time I look at GS in sell-off mode, I cannot help thinking something is seriously wrong with financials specifically and the stock market generally. I sold my batch of puts too early and did not benefit from Wednesday’s large drop. Today, GS closed at a new 17-month low.

Goldman Sachs (GS) is as ugly as ever. The stock lost another 0.9% for a 17-month low.

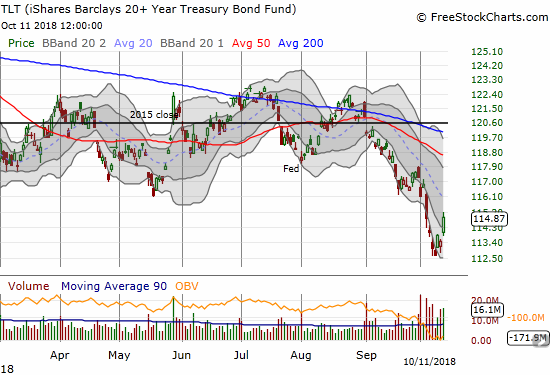

iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT)

There is now enough fear in the market to send interest rates back down and bond prices upward. TLT is up the last three trading days. I accumulated a sizeable position of call options in TLT during its sell-off in anticipation of just this kind of moment. However, the relief rally came a little later than I expected, so now the clock is working against me (expiration next Friday!).

The fear is pushing scared investors into Treasuries. The iShares 20+ Year Treasury Bond ETF (TLT) gained 1.2% as part of a sharp rebound.

Walgreens Boots Alliance (NASDAQ:WBA)

I am still stubbornly short WBA and sticking by my long-term bearish thesis. WBA is clearly considered a “safety” play during the market sell-off. It took a mildly disappointing earnings report to send the stock down…and buyers still were able to close the gap down momentarily. I will clearly be hanging around for the long-term…

Walgreens Boots Alliance (WBA) lost 2.0% and just barely survived a test of 50DMA support.

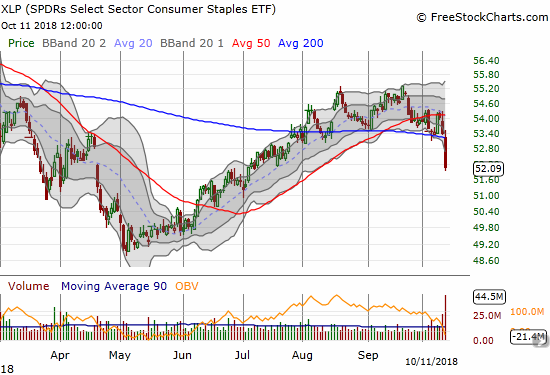

Consumer Staples Select Sector SPDR ETF (NYSE:XLP)

Consumer staples are sometimes considered a place to hide away from the market’s storms. No longer for this sell-off. XLP broke down decisively below its 200DMA support after seemingly bouncing successfully off the support last week. Trading volume surged to its highest level since November, 2016, making for a very bearish setup. I decided to just ride out my call options in XLP.

Consumer Staples Select Sector SPDR ETF (XLP) lost a whopping 2.5% as part of a bearish 200DMA breakdown on very high trading volume.

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #2 under 20% (oversold), Day #2 under 30%, Day #9 under 40%, Day #14 under 50%, Day #30 under 60%, Day #83 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

The charts above are my LATEST updates independent of the date of this given AT40 post. For my latest AT40 post click here.

Be careful out there!

Full disclosure: long UVXY puts, long GLD shares and call spread, long TLT calls, short WBA, long SPY calls

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.