- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

NuVasive (NUVA) Meets Q4 Earnings Estimates, Issues '18 View

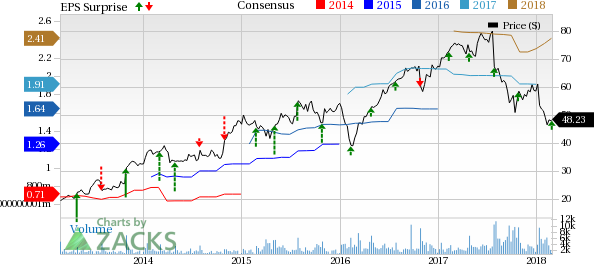

NuVasive, Inc. (NASDAQ:NUVA) reported fourth-quarter 2017 adjusted earnings per share (EPS) of 56 cents, reflecting a 5.7% rise from the year-ago quarter. The figure was on par with the Zacks Consensus Estimate.

Solid contributions from the international business led to the year-over-year improvement in earnings.

Including one-time items, the company reported fourth-quarter 2017 net income per share of 46 cents, up 318.2% from 11 cents a year ago.

Full-year 2017 adjusted EPS came in at $1.91, in line with the Zacks Consensus Estimate. Moreover, the figure improved from the year-ago number by 15.1%.

Revenues in the reported quarter came in at $271.7 million, marginally up (flat at constant exchange rate or CER) from the year-ago figure of $271.1 million. The figure, however, missed the Zacks Consensus Estimate of $272.3 million.

Net revenues in 2017 totaled $1.03 billion, in line with the Zacks Consensus Estimate. The figure also improved 7% from the year-ago number.

NuVasive, Inc. Price, Consensus and EPS Surprise

Notably, the company announced preliminary results on Jan 8.

In the quarter, the company witnessed robust performance in the international market. However, the upside was marred by a decline in U.S. revenues. Notably, pressure in the biologics business, softness in procedural volumes in the U.S. spine market followed by difficult comparisons to the year-ago figure led to the disappointing performance in the United States. However, management is satisfied with the key volume growth in the core hardware business.

Notably, the company faced a $1.5-million headwind in the international business after the hurricanes hit Puerto Rico in 2017.

In the reported quarter, the company’s U.S. Spinal Hardware business declined around 4%. However, revenues in this business were flat, after adjusting the year-ago figure for MAGEC sales of $4.8 million. Notably, rise in pricing pressure and product mix had offset case volume growth of around 5%.

Revenues from U.S. Surgical Support business declined around 10% in the fourth quarter, primarily due to weakness in the biologics portfolio along with persistent sluggishness in the U.S. service business case volume growth.

However, the international business recorded 34% growth at CER or 35% on a reported basis for the fifth consecutive time on solid contributions from key geographies.

In the reported quarter, there was a 12.7% increase in cost of goods sold after excluding amortization of intangible assets expenses. Accordingly, gross profit declined 3.9% to $196.3 million. Moreover, the company reported a 310-basis point (bps) year-over-year contraction in gross margin to 72.2% in the fourth quarter.

Sales, marketing and administrative expenses went down 5.5% to $134.5 million, while research and development expenses contracted 1.6% to $12.7 million.

NuVasive posted adjusted operating income of $49.1 million in the reported quarter, reflecting a 0.4% rise from the year-ago figure. Adjusted operating margin expanded 10 bps to 18.1% in the quarter.

The company exited 2017 with cash, cash equivalents and short-term investments of $76.7 million, down from $153.6 million at the end of 2016.

Outlook

NuVasive provided the guidance for full-year 2018 as well. The guidance has been adjusted for the recent buyout of SafePassage, full-year benefit of U.S. tax reform and suspension of the medical device tax.

The company expects 2018 revenues in the range of $1.095 billion to $1.105 billion, reflecting 4.4% to 5.4% organic growth. Moreover, on a reported basis, the company expects revenue growth in the range of 6.4% to 7.3%. The Zacks Consensus Estimate of $1.08 billion lags the guided range. Foreign exchange rates are expected to prove favorable for NuVasive in 2018. In fact, the company expects foreign exchange rates to have a positive impact of almost $5 million for the year.

NuVasive expects full-year 2017 adjusted EPS within $2.44-$2.47. The current Zacks Consensus Estimate of $2.41 lags the guided range. Additionally, adjusted operating margin for the year is expected at 17.6%, up 100 bps on a year-over-year basis.

Our Take

NuVasive exited the fourth quarter on an unfavorable note, missing the Zacks Consensus Estimate for revenues. Moreover, the company saw softness in both its businesses. However, solid performance of the international business with more than 20% growth for the fifth consecutive quarter buoys optimism.

The company’s expectation to higher adjusted operating profit margin of at least 100 bps in 2018 shows its focus on operational efficiencies and in-house manufacturing facility. Moreover, we are upbeat about the recently-completed buyout of SafePassage. Per NuVasive, the acquisition will strengthen the company's intraoperative neuromonitoring business line. The consolidated giant is expected to deliver services to more than 1,000 customers and 3,000 surgeons.

Zacks Rank & Key Picks

NuVasive has a Zacks Rank #3 (Hold). A few better-ranked stocks that reported solid results this earnings season are PetMed Express (NASDAQ:PETS) , PerkinElmer (NYSE:PKI) and Becton, Dickinson and Company (NYSE:BDX) . While PetMed sports a Zacks Rank #1 (Strong Buy), PerkinElmer and Becton, Dickinson carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported third-quarter fiscal 2018 results. Adjusted EPS of 44 cents were up 88.3% from the prior-year quarter. Revenues rose 13.7% on a year-over-year basis to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted EPS of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million in the year-ago quarter.

Becton, Dickinson reported first-quarter 2018 adjusted EPS of $2.48, up 3.9% at constant currency. Revenues totaled $3.08 billion, up 3.7% at constant currency.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

NuVasive, Inc. (NUVA): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.