- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR Rebounds, USD Corrects Lower

Forex News and Events

DAX index hit a new all-time highs and RUB gains as significant USD correction continues. The catalyst was the ceasefire agreement between the Ukraine and Russia combined with positive comments emulating from Greek debt negotiations. Even commodities got a lift led by crude on weaker USD and comments from oil producers suggest investment spending will be trimmed. US January consumer spending disappointed but most S&P sectors caught up in the euphoria headed higher. Time is winding down on Greek aid talks, so even a six-month bridge loan extension will keep risk appetite high. With US yields rising we remain constructive on USD however, concede that a short term EUR/USD relief rally is possible as we inch closer to a temporary solution to Greece’s financial issues

BoE’s quarterly Inflation Report boost GBP-bulls

The BoE’s quarterly Inflation Report finally dissipated timidity in GBP-bulls and sent the Cable to fresh bullish consolidation zone. The GBP/USD cleared resistance at Sep’14-Feb’15 downtrend top and shortly tested offers above the 50-dma (1.5346). As suspected, the BoE revised up its economic forecasts to scatter deflationary fears. “Output growth remains solid and domestic demand growth robust” said Governor Carney, therefore anticipating a better inflation outlook by the end of 2015. The improvement in labor market, more importantly wages, lead to a significant upside revision in post-tax real incomes from 1.25% to 3.5%. Given that the pound debasing had started with the significant downside revision regarding the wages by mid-2014 QIR, yesterday’s report should pave the way for a more sustainable recovery in GBP verse USD still struggling with contained pick-up in the US sovereign curve.

The first BoE interest rate hike should not be expected any time before 2016 according to Carney, who also warns that the inflation can step in negative territories in months ahead. The improvement is expected only from the second half of 2015. The forward contracts price in a 25 basis point hike in a year from now (Feb 2016). While the divergence between BoE/ECB suggests a clear downside direction for the EUR/GBP toward 0.65/0.70 (2004/2007 range band), while the GBP/USD trend will perhaps be impacted by upcoming elections in the UK. In the short-run, the post-QIR boost has potential to push GBP/USD toward 1.5481/1.5808 (Fibonacci 23.6% and 38.2% on Jul’14-Jan drop).

Riksbank goes negative

Yesterday, the Riksbanks unexpectedly cut main repo rate to -0.10% from 0.0%. Swedish Riksbank now is the first to European central bank to set a negative main policy interest rate. Most analysts had anticipated the Riksbank would holds its main repo rate at zero, although the possibly was always present. In reaction, EUR/SEK spiked to 9.6307. In addition, the central bank stated it will buy government bonds for SEK10bn, basically launching mini QE (balance sheets is over SEK500bn). Unconventional measures had been a low probability scenario but illustrates the concern and fashionable nature of QE in the current climate. On the surface, this is a proactive move to lessen the deflationary influence of the macro environment. However, we suspect this is more geared towards debasing the SEK (CB concern over the EUR/SEK downside) as the slightly negative rate will have minimal impact on deposit rates. Thus unlikely to dissuade speculators. This is a Swedish version of “whatever it takes” to anchor inflation expectations toward 2% target and ‘stand ready’ to do more. In the near term, SEK should remain under heavy selling pressure, yet more accommodating policy should support European equities and constrict rates further.

Swissquote SQORE Trade Idea:

FX StatArb Model: Sell USD/JPY at 118.91 & Sell EUR/USD 1.1427

For forex algorithmic trade details & more great trade ideas:

| Today's Key Issues | Country / GMT |

|---|---|

| 4Q P Non-Farm Payrolls QoQ, exp -0.20%, last -0.30% | EUR / 07:45 |

| 4Q P Wages QoQ, exp 0.20%, last 0.20% | EUR / 07:45 |

| Jan CPI EU Harmonised MoM, exp -0.70%, last -0.70% | EUR / 08:00 |

| Jan F CPI EU Harmonised YoY, exp -1.50%, last -1.50% | EUR / 08:00 |

| Jan CPI MoM, exp -1.20%, last -0.60% | EUR / 08:00 |

| Jan F CPI YoY, exp -1.40%, last -1.40% | EUR / 08:00 |

| Jan CPI Core MoM, last 0.00% | EUR / 08:00 |

| Jan CPI Core YoY, exp 0.00%, last 0.00% | EUR / 08:00 |

| 4Q Industry Capacity, last 88.70% | SEK / 08:30 |

| 4Q P GDP WDA QoQ, exp -0.10%, last -0.10% | EUR / 09:00 |

| 4Q P GDP WDA YoY, exp -0.50%, last -0.50% | EUR / 09:00 |

| Dec General Government Debt, last 2160.1B | EUR / 09:30 |

| Dec Construction Output SA MoM, exp 2.70%, last -2.00% | GBP / 09:30 |

| Dec Construction Output SA YoY, exp 5.50%, last 3.60% | GBP / 09:30 |

| 4Q A GDP SA QoQ, exp 0.20%, last 0.20% | EUR / 10:00 |

| 4Q A GDP SA YoY, exp 0.80%, last 0.80% | EUR / 10:00 |

| Jan Import Price Index MoM, exp -3.20%, last -2.50% | USD / 13:30 |

| Jan Import Price Index YoY, exp -8.90%, last -5.50% | USD / 13:30 |

| Dec Manufacturing Sales MoM, exp 0.90%, last -1.40% | CAD / 13:30 |

| Bloomberg Feb. Canada Economic Survey | CAD / 14:00 |

| Feb P U. of Mich. Sentiment, exp 98.1, last 98.1 | USD / 15:00 |

| Feb P U. of Mich. Current Conditions, last 109.3 | USD / 15:00 |

| Feb P U. of Mich. Expectations, last 91 | USD / 15:00 |

| Feb P U. of Mich. 1 Yr Inflation, last 2.50% | USD / 15:00 |

| Feb P U. of Mich. 5-10 Yr Inflation, last 2.80% | USD / 15:00 |

The Risk Today

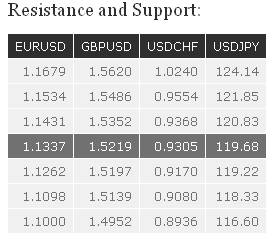

EUR/USD has successfully tested the support at 1.1262 and has broken the hourly resistance at 1.1359, improving the short-term technical structure. A move towards the resistance at 1.1534 is likely. Another key resistance stands at 1.1679. An hourly support now lies at 1.1355 (intraday high). In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Key resistances stand at 1.1679 (21/01/2015 high) and 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD has broken the key resistance at 1.5274 (06/01/2015 high) and the declining trendline, indicating an improving technical structure. Resistances can be found at 1.5486 and 1.5620. Hourly supports stand at 1.5300 (11/02/2015 high) and 1.5197 (10/02/2015 low). In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potentials are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). A strong support stands at 1.4814.

USD/JPY has sharply declined near the resistance area between 120.83 and 121.85. Further medium-term sideways moves are favoured. Supports are given by 118.83 and by the rising trendline (around 117.36). An hourly resistance can now be found at 119.22 (06/02/2015 high). A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 115.57 (16/12/2014 low).

USD/CHF is consolidating below the resistance at 0.9347/0.9368 (15/10/2014 low, see also the 200-day moving average). Hourly supports stand at 0.9170 (30/01/2015 low) and 0.8936 (27/01/2015 low). Another resistance lies at 0.9554 (16/12/2014 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Another key resistance stands at 0.9554 (16/12/2014 low), whereas a strong support can be found at 0.8353 (intraday low).

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.