- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

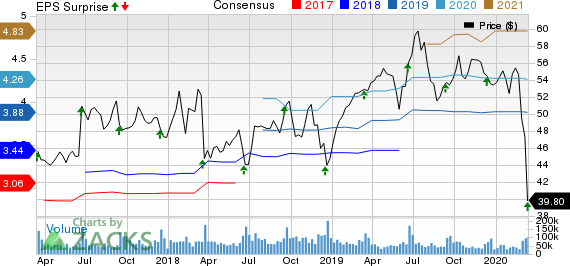

Oracle (ORCL) Q3 Earnings And Revenues Surpass Estimates

Oracle (NYSE:ORCL) reported third-quarter fiscal 2020 non-GAAP earnings of 97 cents per share, beating the Zacks Consensus Estimate by 1.04%. Further, the figure was up 11% from the year-ago quarter (up 12% in constant currency or cc).

Moreover, non-GAAP revenues improved 2% (up 3% in cc) year over year to $9.797 billion, outpacing the Zacks Consensus Estimate by 0.32%.

Top Line in Detail

Oracle reported total revenues (on a GAAP basis) of $9.796 billion, up 2% (up 3% in cc) year over year.

Revenues by Offerings

Oracle’s top line benefited from the ongoing cloud-based momentum. Cloud services and license support revenues (71% of total revenues) in the reported quarter rose 4% year over year (up 5% in cc) to $6.93 billion.

Break up of Cloud services and license support Revenues

Applications revenues (contributed 40.5% to total cloud servicesand license support revenues) amounted to $2.809 billion, up 6% year over year (up 7% in cc).

Infrastructure related revenues (59.5%) came in at $4.121 billion, up 2% year over year (up 4% in cc).

Meanwhile, Cloud license and on-premise license revenues (12%) declined 2% year over year (flat in cc) to $1.231 billion.

Hardware revenues (9%) were $857 million, down 6% (down 5% in cc) year over year.

Services revenues (8%) improved 2% (up 3% in cc) to $778 million.

Revenues by Geography

Revenues from Americas (represented 55% of total revenues) inched up 1.8% year over year to $5.363 billion.

Revenues from Europe/Middle East/Africa (29%) improved 1.9% from the year-ago quarter’s figure to $2.835 billion.

Revenues from Asia Pacific (16%) increased 2% from the year-ago quarter level to $1.598 billion.

Customer Expansion Bodes Well

Management announced that Fusion HCM, NetSuite ERP and Fusion ERP businesses were up 27%, 26% and 38% in the fiscal third quarter, respectively. NetSuite ERP and Fusion ERP have customer strength of around 21,000 and 7,000, respectively.

Additionally, the company is witnessing strong growth in Cloud HCM, which is increasingly being purchased as part of the company’s ERP cloud application suite. Further, the migration of several midsized SAP customers to Fusion ERP is an upside.

Moreover, the next-generation autonomous database launched by Oracle, supported by ML, is gaining traction. In the reported quarter, Oracle added new Autonomous Database cloud customers. New product introductions are likely to boost growth further in this category. Markedly, autonomous database in Gen2 Infrastructure is witnessing rapid adoption.

Expanding customer base is enabling the company to maintain leading position in cloud ERP market. Management is optimistic on latest deal wins from companies including Nomura, Fiserv (NASDAQ:FISV), Gap, Manhattan Associates, T-Mobile, Depository Trust & Clearing Corporation, Sonoco and National Bank of Canada.

The company is undertaking every effort to enhance functionalities of cloud-based applications, which is encouraging adoption. These initiatives are expected to provide the company an edge in the Database-as-a-Service market and reinforce its competitive position against Amazon (NASDAQ:AMZN) Web Services.

Operating Details

Non-GAAP operating expenses increased 2% year over year (up 3% in cc) to $5.44 billion.

Non-GAAP operating income during the reported quarter was $4.357 billion, up 2% year over year (up 3% in cc).

Non-GAAP operating margin came in at 44%, remaining flat on a year-over-year basis.

Balance Sheet & Cash Flow

As of Feb 29, 2020, Oracle had cash & cash equivalents, and marketable securities of $25.858 billion, down from $27.444 billion as of Nov 30, 2019.

Operating cash flow and free cash flow for the 12 months ended Nov 30, 2019 came in at $13.947 billion and $12.403 billion, respectively.

Share Repurchases & Dividends

Oracle repurchased 73.5 million shares worth approximately $4 billion during the fiscal third quarter, and paid out dividends worth $2.33 billion during the nine months ended Feb 29, 2020.

On Mar 12, 2020, the company declared a quarterly dividend of 24 cents per share, payable on Apr 23, 2020, to shareholders as on Apr 9, 2020. The company also increased share repurchases authorization by $15 billion.

Guidance

For the fiscal fourth quarter, Oracle anticipates total revenue growth rate on a year-over-year basis in the range of (2%) to 2%, both at USD and cc.

Oracle expects non-GAAP earnings per share in the range of $1.20-$1.28. The Zacks Consensus Estimate for the same is pegged at $1.22 per share.

Zacks Rank & Stocks to Consider

Currently, Oracle carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the broader sector are Microsoft (NASDAQ:MSFT) , Applied Materials (NASDAQ:AMAT) and Garmin (NASDAQ:GRMN) . All the three stocks currently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Microsoft, Applied Materials and Garmin is currently pegged at 13.22%, 9.94%, and 7.35%, respectively.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.