- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ONEOK (OKE) To Gain From Assets In Prolific Oil & Gas Regions

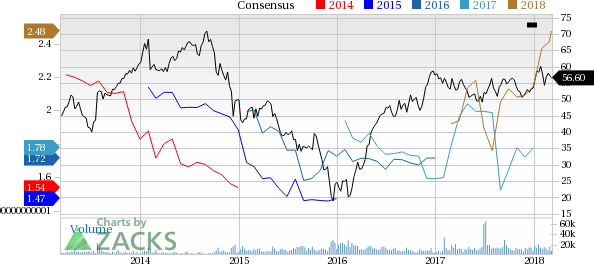

ONEOK Inc. (NYSE:OKE) has gained 4.2% in the last year as against the industry’s decline of 0.6%. ONEOK stands to benefit from higher fee-based earnings and midstream assets located in higher productive regions.

ONEOK has a network of nearly 38,000 miles of natural gas liquids and pipelines that are strategically located in highly productive regions, thanks to $9 billion of its completed growth projects between 2006 and 2016. Another $3.6-billion new natural gas liquids growth project was announced in June 2017. All these projects are expected to come online by the first half of 2020 and further boost revenues of the company.

In 2017, ONEOK’s consolidated earnings were 90% fee based. In 2018, the company expects the same to be on par with the prior year. The company anticipates to benefit from increase in natural gas and natural gas liquids (NGL) production volume in the STACK and SCOOP areas, and Williston and Permian basins, and increased ethane recovery in the Mid-Continent, throughout 2018.

ONEOK is poised to benefit from the Sterling III Pipeline expansion, West Texas LPG Pipeline expansion and Canadian Valley natural gas processing facility expansion announced in June 2017. These projects are fully subscribed under long-term fee-based commitments.

However, ONEOK does not own all the land on which its pipelines are situated. The company runs the risks of cost increase and has the right to maintain the land as necessary. If the company fails to renew existing land rights and add new rights to lay down pipelines, it will impact operation and profitability of the company.

ONEOK has a Zacks Rank #3 (Hold). A few better-ranked stocks in the Zacks Utility Gas Distribution industry are Just Energy Group (TO:JE) , National Fuel Gas Company (NYSE:NFG) and NewJersey Resources Corporation ( (NYSE:NJR) . NewJersey Resources sports a Zacks Rank #1 (Strong Buy) and the other two stocks carry a Zacks Rank #2 (Buy), each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Energy Group reported an average positive earnings surprise of 173.1% in the last four quarters. Its 2018 earnings estimates moved up 205.4% to $1.13 per share in the last 60 days.

National Fuel Gas reported an average positive earnings surprise of 6.34% in the trailing four quarters. Its 2018 earnings estimates moved up 14.9% to $3.32 per share over the last 60 days

NewJersey Resources reported an average positive earnings surprise of 516.94% in the last four quarters. Its 2018 earnings estimates moved up 42.1% to $2.60 per share in the last 60 days.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

ONEOK, Inc. (OKE): Free Stock Analysis Report

National Fuel Gas Company (NFG): Free Stock Analysis Report

NewJersey Resources Corporation (NJR): Free Stock Analysis Report

Just Energy Group, Inc. (JE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.