- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Earnings Preview: Apache (APA) Q2 Earnings Expected To Decline

Apache (APA) is expected to deliver a year-over-year decline in earnings on lower revenues when it reports results for the quarter ended June 2019. This widely-known consensus outlook gives a good sense of the company's earnings picture, but how the actual results compare to these estimates is a powerful factor that could impact its near-term stock price.

The stock might move higher if these key numbers top expectations in the upcoming earnings report, which is expected to be released on July 31. On the other hand, if they miss, the stock may move lower.

While management's discussion of business conditions on the earnings call will mostly determine the sustainability of the immediate price change and future earnings expectations, it's worth having a handicapping insight into the odds of a positive EPS surprise.

Zacks Consensus Estimate

This oil and natural gas producer is expected to post quarterly earnings of $0.08 per share in its upcoming report, which represents a year-over-year change of -84%.

Revenues are expected to be $1.61 billion, down 16.6% from the year-ago quarter.

Estimate Revisions Trend

The consensus EPS estimate for the quarter has been revised 56.74% lower over the last 30 days to the current level. This is essentially a reflection of how the covering analysts have collectively reassessed their initial estimates over this period.

Investors should keep in mind that an aggregate change may not always reflect the direction of estimate revisions by each of the covering analysts.

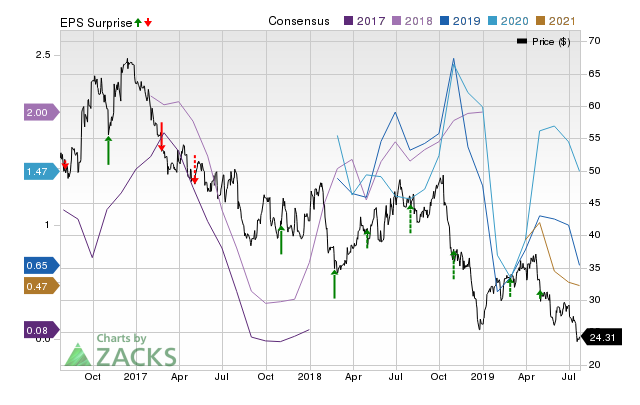

Price, Consensus and EPS Surprise

Earnings Whisper

Estimate revisions ahead of a company's earnings release offer clues to the business conditions for the period whose results are coming out. Our proprietary surprise prediction model -- the Zacks Earnings ESP (Expected Surprise Prediction) -- has this insight at its core.

The Zacks Earnings ESP compares the Most Accurate Estimate to the Zacks Consensus Estimate for the quarter; the Most Accurate Estimate is a more recent version of the Zacks Consensus EPS estimate. The idea here is that analysts revising their estimates right before an earnings release have the latest information, which could potentially be more accurate than what they and others contributing to the consensus had predicted earlier.

Thus, a positive or negative Earnings ESP reading theoretically indicates the likely deviation of the actual earnings from the consensus estimate. However, the model's predictive power is significant for positive ESP readings only.

A positive Earnings ESP is a strong predictor of an earnings beat, particularly when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). Our research shows that stocks with this combination produce a positive surprise nearly 70% of the time, and a solid Zacks Rank actually increases the predictive power of Earnings ESP.

Please note that a negative Earnings ESP reading is not indicative of an earnings miss. Our research shows that it is difficult to predict an earnings beat with any degree of confidence for stocks with negative Earnings ESP readings and/or Zacks Rank of 4 (Sell) or 5 (Strong Sell).

How Have the Numbers Shaped Up for Apache?

For Apache, the Most Accurate Estimate is lower than the Zacks Consensus Estimate, suggesting that analysts have recently become bearish on the company's earnings prospects. This has resulted in an Earnings ESP of -62.48%.

On the other hand, the stock currently carries a Zacks Rank of #3.

So, this combination makes it difficult to conclusively predict that Apache will beat the consensus EPS estimate.

Does Earnings Surprise History Hold Any Clue?

Analysts often consider to what extent a company has been able to match consensus estimates in the past while calculating their estimates for its future earnings. So, it's worth taking a look at the surprise history for gauging its influence on the upcoming number.

For the last reported quarter, it was expected that Apache would post earnings of $0.09 per share when it actually produced earnings of $0.10, delivering a surprise of +11.11%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

Bottom Line

An earnings beat or miss may not be the sole basis for a stock moving higher or lower. Many stocks end up losing ground despite an earnings beat due to other factors that disappoint investors. Similarly, unforeseen catalysts help a number of stocks gain despite an earnings miss.

That said, betting on stocks that are expected to beat earnings expectations does increase the odds of success. This is why it's worth checking a company's Earnings ESP and Zacks Rank ahead of its quarterly release. Make sure to utilize our Earnings ESP Filter to uncover the best stocks to buy or sell before they've reported.

Apache doesn't appear a compelling earnings-beat candidate. However, investors should pay attention to other factors too for betting on this stock or staying away from it ahead of its earnings release.

Apache Corporation (NYSE:APA): Free Stock Analysis Report

Original post

Related Articles

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

When a company is at the top of its industry, it is often afforded benefits that smaller players are not. Industry leaders often have key traits like economies of scale, top...

Often as dividend investors we buy stocks that provide us with income now. We take the current yield and happily collect the monthly or quarterly payout. Sometimes, though, it is...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.