- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TXN, AMD And AKAM Q3 Earnings: Here Are The Key Predictions

We are in the heart of the Q3 earnings season, with more than 700 companies, including 180 S&P 500 members, expected to come up with their financial numbers by the end of this week.

The Picture Thus Far

We already have Q3 results from 87 S&P 500 members that combined account for 24.7% of the index’s total market capitalization. Per the latest Earnings Trends (as of Oct 20), total earnings for these companies are up 9.4% from the prior-year quarter on 7.3% higher revenues, with 71.3% positive earnings surprises and 70.1% beating revenue estimates.Revenues for this cohort were up 4.4% sequentially.

So far, the results paint a positive and reassuring picture of corporate earnings, which is expected to strengthen and get reconfirmed through the remainder of this reporting cycle.

Coming to the technology sector, we expect it to benefit from increasing demand for cloud-based platforms, growing adoption of Artificial Intelligence (AI) solutions, Augmented/Virtual reality devices, autonomous cars, advanced driver assisted systems (ADAS) and Internet of Things (IoT) related software.

Let’s take a look at these three companies that are set to report their quarterly earnings on Oct 24.

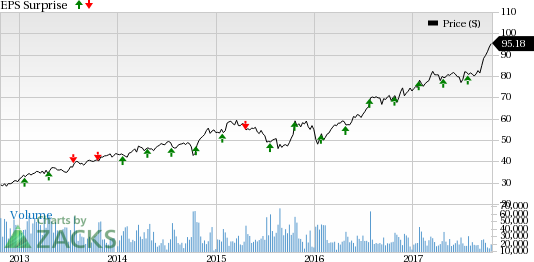

Texas Instruments (NASDAQ:TXN) or TI is likely to beat third-quarter 2017 expectations as it has a favorable combination of a Zacks Rank #2 (Buy) and an Earnings ESP of 0.07%.

Texas Instruments Incorporated Price and EPS Surprise

We expect TI to perform well driven by strength in several high-margin, high-growth areas of the analog and embedded processing markets. It continues to prudently invest its R&D dollars in these areas. This is gradually increasing its exposure to industrial and automotive markets and increasing dollar content at customers, while reducing exposure to volatile consumer/computing markets. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the past four quarters, TI’s analog business has witnessed both sequential and year-over-year growth. We expect the trend to continue in the to-be-reported quarter. The Zacks Consensus Estimate for Analog segment revenues is currently pegged at $2.6 billion.

Given the strong product lines, we also expect Embedded Processing segment to perform well in the upcoming quarter. The Zacks Consensus Estimate for Analog segment revenues is currently pegged at $904 million.

We observe that shares of Texas Instruments have gained 30.4% year to date, underperforming the industry’s 33.8% rally. (You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

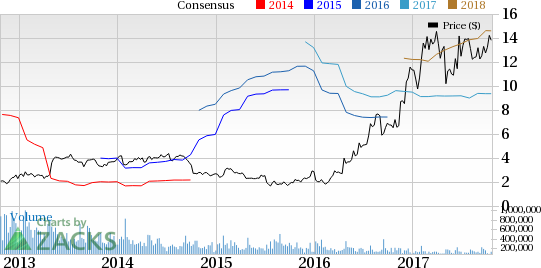

Let’s take a sneak peek at Advanced Micro Devices Inc. (NASDAQ:AMD) , the leading producer of microprocessors and chipsets in the world that is unlikely to beat earnings estimates this quarter.

Notably, the company has a record of positive earnings surprises in the trailing four quarters, with an average beat of 35%. We note that AMD has introduced a host of new products during the quarter which is anticipated to give the top line a boost going forward. The company unveiled AMD4U comprising gaming applications and tools that are in compliance with AMD processors and graphics.

The stock has an Earnings ESP of -7.90% as the Most Accurate estimate is pegged at 7 cents, while the Zacks Consensus Estimate is 8 cents. The stock’s negative ESP and Zacks Rank #3 (Hold) makes surprise prediction difficult.

Advanced Micro Devices, Inc. Price and EPS Surprise

AMD expects third-quarter 2017 revenues to increase 23% sequentially (+/- 3%). At the mid-point, this reflects 15% growth on a year-over-year basis. Further, gross margin is likely to be 34%, while non-GAAP operating expenses are estimated to be $400 million. (Read: What's in Store for Advanced Micro in Q3 Earnings?)

We observe that shares of Advanced Micro have gained 21.8% year to date, underperforming the industry’s 27.9% rally.

Lastly, Akamai Technologies, Inc. (NASDAQ:AKAM) is a global provider of content delivery network (CDN) and cloud infrastructure services.

Notably, the company has a record of positive earnings surprises in the trailing four quarters, with an average beat of 35%. However, Akamai has an Earnings ESP of -0.12%. Also, the company carries a Zacks Rank #5 (Strong Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Akamai Technologies, Inc. Price and EPS Surprise

Akamai's top-line growth continues to be affected by lower revenues from the large Internet Platform group companies. We expect the newly launched products to take some more time to generate meaningful growth.

However, in the last quarter, Akamai stated that it witnessed high level of network traffic on its platform, which is anticipated to be a major tailwind for the company’s revenues.

For the upcoming third quarter, the Zacks Consensus Estimate for revenues is pegged at $610 million, indicating 4.5% year-over-year increase. Revenues in the second quarter came in at $609 million. Earnings are projected to be 59 cents per share, lower than 62 cents per share reported in the last quarter.

Notably, effective second-quarter 2016, Akamai started reporting its business under three main divisions – Media, Web and Enterprise and Carrier.

The Zacks Consensus Estimate projects Media division revenues to be around $271 million. Web division revenues are expected to be close to $327 million while Enterprise and Carrier division revenues are anticipated to be about $19.93 million for the third quarter.

We observe that shares of Akamai have lost 22.2% year to date, underperforming the industry’s 27.5% rally.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Akamai Technologies, Inc. (AKAM): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.