- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Nutanix (NTNX) Posts Strong Q1 Earnings Beat, Continued Customer Growth

Nutanix Inc. (NASDAQ:NTNX) just released its first quarter fiscal 2018 earnings results, posting earnings of a loss of 16 cents per share and revenues of $275.6 million. Currently, NTNX is a #3 (Hold) on the Zacks Rank, and is up a slight 0.91% to $33.10 per share in trading shortly after its earnings report was released.

Beat earnings estimates. The company reported earnings of a loss of 16 cents per share, soaring past the Zacks Consensus Estimate of a loss of 26 cents per share. Non-GAAP net loss was 24.7 million for the quarter.

Beat revenue estimates. The company saw revenue estimates of $275.6 million, also beating our consensus estimate of $266.73 million and growing 46% year-over-year.

Billings came in at $315.3 million, an increase of 32% from the prior-year period.

Nutanix also saw continued customer growth, and ended Q1 with 7,813 end-customers; it added over 760 new end-customers during the quarter.

The company expects revenues between $280 and $285 million for the second quarter, with non-GAAP net loss per share between $0.20 and $0.22. Nutanix also estimates non-GAAP gross margin between 62.5% and 63.5%.

“While we will be focusing even more intently on selling software going forward, it’s worth noting what the past twelve months would have looked like had we chosen not to bill any pass-through hardware-related transactions. Nutanix would have recorded nearly $800 million(1) in pure software and support billings and delivered gross margins above 80%,(2) while continuing to be a leader in very large market,” said Duston Williams, Chief Financial Officer of Nutanix. “Looking forward, we expect continued strong top line growth in the remainder of fiscal 2018.”

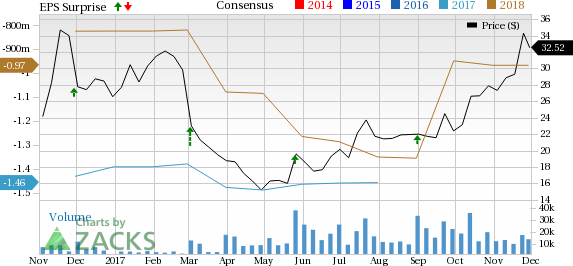

Here’s a graph that looks at Nutanix’s price, consensus, and EPS surprise:

Nutanix, Inc. provides an enterprise cloud platform which converges silos of servers, virtualization and storage into integrated solutions and connects to public cloud services. Nutanix, Inc. is based in San Jose, United States.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Nutanix Inc. (NTNX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.