- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

What To Expect From Epizyme (EPZM) This Earnings Season?

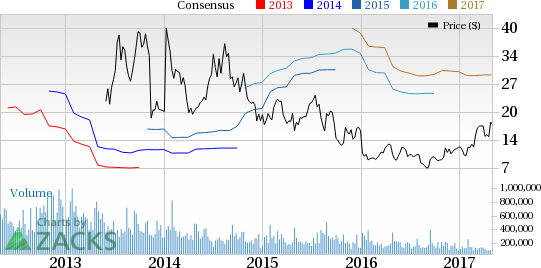

Epizyme, Inc. (NASDAQ:EPZM) is scheduled to report first-quarter 2017 results on May 8, before the opening bell. Last quarter, the company recorded a positive earnings surprise of 6.25%.

In fact, Epizyme’s track record has been strong, with the company surpassing expectations in all of the four trailing quarters, with average positive surprise of 11.96%.

Epizyme’s share price has outperformed the Zacks classified Medical-Biomedical/Genetics industry year to date. The stock was up 43.0% during this time period compared with the industry’s gain of 5.2%.

Let’s see how things are shaping up for this quarter.

Factors Influencing This Quarter

Epizyme is a development-stage company with no approved products in its portfolio. Its top line comprises revenues earned through collaborations. Hence, investor focus is expected to remain on the company’s pipeline updates.

Epizyme’s lead candidate, tazemetostat (an EZH2 inhibitor), is being evaluated for relapsed or refractory non-Hodgkin lymphoma (NHL) and advanced solid tumors.

Currently, the company is evaluating tazemetostat in a phase II study in adults with relapsed or refractory NHL, a phase II study in adults with certain genetically defined solid tumor (INI1-negative tumors, SMARCA4-negative tumors or synovial sarcomas). In Jan 2017, Epizyme opened enrollment to patients with follicular lymphoma in the U.S. as part of its phase II study in NHL as per the FDA’s request. Also, it intends to meet with the FDA, in the second half of 2017and discuss the NHL program, with the goal of defining its registration pathways in various subtypes.

Additionally, Epizyme is exploring tazemetostat to increase the clinical activity of immuno-oncology therapies by combining it with an anti-PD 1 or PDL-1 agent. Under its collaboration with Roche Holding (SIX:ROG) AG (OTC:RHHBY) , the company is evaluating tazemetostat, in combination with anti-PD-L1 cancer immunotherapy, Tecentriq, for the treatment of patients with relapsed or refractory DLBCL to determine the recommended phase II dose and advance into the expansion portion of the study.

The company’s another experimental candidate, pinometostat, an inhibitor of the DOT1L HMT is currently in a phase I study for the treatment of children with MLL gene (MLL-r).

Epizyme expects that its cash balance of $242.2 million as of Dec 31, 2016 to be used to fund its planned operations through at least the third quarter of 2018.

Earnings Whispers

Our proven model does not conclusively show that Epizyme is likely to beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: Earnings ESP for Epizyme is -1.59. This is because the Most Accurate estimate is at a loss of 64 cents, while the Zacks Consensus Estimate is pegged at a loss of 63 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Though Epizyme has a Zacks Rank #3, a negative ESP makes surprise prediction difficult.

Note that we caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies to consider as our model shows that they have the right combination of elements to post an earnings beat in the upcoming quarter:

Fibrogen Inc. (NASDAQ:FGEN) has an Earnings ESP of +23.81% and a Zacks Rank #3. The company is expected to release results on May 8. You can see the complete list of today’s Zacks #1 Rank stocks here.

Editas Medicine, Inc. (NASDAQ:EDIT) has an Earnings ESP of +32.26% and a Zacks Rank #3. The company is expected to release results on May 15.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think. See This Ticker Free >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Epizyme, Inc. (EPZM): Free Stock Analysis Report

Editas Medicine, Inc. (EDIT): Free Stock Analysis Report

FibroGen, Inc (FGEN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.