- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Greenback Woes On Trump

The Week Before

Last week, the United States formally embraced Donald Trump as president, although Trump’s new position spikes market uncertainty. The markets were relatively quiet on Friday, as Trump did not clarify in his speech how he will “Make America Great Again”. The USD lost gains during the week as investors were waiting on Trump to give USD pairs clear direction, which did not occur and leaves us to focus on what’s to happen next.

The Week Ahead

Fundamentals:

Euro: IFO Business Climate

Sterling: EU Membership Ruling, GDP figure

USD: GDP and Trump Day Meeting

Technical Analysis

In a previous article I shared an outlook for the USD January 2017 forecast, which is now proving true and here are your technical indicators on major pairs for January’s last trading week. The markets kick off in stealth mode awaiting a catalyst with most USD pairs ranging even volatile instruments such as gold, and has only moved by $11 with the precious metal having a negative correlation with the USD. One can always look at gold to determine the dollar’s future value. Gold has erased the greenback’s 2016 gains and is making a recovery, will USD shed more gains?

USD/CHF: The pair was hovering above daily support at 0.099 with an RSI at 36. which is 38.2 Fibonacci golden ratio and further downside can be seen should there be a break below 0.099. The pair is now looking to find support at 0.997 the pair has already broke below 1.001 50 Fibonacci golden ratio on the daily chart. Should the pair break below 0.099 possible targets lie at 0.994 and 0.972 in extension.

4hr Indicators

14 EMA – Orange

Relative Strength Index

Stochastic Oscillator

100 EMA - Yellow

Daily Indicators

Stochastic Oscillator

Relative Strength Index

Fibonacci Retracement

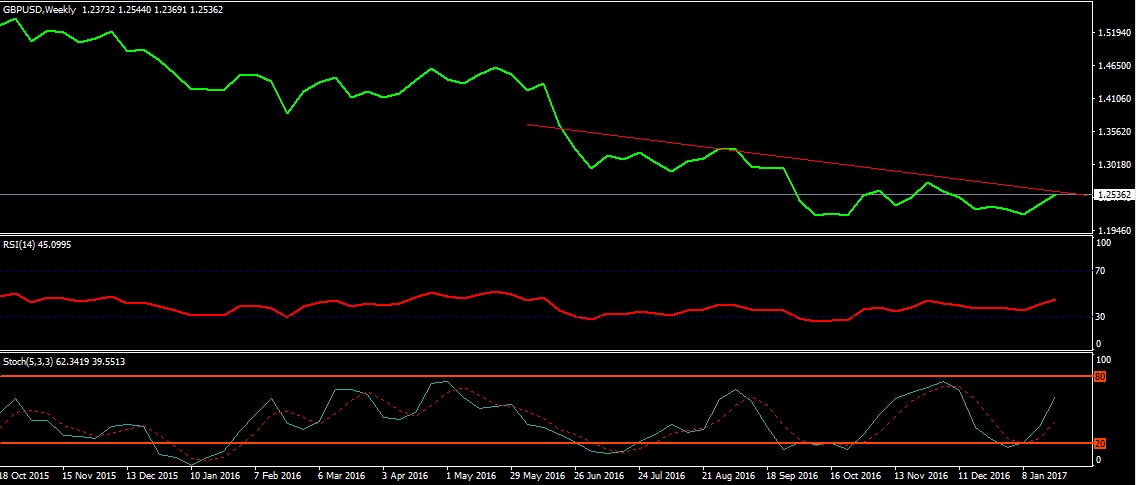

GBP/USD: Sterling has broken above daily resistance at 1.247 and has gained 60 pips now trading at 1.253 and it’s headed for the 100 DMA at 1.258 which is our prefered target. A break above 1.258 targets 1.27 and 1.279 in extension. GBP is threatening to break above weekly trendline resistance at 1.254 is a bull about to hit GBP/USD?

GBP/USD threatening to break weekly trend resistance

Weekly Indicators

Trendline

Relative Strength Index

Stochastic Oscillator

EUR/USD: As though the USD couldn’t be any nearer to a selloff we see yet another possiblity to go short on the USD. EUR/USD is trading right below 1.08 currently trading at 1.076 the pair is near breaking a strong resistance. A break above 1.08 targets 1.088.

EUR/USD trading towards 1.08 – 100 DMA

USD/JPY is hovering above daily support at 112.7 and a break below 112.7 targets the 100 DMA at 110.6 RSI is at 38 and room for further downside is evident.

USD/JPY trading towards 110.9 - 100 DMA support

Daily Indicators

100 DMA

Relative Strength Index

Stochastic Oscillator

What’s your view on the major pairs? Will the US dollar remain king or shall the global currency of exchange shed its gains?

Disclaimer: any views shared herein are that of the writer and although the analysis may prove true in most cases, past performance should not be used as reference for future performance.

Related Articles

Trump confirms 25% tariffs on Mexico, Canada, and a fresh 10% on China GBP/USD struggles as risk-off flows boost the U.S. dollar Core PCE inflation data in focus amid U.S. growth...

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.