- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ophthotech (OPHT) Q3 Earnings & Sales Beat, Zimura In Focus

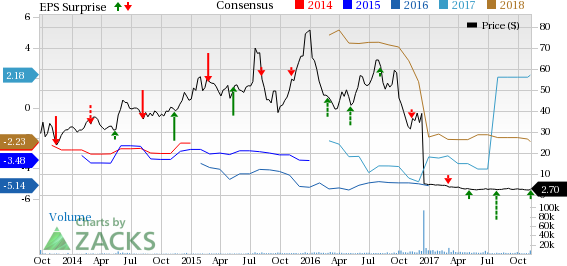

Ophthotech Corporation (NASDAQ:OPHT) reported earnings of $5.25 per share for the third quarter of 2017, beating the Zacks Consensus Estimate of $4.38. The company had reported a loss of $1.71 in the year-ago quarter.

With no approved products in its portfolio, Ophthotech derives revenues from milestone and other payments under collaborations. The company reported collaboration revenues of $206.7 million in the quarter, beating the Zacks Consensus Estimate of $185 million and higher than $1.7 million in the year-ago period.

The significant year-over-year increase in revenues is mainly attributed to recognition of deferred revenues related to completion of deliverables required under its licensing and commercialization agreement with Novartis (NYSE:NVS) .

Shares of the biotech company closed 15.9% higher on Thursday. However, Ophthotech’s shares have underperformed the industry in the last three months. Specifically, the company’s shares have lost 44.1% whereas the industry registered an increase of 3%.

In December 2016, the company announced that its then lead candidate, Fovista, failed in two pivotal phase III studies in wet age-related macular degeneration (“AMD”). Following this, Ophthotech announced a major cut in its workforce and termination of Fovista studies. In August 2017, Fovista failed in a third phase III study and the company terminated it as well.

Quarter in Detail

Research and development expenses decreased 79% to $10.7 million, mainly due to lower expenses related to the phase III program on Fovista, which includes a decrease in manufacturing expenses.

General and administrative expenses decreased 40.8% from the year-ago period to $7.1 million due to lower cost related to the company's operations and infrastructure.

Pipeline Update

With the failure of Fovista in two pivotal phase III studies, the company is focused on Zimura development programs. The company is developing Zimura in dry and wet AMD, and has plans to initiate studies in Stargardt disease, idiopathic choroidal vasculopathy (“IPCV”), and intermediate/posterior uveitis.

In the quarter, the company modified its ongoing phase IIb study evaluating Zimura in Geographic Atrophy ("GA"), a severe form of dry AMD, to reduce the anticipated time to achieve the primary endpoint of mean rate of change in GA. The study will enroll lesser number of patients and is anticipated to achieve the primary endpoint in 12 months, with top-line data expected in 2019.

Ophthotech also initiated a dose determining phase IIa study, evaluating Zimura in combination with Roche’s (OTC:RHHBY) Lucentis in patients with wet AMD. The top-line data is expected in late 2018.

Moreover, the company remains on track to initiate a phase IIa study on Zimura in combination with Regeneron Pharmaceuticals.’s (NASDAQ:REGN) Eylea in IPCV and a phase IIb study evaluating Zimura monotherapy in Stargardt Disease.

Cash Balance

Ophthotech’s cash balance was $180.2 million as of Sep 30, 2017.

The company increased its expectation of cash balance to the range of $155 million to $165 million (previously $145 million to $160 million) by the end of 2017.

Zacks Rank

Ophthotech carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Ophthotech Corporation (OPHT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.