- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Oil & Gas Refining & Marketing MLP Industry: A Steady Growth Story

Master limited partnerships (or MLPs) differ from regular stocks in that interests in them are referred to as units and unitholders (not shareholders) are partners in the business. Importantly, these hybrid entities bring together the tax benefits of a limited partnership with the liquidity of publicly traded securities. The assets that these partnerships own typically are oil and natural gas pipelines and storage facilities.

The Zacks Oil and Gas - Refining & Marketing MLP industry is a sub-sector of this business model. These firms operate refined products' terminals, storage facilities and transportation services. They are involved in selling refined products (including heating oil, gasoline, residual oil, etc.) and a plethora of non-energy materials (like asphalt, road salt, clay and gypsum).

Let’s take a look at the industry’s three major themes:

- Most MLPs derive their revenues based on the amount of fuel transported and are relatively insulated from oil and refined product price fluctuations. The defensive, fee-based business model not only provides cash flow stability to the refining and marketing MLPs, but also makes long-term distribution growth more predictable. Since the revenues they earn are volume-driven and often under long-term contracts, the pipeline operators are likely to enjoy stable demand for their services even if the U.S. economy slows.

- The downstream refining and marketing MLPs tend to get a major portion of their cash flows from gasoline distribution and retail operations. These businesses are quite stable and defensive thanks to the highly inelastic gasoline sales and demand. Consumption of gasoline is a necessity and remains resilient even during lean times as consumers would still need to drive and fill up the tank. In fact, the current low oil price environment influences people to drive and travel more, which boosts gasoline demand. Lower fuel expense also leaves consumers with a larger disposable income that they can utilize on retail store purchases.

- The sentiment among pipeline investors remains cautious following the FERC policy revision (per orders issued on July 2018) that signaled significant future changes on how the pipeline partnerships will go about treating income taxes in their books of accounts. Partnerships charging cost-based rates for interstate transportation service would have to lower customer tariffs to move oil, gas and refined products around the country by the amount of their income tax allowances — substantial in certain cases. A reduction in cost recovery would likely cut into their cash flows. With the new rule expected to be adopted only by 2020, the issue may remain a thorn in the flesh in the foreseeable future.

Zacks Industry Rank Suggests Positive Outlook

The Zacks Oil and Gas - Refining & Marketing MLP is a 13-stock group within the broader Zacks Oil - Energy sector. The industry currently carries a Zacks Industry Rank #67, which places it in the top 26% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bullish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms Sector But Lags S&P 500

The Zacks Oil and Gas - Refining & Marketing MLP industry has outperformed the broader Zacks Oil - Energy Sector over the past year but has lagged the Zacks S&P 500 composite over the same period.

The industry has declined 15.7% in the past year compared with the S&P 500’s gain of 7.5% and broader sector’s decrease of 21.1%.

One-Year Price Performance

Industry’s Current Valuation

Since midstream-focused oil and gas partnerships use fixed rate debt for the majority of their borrowings, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of noncash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, the industry is currently trading at 12.51X, higher than the S&P 500’s 11.08X. It is also significantly above the sector’s trailing-12-month EV/EBITDA of 4.68X.

Over the past five years, the industry has traded as high as 22.39X, as low as 9.62X, with a median of 13.78X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

Bottom Line

The traditional fuels refining operation — where crude is turned into products ranging from gasoline and diesel to jet fuel and asphalt — is heavily dependent on commodity price fluctuations. A tepid oil price environment generally results in the strengthening of crack spreads (or the difference between the price of oil and refined products).

Therefore, given the current weakness in oil (the input for refiners), demand is expected to be strong due to low product prices. This, in turn, will bolster cash flow generation at the partnerships with downstream exposure.

With the abovementioned catalysts set to provide near-term upside, we are presenting four stock with a Zacks Rank #2 (Buy) that are well positioned to grow.

You can see the complete list of today’s Zacks #1 Rank stocks here.

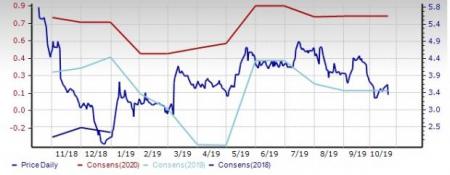

Calumet Specialty Products Partners, L.P. (CLMT): This partnership – focused on the production of high-quality, specialty products and fuels in North America – has seen the Zacks Consensus Estimate for 2019 surge 333.3% over 90 days.

Price and Consensus: CLMT

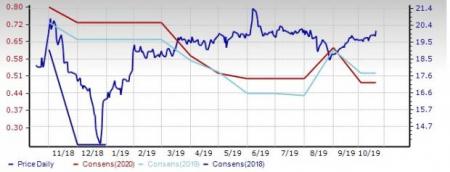

Global Partners LP (GLP): This vertically integrated downstream energy partnership focuses on the distribution of gasoline, distillates, residual oil, and renewable fuels, apart from owning several refined-petroleum-product terminals. The midstream operator has seen the Zacks Consensus Estimate for 2019 surge 18.2% over 90 days.

Price and Consensus: GLP

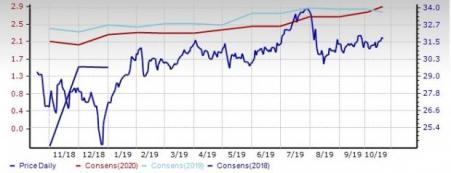

Sunoco LP (SUN): This downstream operator focuses on motor fuel distribution to convenience stores, independent dealers and commercial customers. Sunoco has an expected earnings growth of 101.5% for this year.

Price and Consensus: SUN

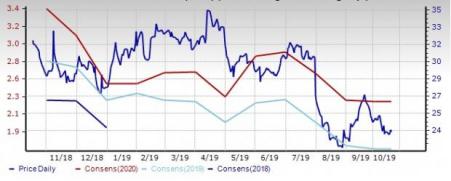

Western Midstream Partners, LP (WES): Western Midstream Partners is engaged in gathering, processing, compressing, treating, and transporting natural gas, condensate, natural gas liquids, and crude oil. The firm’s expected EPU growth rate for three to five years currently stands at 6%, comparing favorably with the industry's growth rate of 4.3%.

Price and Consensus: WES

Western Gas Equity Partners, LP (WES): Free Stock Analysis Report

Sunoco LP (SUN): Free Stock Analysis Report

Global Partners LP (GLP): Free Stock Analysis Report

Calumet Specialty Products Partners, L.P. (CLMT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.