- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Oil Implodes, Currencies Next?

By Adam Button

The June oil futures contract for WTI closed above $11 yesterday from a low of $7, one day after the May contract collapsed to an unprecedented negative $40.30. As for Brent oil, it hit an 18-year low of $17.51. Questions arise whether Brent will find the same fate as WTI, despite less challenging geographical considerations regarding its supplies. The difference from yesterday is that US indices began to feel the hit from oil, falling 3% across the board. A story that fell through the cracks was the RBNZ leader saying he was open to debt monetization. The big question right now is whether central banks and governments can counteract the demand shock. US coronavirus deaths topped 45k on Tuesday, doubling in a little over a week as total cases exceeded 800k.

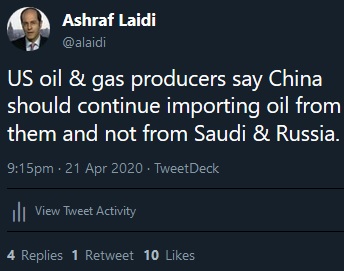

Ashraf's tweet above give an idea about not only Trump's attempts to use bailout money to assist the oil industry (a big no-no among Democrats), but also some Senators' early efforts to force Beijing into importing more US oil.

We have warned repeatedly for weeks here and here that supply of crude outstrips demand and, unlike some other commodities, crude is very difficult to transport and store. That means excess oil is a nuisance and you can find yourself in a position where you need to pay someone to take it away.

Even knowing all that, a plunge to -$40 is beyond shocking. A few cents negative would have been understandable, but this was a sign of leveraged longs forced to liquidate in an illiquid market. The drop extended further out into crude on Tuesday and June crude fell to $6.50 as the USO (NYSE:USO) ETF tried to pare down holdings that exceeded 30% of open interest at the start of the day.

Can central banks and governments can counteract the demand shock?

Stimulus sums right now are astronomical and on Tuesday the US Senate passed another $500B bill with the President saying that even more is in the works.

It's the same story everywhere and no one is even offering a pretense at how it will be paid back. On Tuesday the RBNZ said out loud two words we once thought we would never hear: “debt monetization”. He said he was open-minded on directly monetizing debt. The reality is that there is no other way out of the fiscal holes that governments are digging, it's more a matter of the mechanics of it. But however, it's done it's undoubtedly good for hard assets and precious metals.

USD bulls may see fewer reasons for concern if oil's implosion means prolonged deflationary powers. And if deflation does become a problem, would it be a fear factor for gold? Is thet even possible when desperate central banks are monetizing governments' debt?

Related Articles

Crude Oil WTI Futures oil prices made a run for the 10-day moving average but failed to complete the breakout, keeping us locked in a trading range. Oil prices were hesitant to...

American stock investors have suddenly started buying gold again. After largely ignoring most of gold’s monster upleg, they just started flocking back fueling big builds in...

Analyzing the movements of the natural gas futures since I wrote my last analysis, I anticipate that the natural gas futures will likely start next week with a gap-down opening if...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.