- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amneal (AMRX) Down On Guidance Update & Restructuring Plan

Shares of Amneal Pharmaceuticals, Inc. (NYSE:AMRX) crashed 35.96% after the company announced a restructuring plan and updated its annual guidance.

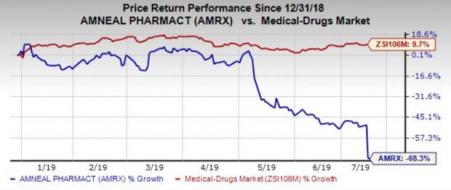

Notably, the stock has plunged 68.3% in the year so far against the industry’s 9.7% growth.

The company recently initiated an in-depth, company-wide review of its organizational structures, operational budgets, current and future capital projects, and existing capability and infrastructure alignments. The review was in response to the continuing industry challenges impacting its business.

The plan will lead to substantial operating budget reductions, and revised and more efficient organizational structures across all company functions.

Consequently, the total cost base will be reduced approximately $50.0 million. A large chunk of the milestones will be achieved during 2020, with the full benefit of these actions being realized in 2021 and beyond.

Amneal has been in troubled waters for a while now. We remind investors that the company’s base generics business is facing persistent pressure from the limited number of buyers. The key generic products are also facing stiff competition, which is adversely impacting performance. The company’s complex product pipeline is yet to produce any substantial result.

Moreover, as a result of continued market pressure and additional competition for the company’s key generic products, uncertainty regarding the supply of epinephrine auto-injector (generic Adrenaclick) from a third-party supplier during the highly-seasonal third quarter, and delays in key product approvals and launches, including generic NuvaRing, the company updated its guidance. Management now expects adjusted EBITDA for 2019 to be $425-$475 million, down from the previous guidance of $600-$650 million.

The generic industry is facing challenging business conditions. Both Mylan (NASDAQ:MYL) and Teva Pharmaceuticals (NYSE:TEVA) are also trying to combat slowdown in generic business through various means.

Zacks Rank & A Key Pick

Amneal currently carries a Zacks Rank #4 (Sell). A better-ranked stock in the healthcare sector is Novartis AG (NYSE:NVS) , which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Novartis’ earnings per share estimates increased from $4.98 to $5.01 for 2019 and from $5.48 to $5.56 for 2020 over the past 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Novartis AG (NVS): Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

AMNEAL PHARMACEUTICALS, INC. (AMRX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.