- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Office Depot (ODP) Q3 Earnings Meet, Sales Beat, Stock Up

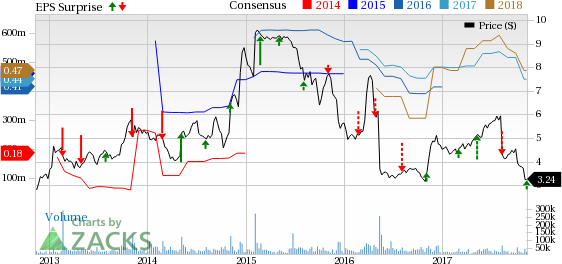

After witnessing a negative earnings surprise of 33.3% in the second quarter of 2017, Office Depot, Inc. (NASDAQ:ODP) delivered in-line earnings in the third quarter. Meanwhile, the top line came ahead of the Zacks Consensus Estimate after missing the same in the trailing 12 quarters. This along with the company’s transformation plan to give itself a complete makeover helped the stock to rise 7.6% during the trading session yesterday.

This office supplies retailer posted adjusted earnings per share from continuing operations of 14 cents that met the consensus estimate but declined roughly 13% from the prior-year quarter, as the top line continues to struggle. The company generated sales of $2,620 million that fared marginally better than analysts’ expectations of $2,612 million but declined 8% year over year due to hurricane related disruptions as one of the primary factors.

For quite some time now, Office Depot has been grappling with dwindling top-line performance. Analysts pointed out that demand for office products (paper-based) has been decreasing due to technological advancements. Smartphones, tablets and laptops are fast emerging as viable substitutes for paper-based office supplies. Further, stiff competition from online retailers such as Amazon.com, Inc. (NASDAQ:AMZN) , loss of customers in Business Solutions Division and lower traffic count in retail stores have been playing spoilsport.

The reflection of the same is quite visible from the stock’s performance in the bourses. So far in the year, shares of this Zacks Rank #4 (Sell) company have plunged 28.3%, wider than the industry’s decline of 22.2%.

.jpg)

Nevertheless, the company is closing underperforming stores, reducing exposure to higher dollar-value inventory items, shuttering non-critical distribution facilities, concentrating on e-commerce platforms as well as focusing on offering innovative products and services.

Gross profit plunged 13% year over year to $633 million, while gross margin contracted 140 basis points (bps) to 24.2%. Adjusted operating income came in at $131 million, down 17% from the year-ago period, while adjusted operating margin shriveled 60 bps to 5%.

Segment Performance

In the reported quarter, the Retail Division’s sales fell 10% to $1,329 million on account of planned closure of stores, hurricane impacts and a 5% drop in comparable-store sales (comps). Comps declined due to fall in foot traffic and average order purchase value during the back-to-school season. The segment reported operating income of $82 million, down 22% from the prior-year quarter, while operating margin decreased 90 basis points to 6.2% due to lower sales and gross margin rate, partly offset by fall in SG&A expenses. Total store count at the division was 1,404 at the quarter end. During the quarter, the company shut down four outlets, thereby bringing the total store closure count to 109 under the second phase.

Sales for Business Solutions Division tumbled 4% to $1,288 million on account of customer attrition in the contract channel, stiff competition and hurricane impacts. The segment posted operating income of $71 million, down from $81 million reported in the year-ago period. Operating margin decreased 50 bps to 5.5% due to lower sales and gross margin rate, partly offset by effective cost management, including lower SG&A expenses.

Other Financial Details

Office Depot ended the quarter with cash and cash equivalents of $788 million, long-term debt (net of current maturities) of $265 million, non-recourse debt of $781 million, and shareholders’ equity of $2,042 million.

During the quarter, the company generated cash flow of $293 million from operating activities and incurred capital expenditures of $37 million, thereby resulting in free cash flow of $256 million. Management continues to expect free cash flow from continuing operations of more than $300 million in 2017. The company anticipates capital expenditures of approximately $125 million in 2017, which comprises of investments to fund critical priorities.

During the quarter, the company bought back 4 million shares for an aggregate amount of $17 million. Since May 2016, the company has bought back approximately 45 million shares at a total cost of $166 million with $84 million remaining at its disposal under the current share repurchase authorization of $250 million.

Discontinuation of International Business

Office Depot concluded the sale of its mainland China business and has entered into a deal to divest operations in Australia and New Zealand. However, the company has retained sourcing and trading operations in Asia. Results from the Asia operations are reported as “Other” segment.

Outlook

Management expects total sales to be lower in 2017 in comparison with 2016, owing to the store closures, tough market conditions, hurricane impacts and losses of contract customers in the previous year. However, management anticipates the rate of decline to decelerate in the final quarter after taking into consideration higher customer retention and strategic endeavors, along with the implementation of new customer wins.

After assessing the impact of recent hurricanes, sluggish sales and soft traffic during the back to school period, temporary rise in the supply chain costs and investments to catapult into a services-driven company, Office Depot now envisions adjusted operating income in the range of $400-$425 million, down from $500 million projected previously.

Strategic Measures

After the termination of merger with Staples, Office Depot has undertaken a strategic review of business operating model, growth prospects and cost structure. To give itself a facelift, the company recently acquired CompuCom Systems, Inc. The buyout will help this traditional office supplies retailer to widen its domain of offerings.

The company will now be able to provide enterprise-level tech services and products to customers. Management believes that the addition of CompuCom will help take a huge leap toward automation and innovation. The acquisition is likely to add approximately $1.1 billion in revenues and help realize cost savings of more than $40 million within a period of two years. The company also launched a new subscription-based business services platform, BizBox, to assist start-ups and small businesses on host of things such as website designing, financing and accounting service, HR/payroll support and others.

Office Depot is also employing a more efficient customer coverage model, focusing on lowering indirect procurement costs as well as general and administrative expenditures. Further, the company will also gain from its U.S. retail store optimization plan. Management expects these endeavors to result in annual benefits of over $250 million by the end of 2018 with nearly two-thirds of those benefits are expected to be realized by the end of the current year.

Interested in Retail? Check these 2 Trending Picks

Zumiez Inc. (NASDAQ:ZUMZ) delivered an average positive earnings surprise of 27.1% in the trailing four quarters. The company has a long-term earnings growth rate of 18% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Home Depot, Inc. (NYSE:HD) delivered an average positive earnings surprise of 3.8% in the trailing four quarters. It has a long-term earnings growth rate of 13.5% and carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Office Depot, Inc. (ODP): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.