- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

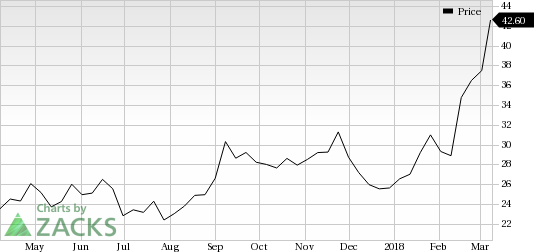

Okta (OKTA) In Focus: Stock Moves 8.8% Higher

Okta, Inc. (NASDAQ:OKTA) was a big mover last session, as the company saw its shares rise nearly 9% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This continues the recent uptrend for the company—as the stock is now up 49.2% in the past one-month time frame.

The move came after the company reported better-than-expected fourth-quarter fiscal 2018 results.

The company has seen one positive estimate revision in the past few weeks, while its Zacks Consensus Estimate for the current quarter has also moved higher over the past few weeks, suggesting that more solid trading could be ahead for Okta. So make sure to keep an eye on this stock going forward to see if this recent jump can turn into more strength down the road.

Okta currently has a Zacks Rank #3 (Hold) while its Earnings ESP is positive.

A better-ranked stock in the Internet - Software and Services industry is Boingo Wireless, Inc. (NASDAQ:WIFI) , holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Is OKTA going up? Or down? Predict to see what others think:Up or Down

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Boingo Wireless, Inc. (WIFI): Free Stock Analysis Report

Okta, Inc. (OKTA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.